Some people are calling this latest pump in the market Chinese New Years manipulation. Some are calling it a Litecoin victory for Mimblewimble privacy/scaling technology. Some are saying it means an ETF will be approved soon and this is pre-purchase insider trading.

I'm calling it business as usual.

The news is more of a catalyst to get price action to where it should be, rather than actually dictating the price. Last year we saw many downward trends attributed to this or that news. Well, I've got news for you: Bitcoin was going to crash 80%+ no matter what the news was.

We had no Mt. Gox legendary fuck-up incidents, yet Bitcoin crashed just as hard for just as long all the same. These 4 year cycles are simply a natural part of Bitcoin evolution and they revolve around the Halvening event.

Buy the rumor, Sell the news

If this is a victory for Mimblewimble as it appears to be (because Litecoin went up the most at 30%) no one is pointing out the most obviously amazing thing about this scenario:

Bitcoin doesn't control the market; the entire market is connected. If Litecoin is the reason for this pump that means the Litecoin increased that value of everything, not Bitcoin. Everyone just assumes that bitcoin controls the market, and this is obviously false. Every coin has sway, even if Bitcoin has more.

This is one big reason why I don't understand why so many people are waiting for these assets to decouple from one another like it's a bad thing. This entire space is connected; severing the connections is not a good thing. (If such an occurrence is even possible.)

Moore's Law

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 | $3200 | $6400 | $12800 |

I continue to push the theory of Moore's Law onto the cryptosphere. Bitcoin will continue to double each year.

As we can see, Bitcoin often hits its target at the end of the year. If we extrapolate Bitcoin to be valued at $6400 by the end of the year the price should increase $266.67 per month on average.

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $3467 | $3733 | $4000 | $4267 | $4533 | $4800 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $5067 | $5333 | $5600 | $5867 | $6133 | $6400 |

If this turns out to be accurate the value of Bitcoin is pretty much exactly where it should be.

Using this model, we expect another bull run at the end of the four year cycle (at the end of 2021 and beginning of 2022). The base value of Bitcoin in 2021 will be $25600. However, as we've seen in 2013/2014 and 2017/2018 the price spikes up x10-x13 higher than the base value. This would put a bubble at around $250,000-$350,000 for a single bitcoin, with a crash back down to the 2022 baseline at 56K.

Kinda makes me think back to the days of 56K modems and how people thought we'd never have faster internet. Many experts have spoken on the topic of crypto today and compare it to this time in the Internet's history. We have quite a long way to go.

Make no mistake, when Bitcoin is ascending higher than a quarter million per coin crypto mania will be in full effect.

$1,000,000 Bitcoin! $2,000,000 Bitcoin! It's happening!

Then it will crash 85% just like it always does.

If the doubling effect of Moore's Law applies to Bitcoin, every ten years Bitcoin should go about x1024.

It's important to note here that I believe it takes at least 4-5 years for a project to find to even find its baseline to begin with. This makes new projects like Steem very unpredictable and volatile as they attempt to stabilize at a fair-market value.

Ethereum?

Ethereum has hit $100 four times this year. Perhaps Ethereum is starting out where Bitcoin left off 5 years ago. However, When you consider smart contracts and ERC-20 protocol Ethereum might multiply even faster than x2. If a coin like Maker is doubling every year, those MakerDAO contracts are locking Ethereum away for as long as users want to create Dai stable-coin (forever?).

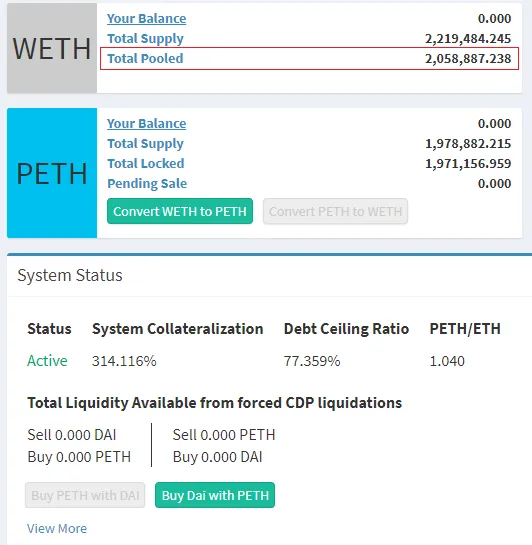

Second layer tokens can add a multiplier an top of the x2 that the main chain experiences. Dai isn't even a popular stable-coin right now, but already 2% of all Ethereum is locked in MakerDAO contracts Coins like Maker significantly reduce the active liquidity of Ethereum and push it in a bullish direction. With Coinbase adding Dai coin to their arsenal just recently we should see some very interesting developments within the next few years.

Tax season?

Just like we experienced another Chinese New Years movement will we also experience another bump in April from tax season? Probably.