INVESTMENTS BY CATEGORY

INVESTMENTS BY CATEGORY

VC investment in blockchain can be loosely categorized into 5 areas:

Investments in the recent wave of cryptocurrencies and ICOs, most immediately via cryptocurrency hedge funds

Investments in companies directly correlated with bitcoin speculation, such as exchanges, trading platforms, and mining companies

Investments in companies exploring bitcoin as a currency, primarily for peer-to-peer payments and remittance

Investments in farther-ranging blockchain use-cases, like media, e-commerce, and identification

Investments in private blockchain firms building enterprise-facing software.

Cryptocurrencies & ICOs

Cryptocurrency returns have proven both difficult for VCs to ignore and difficult to capitalize on, as typical venture investment mandates require equity investments and the regulatory climate around ICOs remains uneven.

As a result, brand-name VCs have invested into ICO cottage industries, most prominently cryptocurrency hedge funds. Over 70 of these funds have sprung up since the start of 2017, many with venture funds as investors.

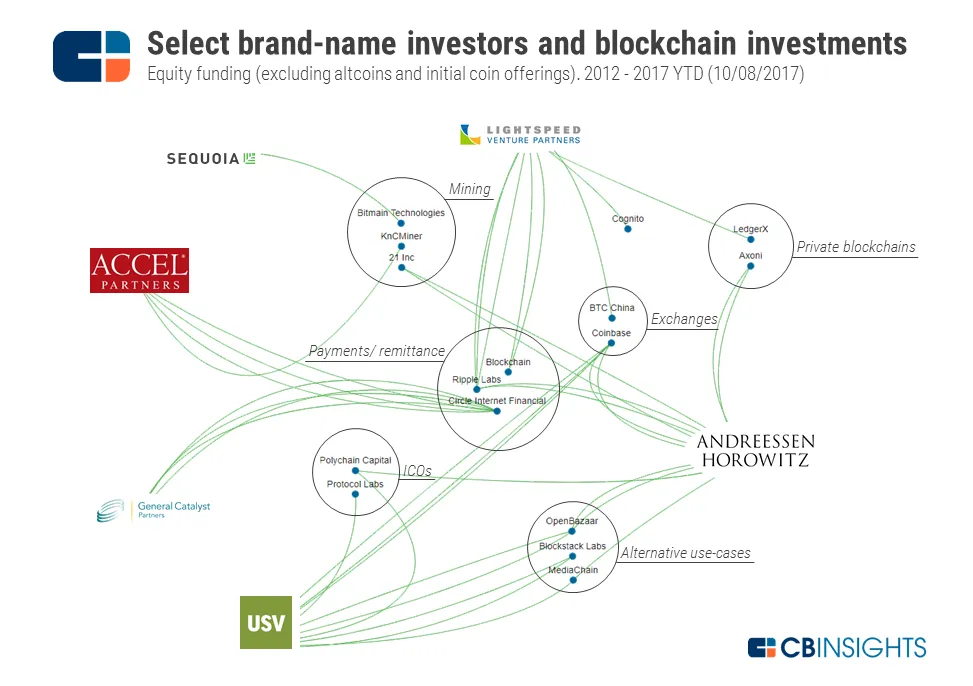

Polychain Capital and MetaStable Capital are two such funds that have received lots of attention from venture investors. MetaStable has received investments from Sequoia Capital, Union Square Ventures, and Founders Fund, while Polychain has received investments from Andreessen Horowitz and Union Square Ventures, among others.

Still, ICOs are beginning to see direct venture investments, typically via SAFT (Simple Agreement for Future Tokens) agreements. Filecoin sold tokens to accredited investors and VCs in its $52M August 2017 pre-sale, which saw participation from Sequoia Capital, Andreessen Horowitz and Union Square Ventures.

- Bitcoin-Correlated Investments

VCs have often looked to gain exposure to cryptocurrencies by investing in startups correlated with cryptocurrency prices and trading volume, such as exchanges or mining companies.

Investments by brand-name VCs into Coinbase (USV, Andreessen Horowitz), BTC China (Lightspeed), Bitmain (Sequoia Capital China), and a number of other exchanges and mining companies emphasize this sustained trend. Bets on exchanges have paid off as cryptocurrencies have seen higher trading volume, with Coinbase’s most recent $100M Series D valuing the firm at $1.5B.

- Payments & Remittance

VCs have also bet heavily on Bitcoin’s whitepaper-outlined use-case as a decentralized currency, seeing immediate applications in payments and remittances.

However, companies focusing on bitcoin as a means of exchange have often been stymied by the cryptocurrency’s volatility.

Fred Wilson of Union Square Ventures highlighted this volatility in a recent blog post, writing: “This was a Bitcoin t-shirt I bought in the summer of 2013 [for .18 BTC]. At today’s prices, that t-shirt cost me $830 […] You can’t keep spending something that goes up as much as Bitcoin has.”

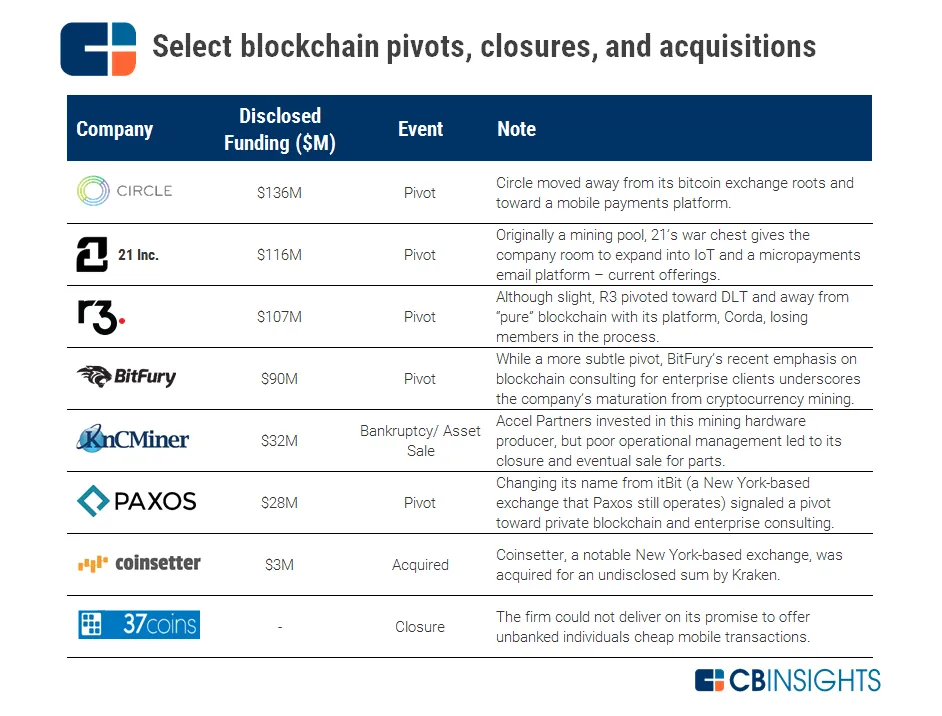

Indeed, many portfolio companies that focused on payments have pivoted.

Coinbase initially promised “instant payments [and] widespread [bitcoin] adoption” in addition to its exchange, but, after years of minimal consumer traction, now focuses most of its resources on its successful exchange and trading platforms.

Circle closed its $9M seed round in 2013 promoting peer-to-peer bitcoin payments, but no longer mentions bitcoin on its site.

BitPay, a notable exception, received January 2013 seed funding and has stayed true to payments processing, allowing merchants to transact in bitcoin. It recently saw its volume surge 328% and predicts $1B in 2017 turnover.

- Alternative Use Cases

Farther-ranging blockchain applications have also seen venture backing, especially as the conversation has shifted from Bitcoin to blockchain at large.

USV and Andreessen Horowitz have frequently bet together on alternative blockchain use cases, including investments to Mediachain (which focuses on blockchain-based digital rights management and was acquired by Spotify) and OpenBazaar (which focuses on decentralized e-commerce).

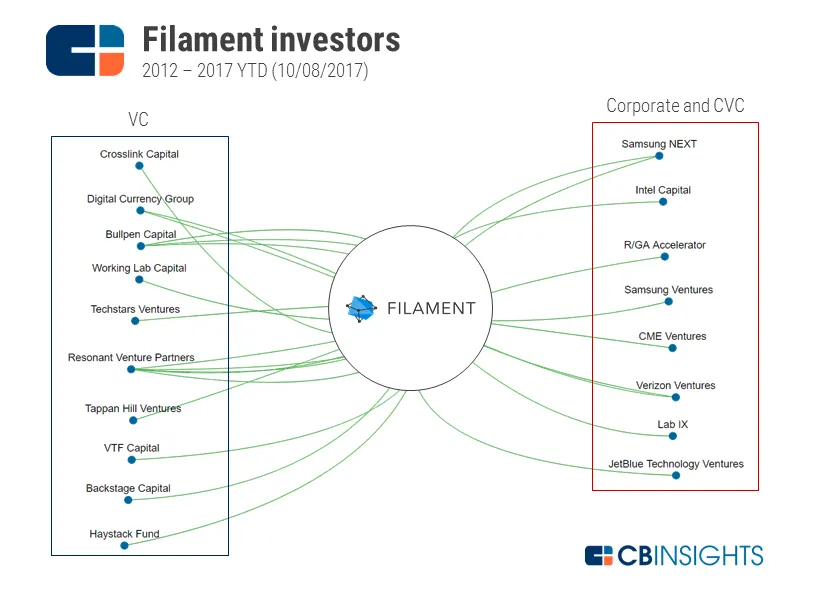

Corporates have also co-invested alongside venture investors in this subcategory, with Filament, a blockchain-based IoT platform, raising a $15M Series C in Q1’17, with participation from Intel Ventures, JetBlue Ventures, and Verizon Ventures, among others.

- Private Blockchains

Private blockchains — as opposed to public blockchains, like Bitcoin and Ethereum — are often run by centralized administrators and customized for internal organizational use cases, making them more palatable to corporate interests concerned with privacy and security.

However, private blockchains have been criticized for diminishing blockchain’s implied network effects and likened to intranets (as opposed to internets).

Key private blockchain providers include Digital Asset, which has raised $67M in total disclosed funding, and Axoni, which raised a $2.8M seed in Q3’14. Additionally, Chain raised a $4.2M seed round in Q3’13 from Thrive Capital, RRE Ventures, and SV Angel, among others, to build out its “blockchain API,” pointing to virtual currency as just one of many blockchain applications.