Cryptos Are Institutional Asset Class According To Morgan Stanley

Morgan Stanley has recently released a new report updating on the status of Bitcoin (BTC), Cryptocurrencies and Blockchain.

The report is an update to its earlier report dubbed as “Bitcoin Decrypted: A Brief Teach-in and Implications” which was released last year in December.

According to its latest report, Bitcoin is no longer a store value but is in fact an institutional asset class set to take on trading and cater for the needs of big banks and family offices across the globe.

With this latest report Morgan Stanley seems to be positioning itself to become a major player in the cryptocurrency industry.

This stems from the fact that the research division of the firm has produced 15 research papers that revolves around this new asset class and its underlying technology.

This would not be surprising as there is not a lot of money to be made in leveraging the volatility of the crypto market. The firm might not be interested with a custody solution but might be interested on other crypto-related products.

These products include an institutional trading desk which handles futures contract, OTC transactions, and Non-deliverable Forward products that can be traded across other Level 1 institutions.

They can also offer Bitcoin futures transactions using readily available infrastructure of CME, CBOE, ErisX and the soon to be released Bakkt Bitcoin Futures.

Perhaps to differentiate from the aforementioned financial products, they might be interested in offering Ethereum based product.

Only time can tell if Morgan Stanley will go all out in cryptocurrency but truth be told any company would not waste valuable resources in research not unless they want to get something out of it and most of the time it is for profit.

BlackRock Still Waiting For Further Legitimization Of The Crypto Market

The world’s largest asset management firm, BlackRock is still waiting for the right moment before it starts offering its clients exchanges traded funds (ETF).

It reveals that it is still waiting until the crypto markets are further legitimized before making any move.

This is despite the company’s CEO, Larry Fink being bullish on blockchain technology but at the same time hesitant about cryptocurrencies.

The CEO further explains that his company is not dismissing the possibility of offering crypto-related investment products but rather his company is not yet ready at this time.

He also reveals that there is a possibility BlackRock will offer crypto ETF if and when it is legitimate.

The type of legitimization Mr. Fink might be asking is maybe just around the corner as SEC is set to decide the fate of Bitcoin ETF applications in the near future.

One of the applications was submitted by VanEck and SolidX which many believe has the greatest chance of getting the SEC’s approval.

The approval of VanEck Bitcoin ETF could be the legitimizing event that companies like BlackRock are waiting for before entering the market.

When this happens, this could be the start of the end of the almost year long bear market and a start of another massive bull run that was widely believed to have been triggered by the approval of bitcoin futures of CME and CBOE.

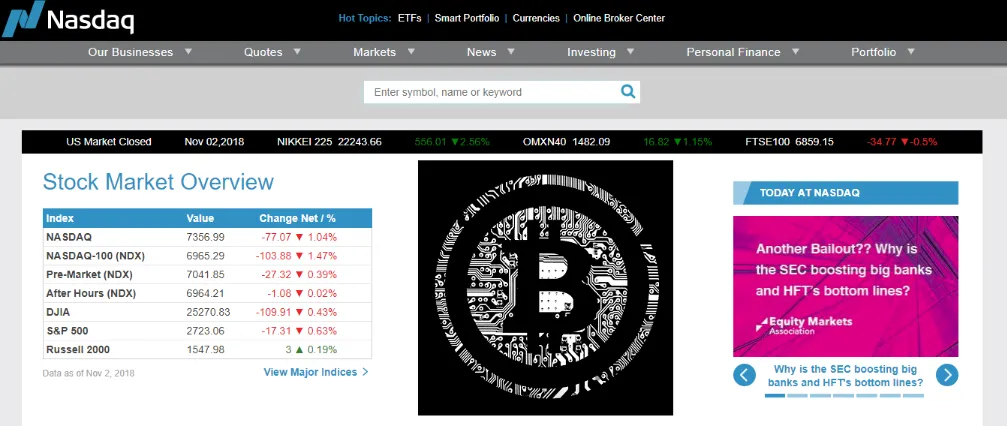

Nasdaq Mulling Over Deploying Their Platform For Crypto

In a telling report about the current state of cryptocurrency exchanges, the Attorney General of New York revealed a great variance in the maturity of several exchanges that were surveyed by the agency.

It concludes that there are a lot of things still needed to be done before it can be considered acceptable.

With that being said, Nasdaq might have the suite of tools that can help cryptocurrency exchanges achieve the level of maturity that is deemed acceptable by institutional standards.

Nasdaq states in an unpublished internal documents its ability and expertise to detect market manipulations and other scams.

It said that the firms surveillance teams can monitor, capture and analyze abusive behaviors including pump-and-dump schemes, insider trading, wash trading as well as spoofing and layering using it advance technologies.

It has been reported that Nasdaq is already considering to list some cryptocurrency related assets in its own platform starting next year and has supported crypto exchange Gemini with its technology.

Furthermore, that company also initiated a closed-door meeting to discuss the emerging asset class in what many believe as one of its efforts to legitimize the current space which was attended by its CEO Adena Friedman, who believes that cryptocurrencies is the right next step in the space of currency.

Its latest initiative to integrate Microsoft’s Azure Blockchain into its financial framework might be its preparation to integrate other blockchain platforms into its own software.

Binance Uganda: 40,000 Crypto Traders Signed Up In First Week Of Operations

The general bearish condition the whole cryptocurrency market is currently experiencing did not dampen the enthusiasm of Ugandans towards cryptocurrencies as demonstrated by its whopping 40,000 registrants during the first week of operation of Binance Uganda.

Binance is currently offering Bitcoin and Ether in its trading platform and will gradually increase the number of crypto trading pairs moving forward.

The new subsidiary will only offer crypto-to-crypto exchange.

Customers who want to trade fiat-to-crypto and vice versa will have to go through an undisclosed mobile payments provider.

The identity of the firm is being withheld as a precautionary measure when managing large quantities of cash.

KYC is also mandatory in Binance Uganda which differs from its flagship global trading platform.

According to Wie Zhou, the chief financial officer of Binance, users of Uganda will not need bank accounts as they will only need to have money within the mobile payment systems.

This bodes well with Ugandans it has been stated in the past by a Stanford University paper that 74% Ugandan households are unbanked.

Zhou also reveals that the company is also looking into hiring local operational staff for both local support and expansion of similar subsidiaries in 2019 to either Kenya, Nigeria or South Africa.

Charities in Minnesota Starts Accepting Cryptocurrency Donations

Charitable organizations from the state of Minnesota is now reaping the rewards for educating themselves on cryptocurrencies and how they can leverage this emerging technology to benefit their common cause.

These organizations are Saint Paul and Minnesota foundations which are Minnesota’s largest community foundation.

Through shared resources and knowledge sharing, they were able to understand the industry better a bit more and develop policies for accepting this new type of contributions.

According to Jeremy Wells, the vice president of philanthropic services of the two foundations, they treat cryptocurrencies as properties which are donated to them.

In this regard like any other property that is donated to them they turn it into cash as soon as they are received.

This resonates well with the current IRS definition of cryptocurrencies which classifies the new asset type as properties.

The vice president also reveals that through the learning process of cryptocurrencies it enabled the foundations to not only be aware of different ways of donating but has also opened the door to other potential donors.

The foundations wants to share what they have learned in this initiative and wants to empower other non-profit charity organizations through seminars and presentations to understand the industry more and also benefit from this technology.

The first crypto donor to the foundation praised the organization for their willingness to understand the industry stating that crypto is the future of money and it is good to learn now and be ready.

Headlines for the world of Cryptocurrencies - November 03, 2018Is Warren Buffet Ready To Invest In Crypto? / MetaMask Announces A Mobile App / Cryptocurrency Project In New Zealand Funded By Government / Ethereum 2.0 Soon According To Its Founder / World’s First Private Transaction On the Ethereum Public Blockchain |

|---|

Headlines for the world of Cryptocurrencies - November 02, 2018Goldman Sachs Enlisting Clients For Crypto-Related Product / Bitcoin Will Not Destroy Our Climate / Dismissing Crypto Is Like Dismissing Internet 1993 VC Investor / Finance Minister Of South Korea Sees No Problem Allowing Crypto Exchanges Banking Services / Coinbase Debanks IPO Initiative But Reveals Adding Up To 300 Digital Assets |

Headlines for the world of Cryptocurrencies - November 01, 2018Blockchain Documentary Released In New York / French Business College Now Accepting Cryptocurrencies / Blockchain Will Surge In 2019 According Fidelity Digital Assets Lead / Bank Of Canada Official: Fiat and Crypto Co-Existing Could Work / Berlin Blockchain and Cryptocurrency Hotspot |