Time: 8.16 A.M. / GM+2 / 5th July 2018 – Thurs.

- Bitcoin price resumed Positive Trading to move away from EMA50,

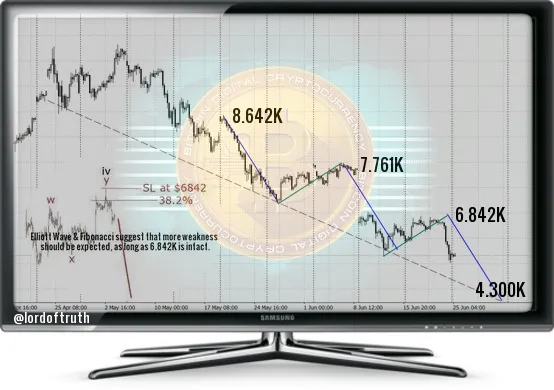

to consolidate inside rising wedge formation shown on the below 1H chart, trying to continue the climb ( Short Term ) towards 6.842K that most likely will be followed by a decline.

- Noting that breaking 6.210K, will lead to the continuation of Harmonic Swings, as you can see on below chart. So we still watching for bearish continuation patterns ( Medium Term ) / "222" Sell, towards 5.500K followed by 4.300K Area, unless breaching 6.842K and settling above it.

- FOMC minutes this week could contain more clues on Fed tightening expectations, to set the tone for USD direction, NFP release might also be a major catalyst for USD, and Strong jobs data with a hawkish Fed bias, could cause More Bullish For USD Than BTC Price.

In our previous post / 643 / we had forecast the trading range will be between 6.210K & 6.842K. The intraday low was 6.462K and the high was 6.784K.

Technical indicators ( RSI & Stochastic ) suggest that the uptrend is more likely to resume.

This week we still need to keep an eye on Downside Tendency as if the price do not move above 6.842K, our bearish scenario ( Medium Term ) will remain valid.

The trend is Neutral for today ( Short Term ).

The trend is Bearish on Medium Term.

Support 1: 6210.000 level.

Resistance1 : 6842.00 level.

Support 2: 6.039 level.

Resistance2 : 7000.000 level.

Expected trading for today:

is between 6210.00 and 6842.00.

Expected trend for today :

Neutral.

Medium Term:

Bearish.

Long Term:

Bullish.

The low of 2018:

4267.00 / Expected.

The high of 2018 (BitcoinTrader's Year):

14469.00 / Expected.

The low of 2019: ???

The high of 2019 (Bitcoin Holder's Year):

36000.00 level / Expected.

investing considerable time and effort up front in

hopes of considerable returns down the road.

I'm so proud of my little blog, and so grateful to all of you

for support to keep it going.