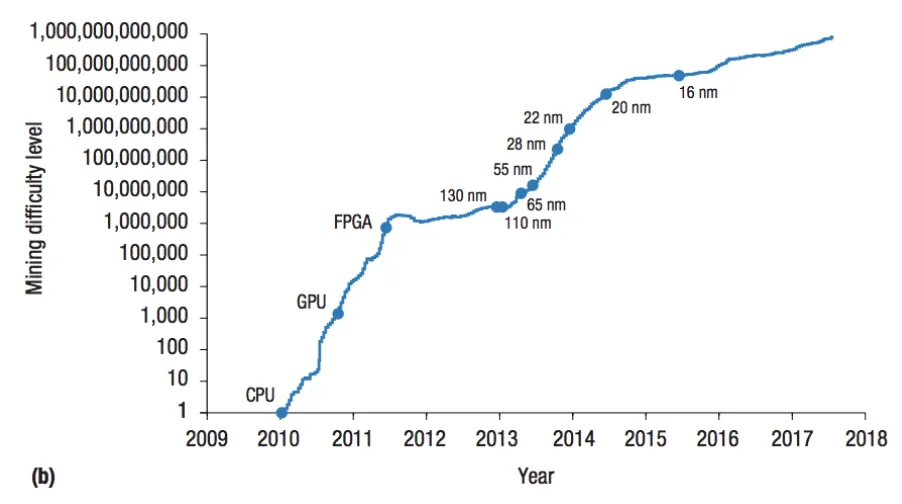

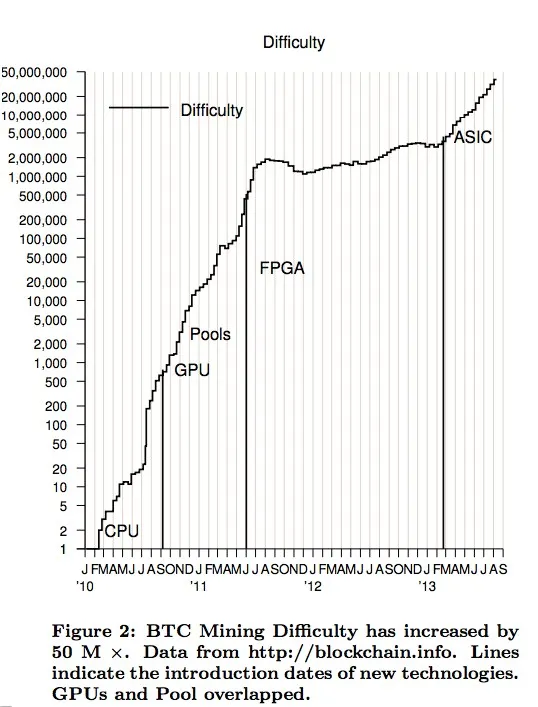

The sudden rises in the Bitcoin price are due to sudden increases in the proof-of-work difficulty level. In the past that was due to onboarding better mining technologies. In 2020, this surge in difficulty will be due to massive funding from SegWit booty.

The following fits the topological model McAfee’s Dick Math: illuminating Bitcoin’s ACCELERATING price.

I commented on my subsequent blog Our Bitcoins Will Be Taken/Frozen By the Miners; Involuntary INCOME Tax on Frozen Bitcoin!:

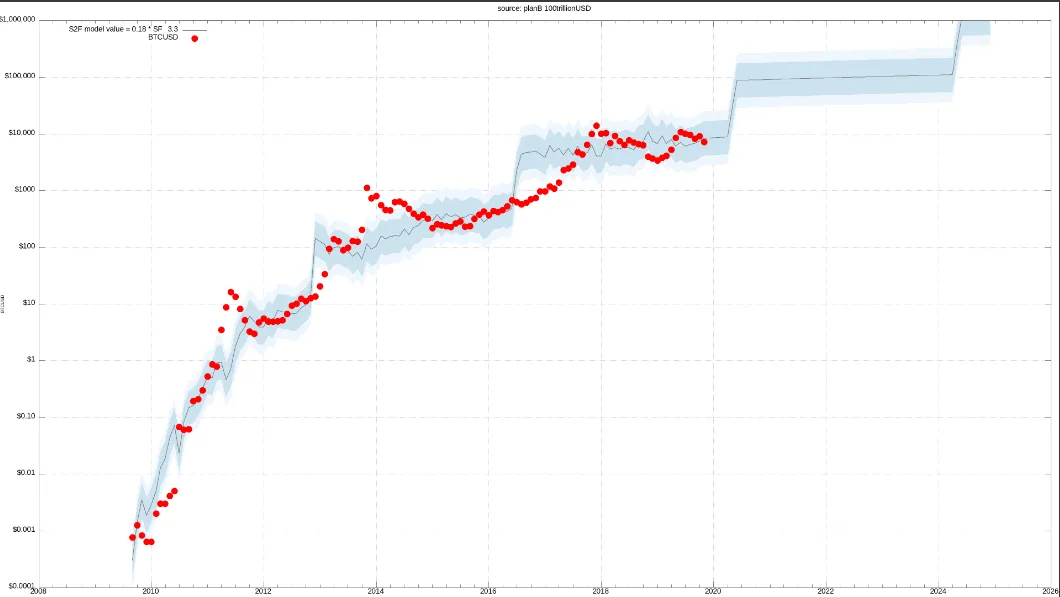

EDIT: the stock-to-flows valuation model of a proof-of-work cryptocurrency is based on the cost of mining production. The marginal cost of mining rises to match the rise in mining rewards. Yet the average mining production costs rise faster than marginal cost, as the average efficiency of the mining hardware declines if price is rising very fast thus making a lot of inefficient mining hardware profitable again. Consequently hashrate rises slower and the most efficient mining hardware rises in value faster than marginal cost and mining rewards.

[…]

With the mining rewards rising to insane levels at the instant of the start of the posited SegWit “ANYONECANSPEND” donations redeeming because each block will redeems 100s or 1000s of Bitcoin donations as extra mining rewards (which what this blog is about), I suppose it might be plausible that GPUs become profitable for mining Bitcoin again until the most lucrative (e.g. large balances) of the SegWit donations have all been redeemed.

Don’t forget I recently reiterated that mining hardware is the tangible mass of a proof-of-work cryptocurrency, so thus it is a monetary component as also is separately the informational value stored in the private keys (i.e. both components have a monetary role to play!):

[…] suddenly no longer think so. It would require that the Herculean tangible mass of Bitcoin […] Bitcoin is just as tangible as gold, yet additionally has the incredibly important increase in utility because the transferable value is information and detached from the tangible mass.

Consequently the security of proof-of-work altcoins is going to become very vulnerable to 50+% attack with ASICs as the most efficient hardware is pulled to the blockchains that have the fastest rising mining rewards, i.e. blockchains with huge SegWit booties for miners. Perhaps this is the basis of Craig Wright’s warning about destroying the altcoins.

Six months ago I blogged in Secrets of Bitcoin’s Dystopian Valuation Model:

[…]

Uh oh, some of you may now really be contemplating if I’m Satoshi. 😲

So now we know why cryptocurrency scales so much faster to monetary dominance than the 1000s of years that gold required:

Compare the periods in the charts above to the following chart and note this is the reason the following interpretation is topologically incorrect:

(click to zoom to source)

Note that in 2013 which was the corresponding topological juncture as current fractal pattern, the price peaked at 20 times higher than the stock-to-flows model price. So that projects a ~$2 million peak price in 2020/21:

(click to zoom to source)