Fundamental Cryptocurrency Analysis

Welcome to the seventh post in the cryptocurrencies for dummies series. We are going to talk about how to determine what cryptocurrencies to buy. Furthermore we are going to be talking about fundamental investment analysis and my basic process for completion. Fundamental analysis is a technique used to inspect the business aspects of the cryptocurrency project. As opposed to technical analysis where you study trends and market movement to make investment choices. Technical analysis can lead to many false flags in the cryptocurrency market due to easy manipulation. Therefore, it's important to first understand fundamental analysis when investing in cryptocurrency.

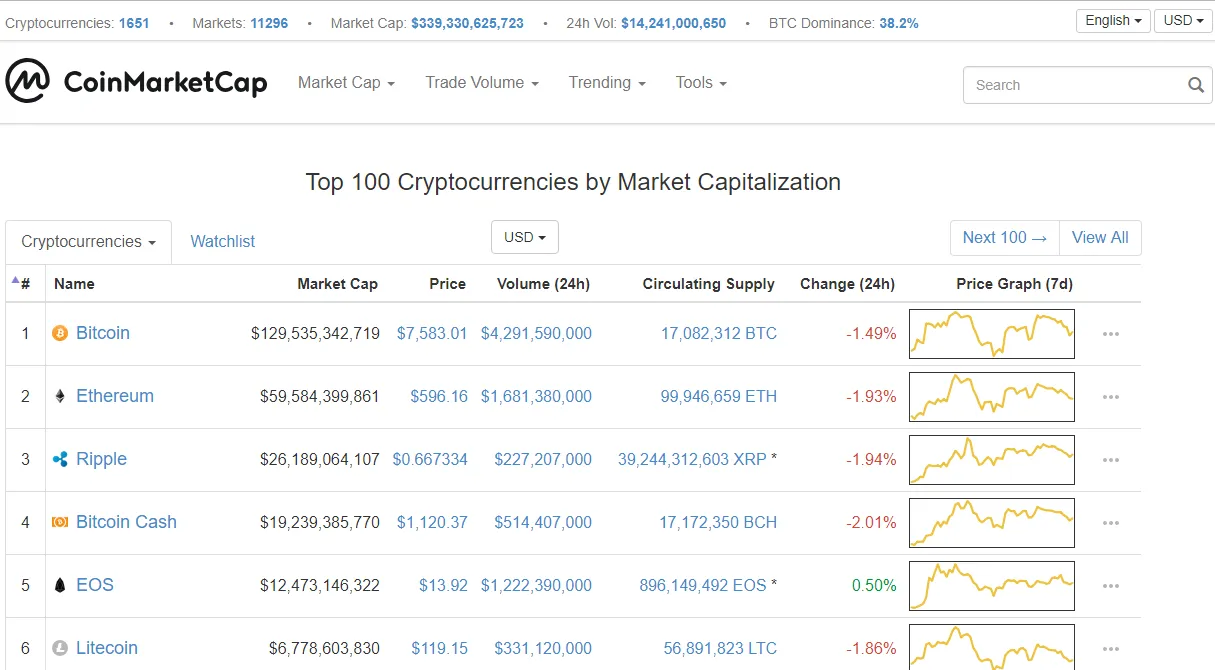

There are hundreds of projects to invest in within the market. To illustrate this point I have shown a screenshot of Coin Market Cap. Here you can see the hundreds of different projects available to choose from and information for each one. Coin Market Cap will be a valuable tool in determining sound investments and moreover tracking them later. Although many of these projects might look great on the surface you must be wary of scams. In the last edition of cryptocurrencies for dummies we went in depth to avoiding scams. Again you must always be careful and you can re-read the last post if you need a refresher on the warning signs.

Over time I have developed a process I use to analyze different projects. This process is always changing as I learn more and more however I will share the basics with you guys. Before going into the process, you should realize that keeping track of information is important. In order to accomplish this I either keep my information in a notebook, or on an excel spreadsheet. Furthermore you should understand the risks that come with any investment. We have covered some of the risks here however if you want to learn more then check out this post from the Rublix blog.

How to analyze a cryptocurrency

Team and Leadership

My process for fundamental analysis of cryptocurrencies involves three easy steps. Firstly, I take a look at the project's team and leadership. This is a very important step because good leadership will take a solid project a long way. For example, a great project idea with a bad team and leadership will not do well at all. However, a poor project idea can still perform very will with a great team and leadership backing it. In order to inspect the team and leadership, you can check the whitepaper for the project. Every cryptocurrency project has its own white paper on their website. As an example I have linked the VeChain whitepaper below this paragraph. White papers are documents containing essential information about the technology, business plan, and team behind the project.

White papers are fantastic resources to use in your analysis. In this example white paper you will find the team details towards the end of the document. You want to inspect for key details pertaining to key personnel and advisers for the project. Look for a good history of successful projects from the leadership and an experienced team that will make a successful project. Also take note of strong advisers and initial investors that have a stake hold in the project. These personnel can play a key role in guiding the leadership through a successful journey.

Product and Mission

Next in our process we want to analyze the project's product and mission. Again you can use the white paper as a starting resource in your analysis. Make sure the product has a strong use case that solves a real world problem. To illustrate this point you wouldn't want to invest in a company that doesn't solve any issue of the people or the world. Doing this might take some extra time and thinking, and I suggest you to use alternate resources at your disposal. Blogs and forums are a great resource for finding additional information and sentiment from the market. Use all available resources and consider multiple viewpoints in your analysis and take note of everything important you find.

Every cryptocurrency project should define a strong mission for itself. In fact all of the top cryptocurrency projects have their own missions and goals they want to accomplish. For instance, bitcoin's mission is to provide peer to peer transactions that circumvent central banks. Similarly ethereum wants to provide an ecosystem that provides a network for payments and fuel development of business applications upon it's blockchain. Make sure you know what the product's mission is and that it serves a purpose in the real world.

Having a good mission serves no purpose if there is no product that can actually work. There are many projects in the cryptocurrency space that have no real working product or solid plan available. Investing in these projects is just a form of blind speculation and should be avoided. A working product and plan for development is key in determining the future success of that project. Like the other steps, you should inspect the product in the white paper to see if it makes sense and is viable. Use all the resources at your disposal and determine the validity of the product and its technology. Check out this post from Coin Telegraph discussing Initial Coin Offering and white paper analysis to learn more about the basics of fundamental analysis.

Cryptocurrency market

Analyzing the competition

Most cryptocurrency projects will have competition in their respective niche. For example, there are many projects with the goal of acting as a currency in transactions. There are also many projects with the goal of acting as a platform for other applications. It's good practice to take note of these competitors and compare/contrast them. Check to see how the project you are interested in is better or worse. This can be done in the areas of product mission, team, and the cryptocurrency's market cap. The market cap is simply the number of tokens or coins multiplied by the total supply.

Market Cap = (Total number of tokens available) x (Price per token)

Comparing the two market caps can give you a general idea of how much room there is to grow for the smaller project. Combining that with the other information you gathered you can create a decent forecast for how this smaller project might perform. There are many things you may compare/contrast about different projects, you don't have to just look at the topics I listed. Sometimes you may have found a unique project with no real competitors in it's respective niche. However this is generally a good thing and you may have found a fantastic project that could go a long way. You just need to ensure that their business plan and product are viable and serve a purpose in the world.

Making wise investment decisions is an art that you will become great at with some practice. Any questions or comments are deeply appreciated as I am here to help you guys. Our business website has just been revamped and rebranded, I hope you guys can check it out! Check out the personal coaching/mentoring on the website if you are interested in assistance or guidance on this topic

Check out our website - Fiducator

Go to part VIII of the series (Coming Soon!)

This content was created by me for use on http://www.fiducator.com and on @kennynneken. Fiducator does not offer financial or investment advice. This material is for information and educational purposes only.