In the classic children's game,

Hot Potato, players sit in a circle and toss a small object (often a potato) around while music is playing. Once the music stops, the player left holding the potato loses the game.

credit: gameonfamily

Musical Chairs, on the other hand, has players run around a scarce number of chairs while the music is playing. Once the music stops, the player left standing without a chair becomes the loser.

credit: strengthpowerspeed

In each of these games, the rules and incentives determine the holding time (H) of the asset (in this case, potatoes or chairs). In hot potato, players are incentivised to get rid of the asset as quickly as possible, giving it a short holding time. In musical chairs, players are incentivised to hold on to the asset as much as possible, increasing its value.

Are you holding a hot potato or a scarce asset?

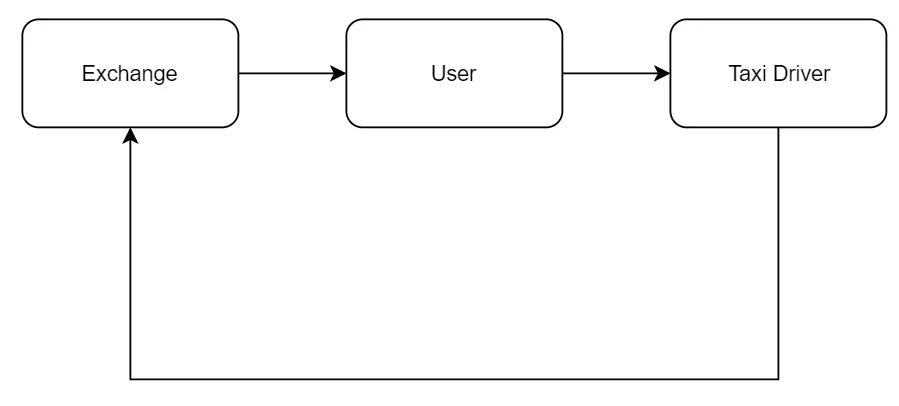

Using this simple analogy, it helps to consider the holding time (H) of the asset you are buying into. For example, a decentralised taxi coin TAXI that is used to access taxis has a short holding time. You, as a user would buy it from an exchange, use it to pay the driver, who would then immediately sell it back to the exchange.

This arrangement creates continuous selling pressure on TAXI, where no player is incentivised to hold the token and simply passes it on to the next player, like a hot potato. Vitalik has a great post on this where he mathematically defines (H) and states:

if someone creates a very efficient exchange, which allows users to purchase an appcoin in real time and then immediately use it in the application, then allowing sellers to immediately cash out, then the market cap would drop precipitously.

Simple tokens whose utility could be replaced by another token or fiat are weakly coupled to the economy, and are prone to economic collapse or at the least, poor gains.

HODL Tokens

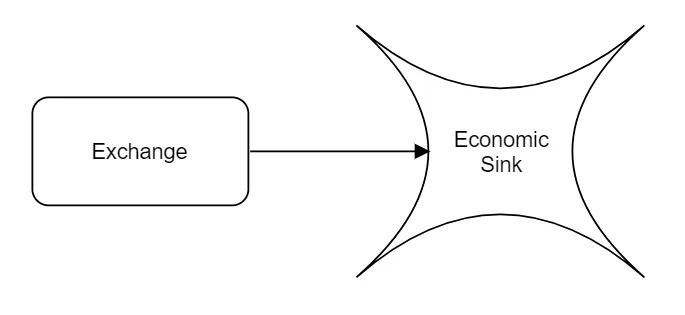

Like musical chairs, some tokens are designed with strong incentives to hold, where there is an economic advantage to hoarding as many of the tokens as possible. This acts as an economic sink, where the available token supply decreases with time. William Mougayar has a great post where he describes how the utility of tokens can be built. In it, he states simply that

Usage without value linkage is a waste

In other words, a simple medium of exchange, 'use it and lose it' token could lead to economic failure.

Vitalik and Mougayar argue that not all tokens are created equal, in terms of economic incentives and safety. Let us go through some example tokens with strong incentives to hold and good economic prospects:

Steem:

Holding on to STEEM lets you vote, comment, publish, etc, while earning on the fastest growing blockchain powered social netowork. STEEM will also be needed to power social networks that start to use its Smart Media Tokens

OmiseGO:

Holding on to OmiseGO let's you stake in their network, and earn transaction fees in any currency of your choosing. (USD, ETH, BTC, etc).

LOOM:

Holding on to LOOM let's you develop and use large-scale online games and social apps on Ethereum, and also stake on their network.

KIN:

KIN acts as a massive economic sink, where tokens flow from investors into an insulated economy of millions of users, and are held in a growing ecosystem of apps, websites and social networks. Holding on to KIN lets you participate in these networks.

Each of these systems has a strong incentive for its users to hold on to the tokens. This way, tokens flow from an exchange and become 'locked' or vested into these ecosystems. Before investing into a token, remember to consider the holding time (H), which could affect the future value of your investment. In other words, always ask yourself - Where is the sink?

credit: pinterest

Let me know which of the three tokens, OmiseGO, LOOM, or KIN you would like reviewed in detail