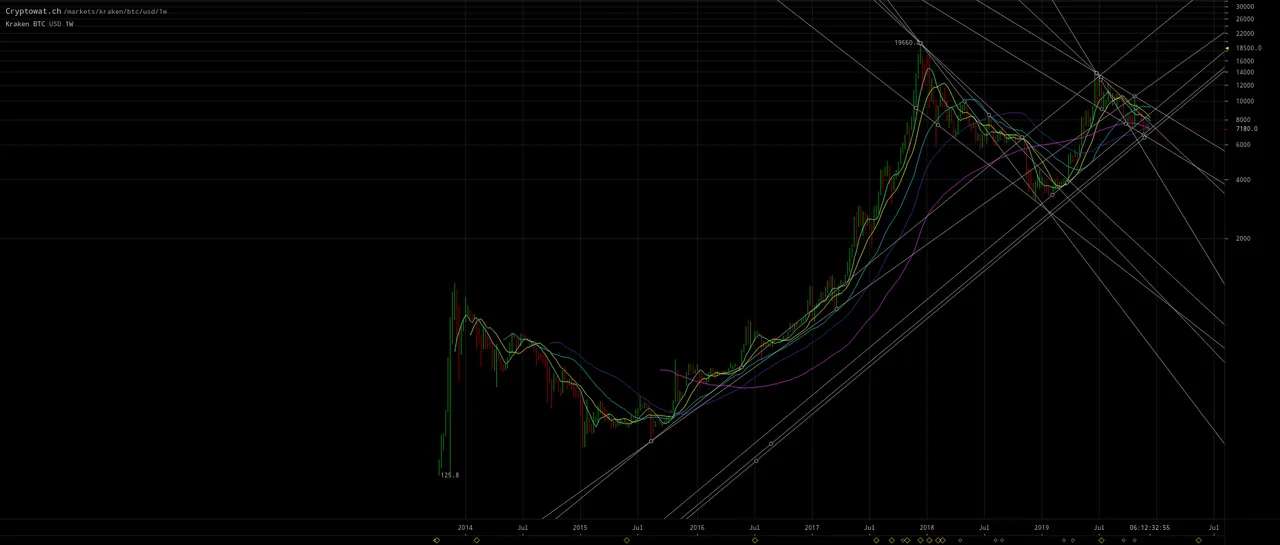

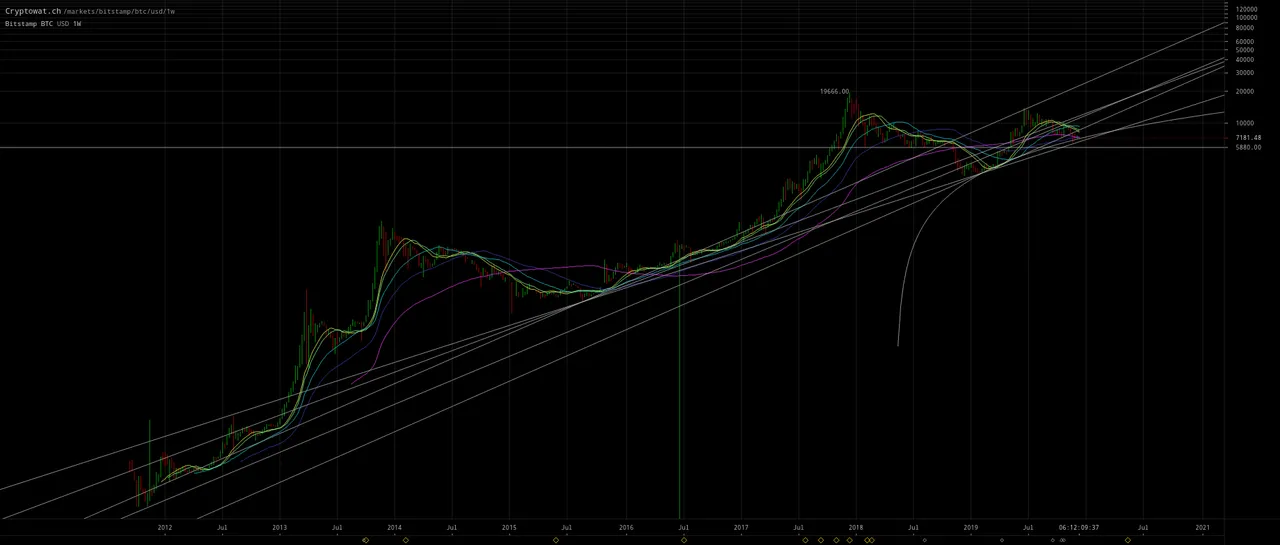

The following charts are an update to charts I posted recently on this blog and also my recent blog Phoenix rises in 2020; all altcoins (including Bitcoin Core) will be 50+% attacked/destroyed.

Click here to zoom the following of my latest charts and read my commentary about them:

(click to zoom to source & to read commentary)

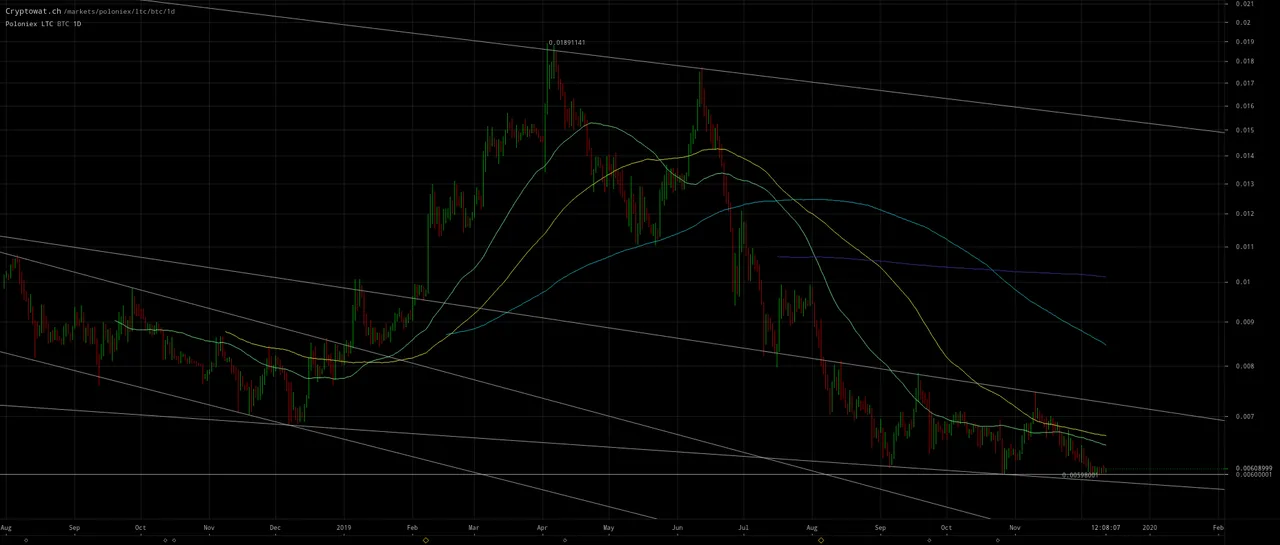

The scenario posited in my recent analysis and above updated charts is in stark contrast to scenario of a possible drop to $2.7k detailed in a recent article Sorry — But Bitcoin Can Still Drop to $2.7K While Everyone’s Bullish. Two key charts from this bearish article are:

(click to zoom to source)

Essentially this bearish article is comparing the weekly RSI and MACD to the prior cryptowinter during the entirety of 2018. I believe it’s highly erroneous to compare a decline from a nosebleed ATH into a one year cyptowinter to a correction from an interim high below the prior ATH coming out of the bottom of a cryptowinter. In short, the bearish scenario supposes that the bounce from $3.1k to $13.9k was a deadcat bounce and not the start of an acceleration out of the bottom of a cryptowinter. I reject this bearish hypothesis for numerous fundamental reasons which I have elaborated before and will not repeat again. If I’m incorrect then Bitcoin could collapse to $5k or below. We need this maximum fear of doom to make a bottom though. Has there been enough capitulation or do we need another significant collapse downward? I’m still in the camp that argues the bottom for this correction is $6k or above, but it’s possible I need to capitulate before the bottom is reached, lol.

Ditto other recent short-term bearish articles Why Bitcoin Price Is Headed to 7-Month Low If $7K Support Fails and Bitcoin Price ‘Boring and Fragile’ as Trader Plans for Dip Below $7K. In the last linked article, I quote:

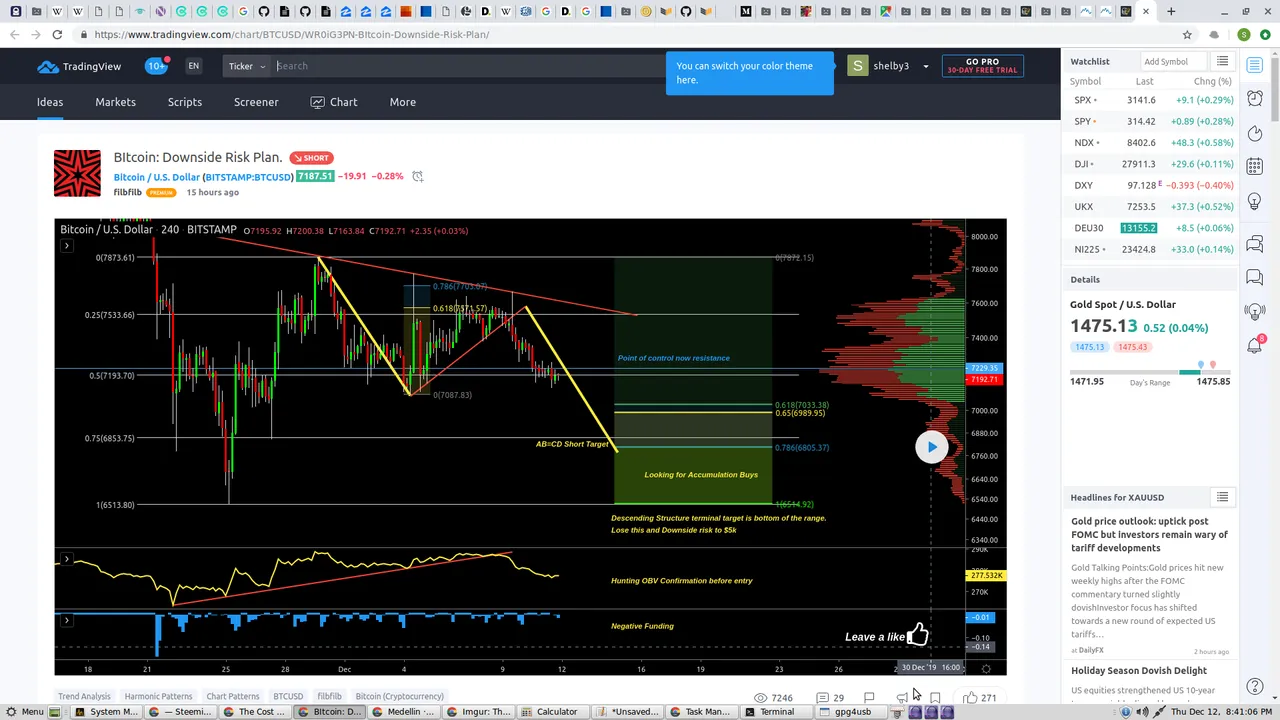

Fellow contributor filbfilb meanwhile was more risk-averse. Revealing his short-term risk plan to readers on Wednesday, he confirmed he was short BTC, eyeing a likely dip below $7,000.

“Overall I am bullish pre halving its just a matter of trying to micromanage the mid term optimal entry,” he added.

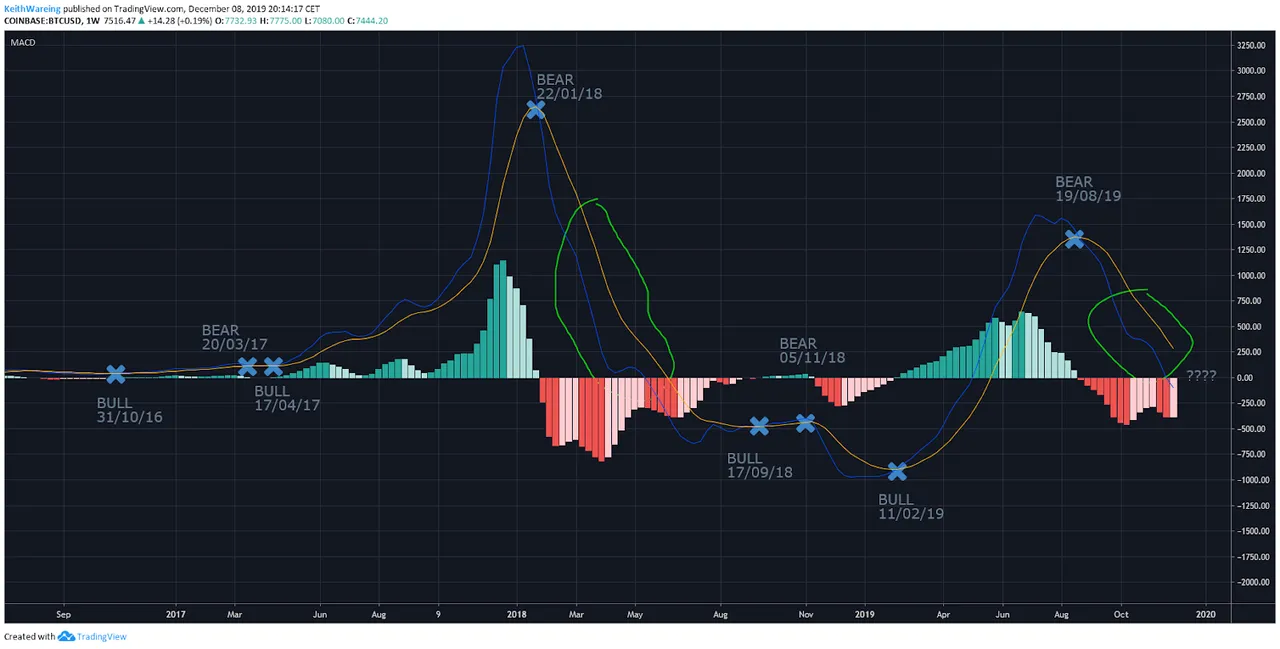

(click to zoom to source & to read commentary)

From the above quoted update from his prior article It’s All About $7,400 for Bitcoin Price as a Big Move Is Now Imminent, @filbfilb appears to be in agreement with my stance and still eyeing a second bottom above $6.5k. And he has noted the fractal correlation to the $3.1k bottom that I have been mentioning/expecting for months. When I read that linked article It’s All About $7,400 for Bitcoin Price as a Big Move Is Now Imminent a few days ago, I was expecting he would be incorrect and that we would have to see a second test of the recent bottom first as was the case for the $3.1k bottom earlier in 2019.

In the above linked article, @filbfilb again noted the arrival of the major bullish cross he has been anticipating:

Bitcoin closed the week back above the 50 and 100 weekly moving averages (WMA), which at the time of writing are now crossed bullish. This typically occurs in advance of bull markets in previous Bitcoin cycles.

In his recent newsletter @filbfilb is even more bullish indicating that the marginal “miner’s cost bottom” of $6500 he had been anticipating for months had been achieved. And that the “Plus Token” scam selling had likely been a cause of recent declining prices but that this selling was winding down. He noted signs of accumulation and bullish divergences of many time frames, including “Volume Declining as price declining”.

@filbfilb is conservatively expecting at least $10k before the halving in May 2020. I’m much more bullish than that for reasons I have explained in my recent blogs, expecting $10k before end of January and $30+k before the May 2020 halving.

RE: Bitcoin’s Whiplash Bear Trap