Untrap That Cash!

Many people who have a day job and plan to stick around a little while, also have a 401k that has some sort of employer match. My employer matches 100% of my contributions up to 5% of my income. This is 100% return on my money, and frankly it's stupid not to take it, even though I'm not really a fan of trapping my money into a retirement vehicle. The good news is, I can untrap 50% of my vested balance by taking out a loan against my 401k. I know you're thinking, debt is bad. And you're right, unsecured debt is bad. We are talking about debt secured by my retirement though, and I'm not borrowing from a bank. I'm borrowing from myself, and paying interest to myself. I'm talking about a 401k loan. With one, I am literally acting as my own bank, and my retirement custodian is servicing the loan. The rate offered by my 401k custodian is 4.25%, which means I will be paying that return to myself, rather than investing in whatever pre-packaged garbage my custodian offers. If you don't have the cash flow to make something like this work (i.e. the monthly payment), this may not interest you. If you are living below your means and can divert some cash flow, this might make sense to do. Oh and by the way, I don't want to tell you what to do, but you really should be living below your means or should be working to get there.

Stable Value and 401K Investments In general

I keep my employer-sponsored 401k in their standard stable value fund, which typically pay between 1-2%. So you can see that paying myself a 4.25% return is much better than stable value. Why stable value, and not some target date fund or company stock? Well for starters, a target date fund implies that I plan to keep the 401k until I retire, and they also follow the antiquated stock/bond ratio model that QE is basically murdering. In short, you go heavier into bonds as you get older, because bonds are supposed to offer more stable return. That might have been true 30 years ago, but it's horseshit now. So on to company stock. I believe it's absolutely stupid to put your own money into your company stock. If your company wants to award you options or shares fine, though it might be a good idea to dump them as soon as they are vested. Why, you ask? It's putting all your eggs into one basket. If your company goes out of business or experiences a black swan event, you're out a job and retirement capital. In any case, the return on your company stock won't necessarily match your enthusiasm for working there, so isn't it better to stick your money somewhere else? Back to the loan.

The 401k Loan

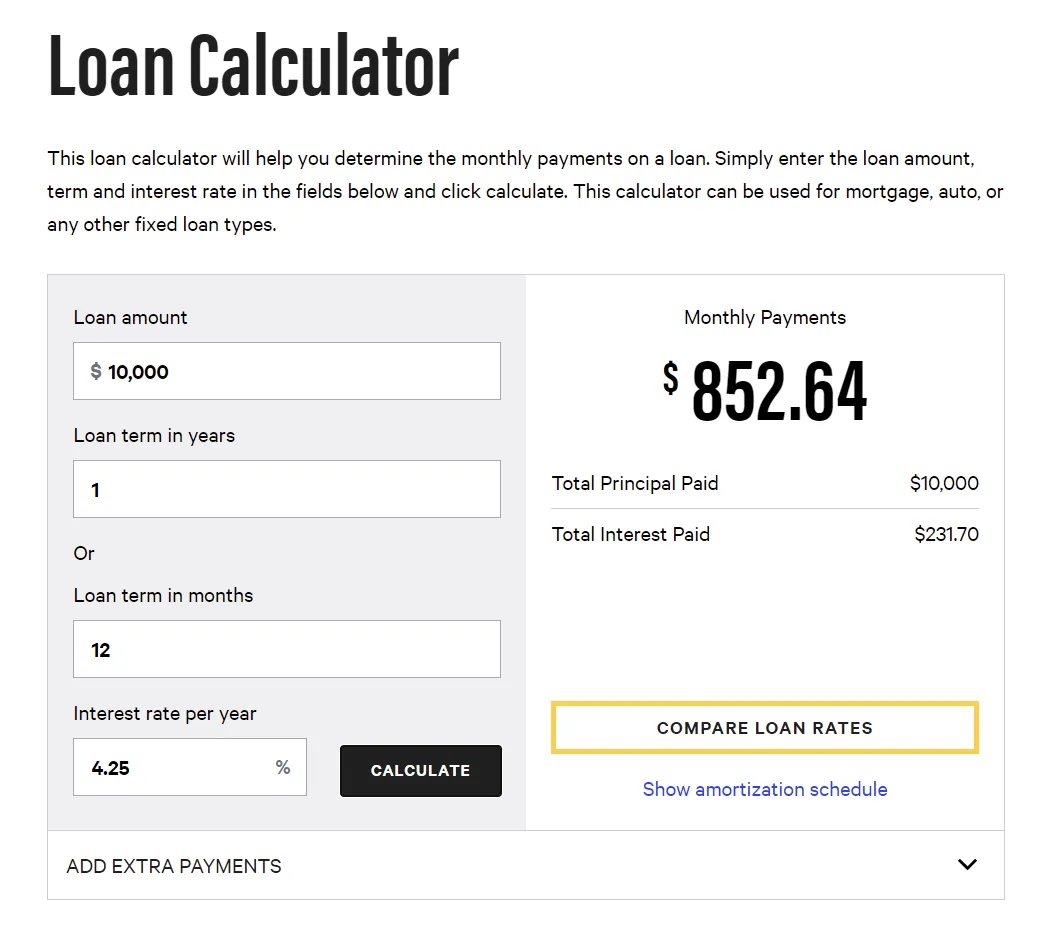

Let's assume that I have $20,000 in my 401k, which means I would be eligible to borrow $10,000 against it. Let's calculate some numbers.

Source: Bankrate.com

Ideally you want a six month loan, but no more than a year. Jobs can be ephemeral remember! So by borrowing $10,000 from my 401k, I'll be putting away an extra $200 bucks or so (loan origination fee is around $25) into my 401k. Big deal right? No, that's nothing groundbreaking, but now I've got $10,000 cash freed up from my retirement, but I am now on the hook to pay about $850/month in payments (to my retirement account). So this begs the question: what should I now do with that newly free $10,000? Buy a Rolex?

I'm Not Buying A Rolex

So you probably figured out for yourself that I'm not going to be buying a Rolex with my liberated retirement money, I want to get yield on it and keep it as liquid as possible! Why do I want to keep it liquid you ask? Well if I happen to leave my job for whatever reason, I'll owe the entire balance of my loan (usually within 90 days). What I'm going to do is convert these dollars over to USDC, and send them on over to Ledn (Ref Link) where I can get 12.5% APY on them. I could also send them to BlockFi (Ref Link) if I wanted to generate returns denominated in Bitcoin, but remember, I want stable and liquid. I'd want to have the equivalent amount of money somewhere else to pay back the loan balance. That being said, I could incrementally move the money into something else (like Bitcoin) as my loan balance drops.

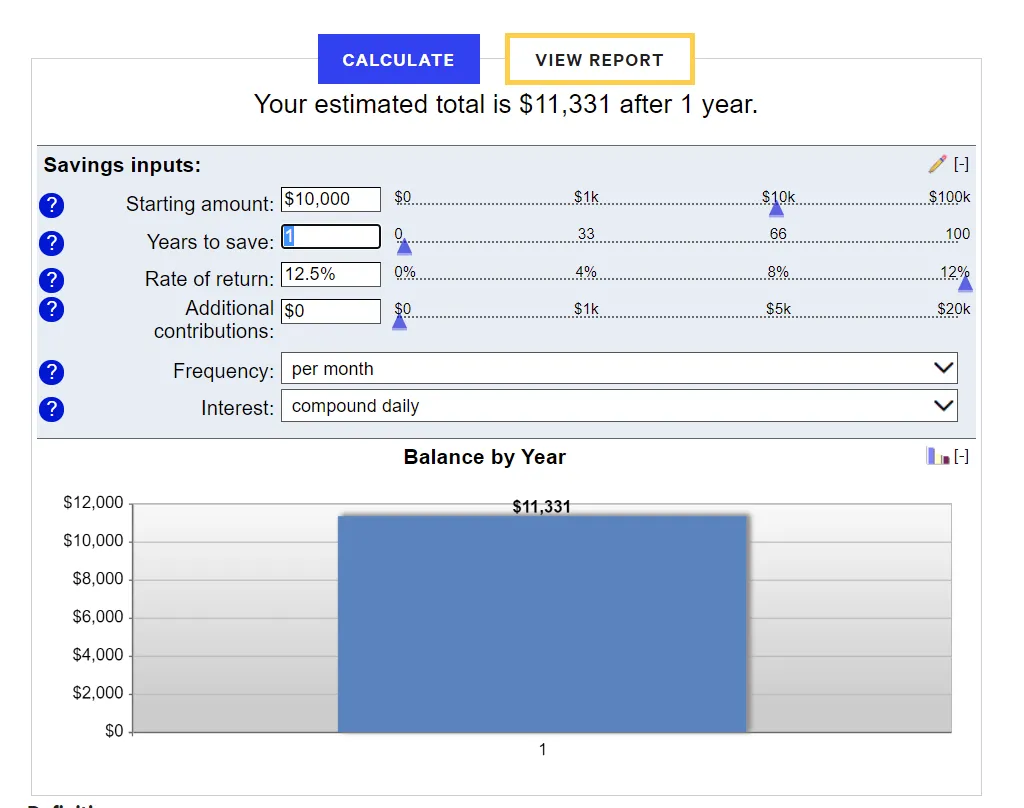

With the calculator below, you can see the result of my $10,000 at 12.5% APY compounded daily.

Source: Bankrate.com

Not bad right? What about taxes? I'm glad you asked. Yes, that interest would be taxable. But once the loan is paid off, you'd be getting a return in perpetuity (assuming counterparty risk of course). If you regularly took out new loans, you could see how quickly you could compound your growth.

Onward

Using this approach, I can continue to modestly grow my 401k with money I'd be saving anyways, with a slightly better return I'd be getting otherwise, and at the same time put my money to work outside of my IRA. I can have two active loans at any given time, so if I accrued more, or payed off a certain amount, I could take another loan, pay it off and take a larger loan, or stagger my loans out. If I decide to leave my job, I can pay off what's left of the loan because I didn't buy a Rolex, and roll over the balance to a self-directed IRA (like https://www.retirewithchoice.com/), where I have the freedom to invest my money where I want it. Even self-custodied Bitcoin if I get the notion. Wink. Wink. If the loan is already paid off, I'd be free to leave it in USDC, or allocate it into something harder like Bitcoin, where I can get about 6% APY.

What's It All For @joshman?

So what does this accomplish? While I'm employed, It gets value I have locked into a government-controlled investment vehicle I don't really believe in, to a next generation financial vehicle that I do believe in. It allows me to continue to get my 100% employer match, and use it to get yield (and ultimately Bitcoin). It provides me full access to those funds, and for the privilege, I have to pay myself back at a modest 4.25%.

So what do you think, is this something you would do?

PS. These are my thoughts and ideas, and SHOULD NOT be considered investment advice. Please talk to your spiritual advisor or whatever.