Bitcoin as conceptual art

Yesterday evening was extremly unusual. A few weeks ago I had been contacted on LinkedIn by a young luxembourgish lawyer who sent me a surprisingly sharp legal analysis on the aspects of crypto currencies in relationship with European Value Added Tax (VAT). We exchanged a few more messages and I decided that this guy was definitely an extremly bright mind and I had to meet and get to know him.

He suggested an "after-hours" drink in a hip pub in the old city, "de Gudde Wëllen" ("The Good Vibes", in luxembourgish). We were going to discuss bitcoin and more generally the attitude of the local authorities with respect to crypto.

I arrived in the bar a few minutes before him and went to the gents room. I was struck by some very coïncidental surroundings ...

To fully appreciate the situation, we need to step back about one year ago when I stumbled upon an article by @sikoba called "Bitcoin as conceptual art".

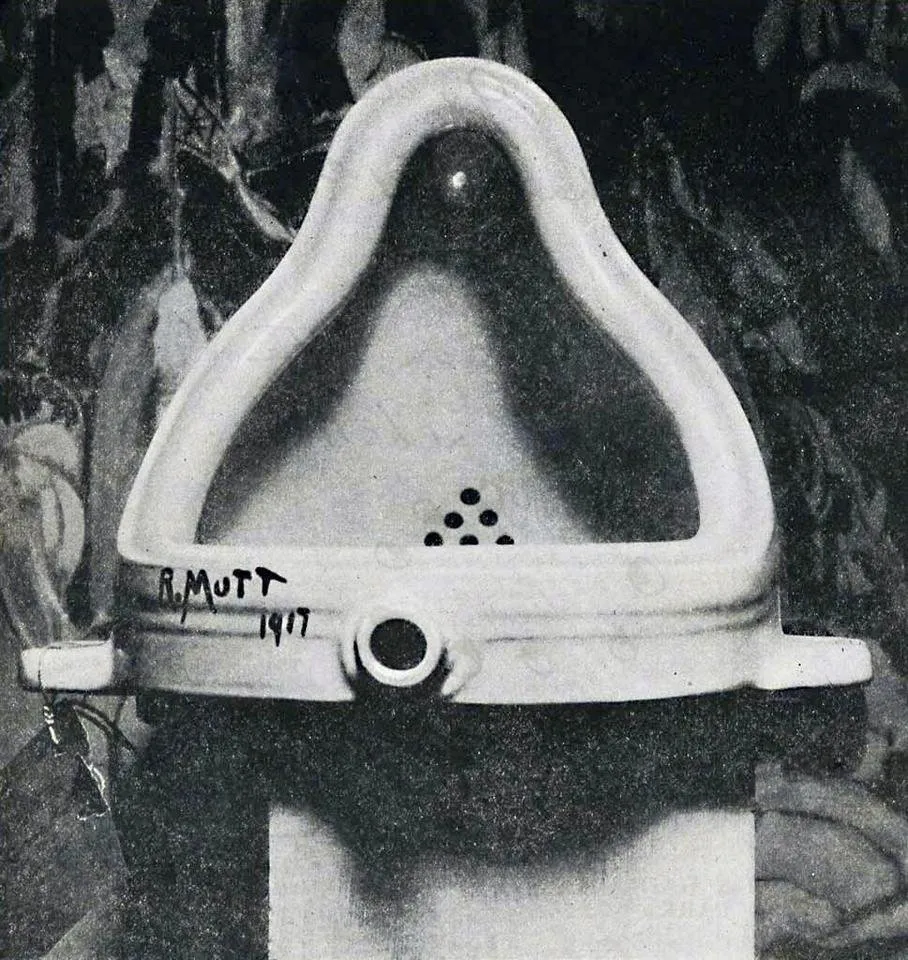

The article draws a parallel between (revolutionary and misunderstood) bitcoin at the beginning of 2017 and a particular event in the history of art, the birth of what was later called "conceptual art" when, in 1917, Marcel Duchamp submitted to the first exhibition of the Society of Independent Artists in New York a ... white urinal, with the title "Fountain"

Original picture by Stieglitz, Public Domain

Imagine what was the first thing that came to my (already "primed") mind when I entered the gents room and saw ... this

"When moon?"

Bitcoin as systemic hedge

The discussion with the young lawyer was a bit surrealistic but went extremly well - he is exceptionally gifted and passionate and told me that there are some big investors (Canadian pension funds) where a new investiment strategy is about to gain hold, the so called "0.1%" This strategy is about having 0,1% of the assets under management by the fund invested in crypto (mostly BTC and ETH) as a "systematic hedge". The reasoning behind this is detailed in a recent article on Coin Telegraph.

The four most dreaded letters in crypto-universe: GDPR!

The evening ended fittingly with a very interesting discussion around a position paper that is slightly becoming a reference in the institutional world when discussing blockchain in conjunction with GDPR, a paper authored by Dr. Michèle Finck from the Max Planck Institute (one of the most prestigious research institutions in the world) who is also an Oxford scholar.

As it happened, I had read that paper shortly after coming back from Malta and was struck by ... how bad it was! But I felt uneasy about trying to come out against the many logical flaws in it as I'm not myself a lawyer ...

I felt a lot of relief when this guy who is a lawyer, and a very well read one, shared my opinion! Michèle Finck's article is dross! But the problem is that it has been published by an Oxford scholar under the banner of the Max Planck Institute ! It is therefore both extremely hard to disprove it and all the more important to do so as soon as possible, before the opinions expressed in it become entrenched.

We ended the evening by deciding to join forces and pool our shared competences into writing a critical analysis of the deep flaws and misunderstandings in Dr. Finck's paper. Hubris? Maybe, but better to come out publicly and let the community debate than to say nothing and let non-lawyers assume that "it's the commonly agreed position".

Other posts on blockchain technology that you might enjoy:

- Blockchain and the End of the Western Civilization

- Toward a pan-EU blockchain infrastructure

- Sovereign identity on blockchain

- Blockchain revolution: Money and Credit

- La Blockchain et la Fission Nucléaire - with English abstract

- Blockchain Global Expo 2018 @ London Olympia

- Blockchain Global Expo 2018 - day 2

- The Holy Blockchain

- Blockchain, Credentials and Connected Learning Conference

- Decentralized Learning: The Future of Student Mobility in Europe

- Poker Champion Tony G turns MEP Blockchain Champion!

Other posts on the impact cryptocurrencies are likely to have on our societies:

- The future of society

- The Church of Bitcoin

- Hack Your Life in 3 Easy Steps!

- Small worlds

- Steemit and the Fractal Society

- The Press needs to be Freed from the Tyranny of Money

- Steem $10Bln!

- A New Hope

- Immigrate to Romania!

- Ons Stad liewen

If you enjoy my posts, please approve @lux-witness as a witness!

Also, why not optimize your own rewards and benefit from my pledge as explained in this post:

- Help Yourself! (steemit for dummies) (in short)

and in more detail in this post: - Best way to Grow on Steemit