Bitcoin is about to get very interesting from a store of value perspective.

Bitcoin is going to have its next halving event in a little over one year.

This may sound like a long ways off still, but keep in mind, historically bitcoin has started to price in a halving event roughly 12 months and 10 months prior, at least in the two prior halving cycles.

You can see how the price has reacted around the last two halvings here:

(Source: https://www.bitcoinclock.com/)

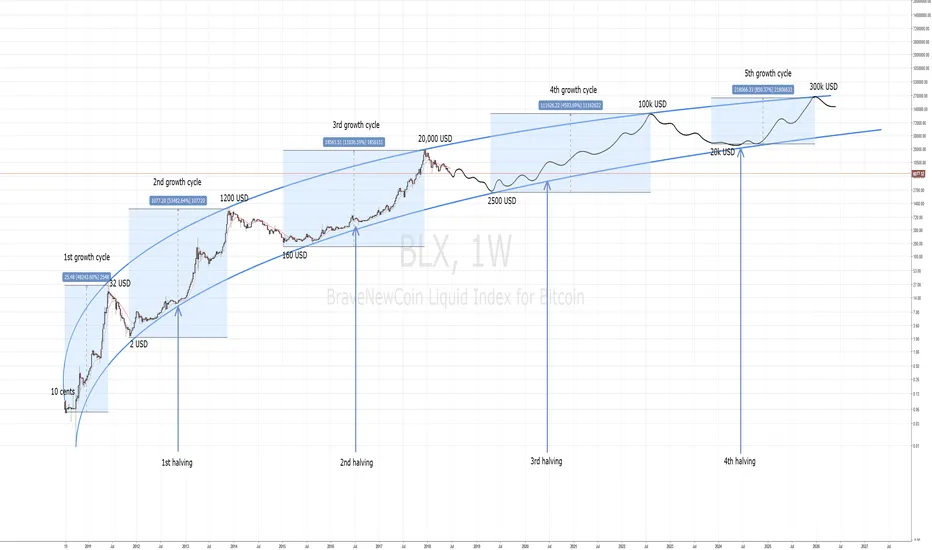

A possible outcome from the next ones can be seen here:

(Source: https://www.tradingview.com/chart/BLX/uYKn9Nrx-Bitcoin-longterm-chart/)

We are getting very close to those 12 and 10 month time-frames now...

The reason this halving in particular is so interesting is because it will mark the first time ever that the issuance rate of new bitcoins will fall below that of the target annual inflation rate of central banks.

Some specifics:

The next bitcoin halving date is projected to be roughly 429 days from today.

(Source: https://www.bitcoinclock.com/)

Roughly 1,800 new bitcoins are mined every single day currently.

That number will fall to 900 every day once the next halving takes place.

That will drop bitcoin to roughly a 1.8% inflation rate.

A number that is below the 2% target rate of most central banks.

This will mark the first time bitcoin's inflation rate will be lower than that of the USD and other fiat currencies.

It's at this point it really starts to get interesting as a store of value.

It really gets interesting once the next halving event occurs after this one, in 2024.

At that point, the inflation rate will fall well below fiat currencies, precious metals, and commodities.

If we can hold on till then, I think prices will be significantly higher than they are currently!

Stay informed my friends.

-Doc