Cboe Withdraws Bitcoin ETF Application

According to online news reports around the net, Cboe has decided to withdraw its application for a Bitcoin Exchange-Traded-Fund (ETF) backed by VanEck and SolidX.

The U.S. Securities and Exchange Commission (SEC) deputy secretary Eduardo Aleman confirmed the withdrawal of the exchange’s rule proposal that would have granted it to list shares of the VanEck SolidX Bitcoin Trust if approved.

It was revealed that the withdrawal was made January 22, 2019.

The SEC in the past has delayed its decision on whether to approve or disapprove the Bitcoin ETF application.

It has been asking public comments and holding meetings with proponents to get more insight about the initiative.

If the application was not withdrawn the agency faces a deadline on February 27, 2019 to approve or disapprove it.

VanEck director of digital asset strategy Gabor Gubacs reveals that the application is temporarily being withdrawn without stating any particular reason why it was.

However some securities lawyers speculated that the ongoing government shutdown would result in the ETF being denied as there is no staff to review the proposals.

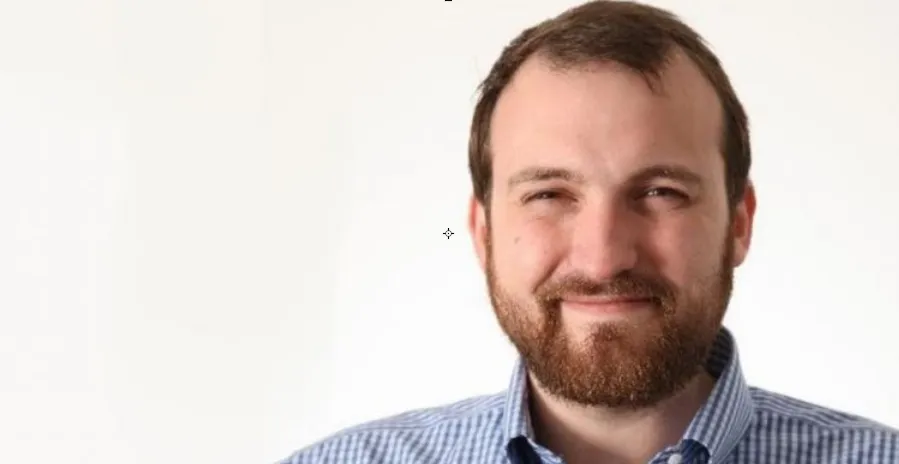

Cardano Founder Believes It Could Take More Than A Decade To Regain 2017 Crypto High

The founder of Cardano, Charles Hoskinson has recently expressed that it could take more than 10 years before the whole cryptocurrency ecosystem could regain the value it has reached during the 2017 bull ran.

He made this revelation during an interview he had with an online crypto news outlet at the Crypto Finance Conference last January 17, 2019.

He also states that when it eventually recovers it might be a whole lot different from what it is today comparing it to Amazon which took 11-12 years to regain the value it has gained during the dot-com bubble in the early years of the internet, adding that the company is now more mature and more realistic company.

Hoskinson emphasizes that cryptocurrencies might take the same growth pattern of Amazon and will be dramatically different from what we know it today.

By then there will be billions of users and many easy-to-use applications, not to mention the on-boarding of institutional investors that will bring in a better and regulated marketplace in the crypto space.

Andreessen Horowithz And PaypPal Co-Founder backed Crypto Custody Service Provider Launches

A new cryptocurrency custody services provider has recently launched with the backing of several well known venture capitalist firms.

The Anchorage cryptocurrency custodian for institutional investors was launched following a $17 million funding round led by venture fund Andreessen Horowitz and other major venture fund firms such as PayPal co-founder Max Levchin’s SciFi VC, Khosla Ventures and Mark McComble of investment firm Blackrock.

Anchorage intends to create a custody service for digital assets that they claim to be more secure than a cold storage to better support institutional investments.

The company states that their service offering will be based on the principles of easy access to assets, voting, auditing proof of existence and fast transactions.

The active participation of venture capitalist firms into blockchain and cryptocurrency projects demonstrates the willingness and enthusiasm of institutional money pouring into the space.

However due to the current market down trend Wall Street’s crypto planes are largely on hold and have somewhat dampen some of the interest.

Pundits are claiming that 2019 might be a better year for cryptocurrencies in general as may expects the year will see increase of regulatory clarity in the whole ecosystem.

Institutional Investor Spot Trading Launched By US Crypto Exchange

This was revealed by an official press release published on the 23th of January 2019.

Spot trading is the purchase or sale of currency, financial instrument or commodity for immediate delivery.

Sport include the physical delivery of the instrument, commodity or currency.

The exchange’s spot market will support trading for Bitcoin (BTC) to U.S. dollar pair initially. Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) pairs will be added later this month. Seed CX also revealed its intent on adding new fiat pairs later in the first quarter of this year.

According to company they are looking into adding Euro and Japanese fiat pairs. Aside from the Spot Market the crypto exchange will also offer a market for digital asset derivatives regulated by the United States Commodities and Futures Trading Commission (CFTC).

According to Edward Woodford, co-founder and CEO of SEED CX, the exchange have already received positive feedback from its customers and expect to attract institutional investment.

The exchange will be using a zero fees to deposit and withdraw fiat or digital assets.

All dollar deposit will be help in a regulated U.S. Bank and protected by the Federal Deposit Insurance Corporation.

Crypto Asset Guidelines Will Soon Be Released By UK Financial Watchdog

An independent financial regulatory body in U.K., the Financial Conduct Authority (FCA) has begun consulting on guidance related to cryptassets.

The regulator aims to give greater clarity and understanding surrounding crypto asset activities to ensure that they comply with regulations and provide safety to protect consumers.

According to Christopher Woolard, FCA director of strategy and competition, the agency wants to be clear what is regulated and what is not.

He believes this is important so that consumers know what protections the will benefit from and have a market functioning as it should be.

The agency has already published a consultation paper and Is currently gathering feedback from participants in the ecosystem.

This will last for 10 weeks and will be ending on April 5, 2019. This will be followed by a policy statement in the summer of 2019.

Headlines for the world of Cryptocurrencies - January 24, 2019Swiss Bank Launches Crypto Wallet With Fiat Withdrawals / Coinbase Expanding Its Business To Asia and Europe With New Services / Celebrities Are Taking Positions on Bitcoin / Huobi To Release Own Stablecoin / Nasdaq CEO States That Crypto Will Be The Global Currency Of The Future |

|---|

Headlines for the world of Cryptocurrencies - January 23, 2019New Report Reveals Centralized Exchanges Still Dominates / Mysterious Virus Targeting China Bitcoin Miners / University Researchers Discovers A Way To Track Stolen Bitcoin / Banking Association Pushing For Blockchain Digital ID System / Regulated ICOs Can Be An Effective Crowdfunding Model Says OECD |

Headlines for the world of Cryptocurrencies - January 22, 2019Justin Sun Hires Former SEC Official / United Arab Emirates and Saudi Arabia To Launch Crypto Pilot For Cross-Border Payment / Ukraine Seeking To Increase Blockchain Professionals / Prominent Crypto Investor Believes Bitcoin May Reach $20,000 On The Next Wave Of Adoption / SBI Invest $15 Million USD TO Swiss Smart Card Cypto Wallet |

g

g