An Exclusive HDFC Bank Credit Card Offer, Just for You - Rs 1500/- Amazon Voucher gift.

The offer sounds exciting, isn't it ? Just apply and get a Credit Card and you will receive 1500 Amazon voucher as a welcome gift. But that's not entirely true. There are terms and conditions and barely very few read that and jump in instead.

They keep reminding me in a continuous basis to refer my friends via mail or whatsapp. Once I click on that mail link, it creates a mail with this content :

Hi, I wanted to share some exciting news with you. I have been using an

HDFC Bank Credit Card for some time and my overall experience has been amazing! The best part is, if you get a new HDFC Bank Credit Card using this special Link, you'll receive a Rs. 1500 Amazon voucher as a welcome gift. Trust me, It's an offer you don't want to miss! Check this Link to Avail the Offer: hdfcbk.io/k/DUvfEek3HLy

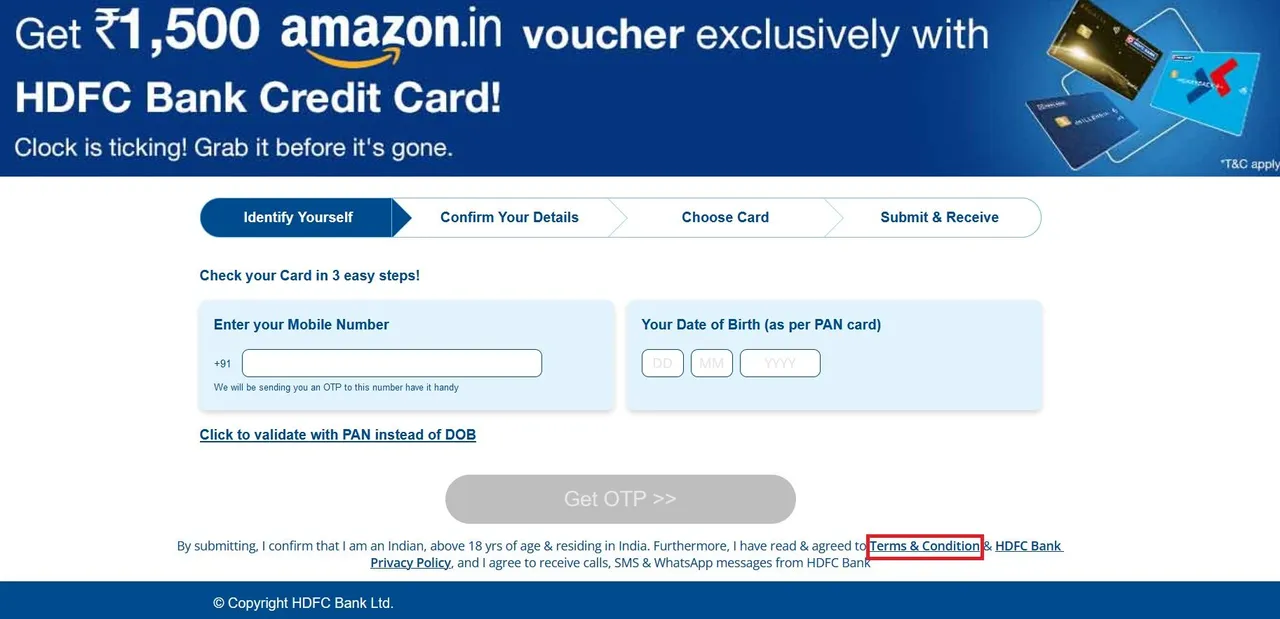

The link seems to be very generic, and you can use it. Once you click it, it lands you on the above page, where you need to enter and confirm your details with the OTP and it will take you to a page where you can select the card of your choice. But before that, spare a moment to read that Terms and Conditions.

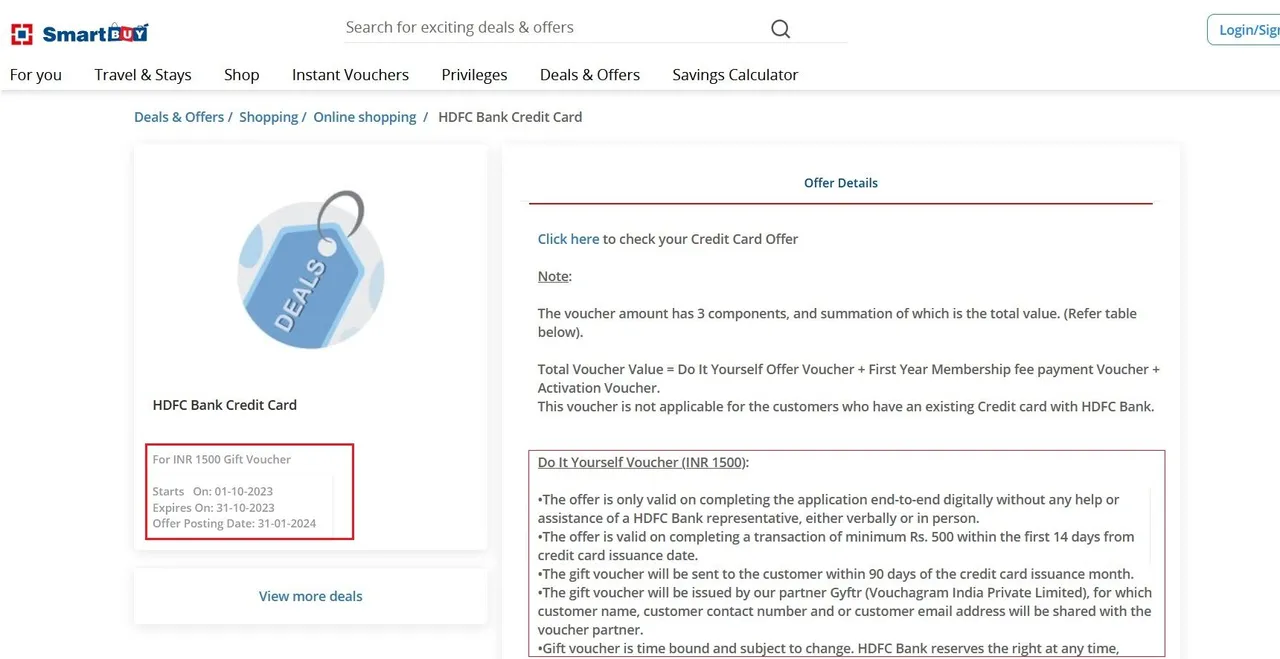

They call it a "Do It Yourself Voucher" - you must complete the application end-to-end digitally without any help from a HDFC Bank representative, and you must complete a transaction of minimum Rs. 500 within the first 14 days from credit card issue date. There are many other conditions in that page which you should read, but the point is that apparently they run this offer forever, but tell you in such a way that you will feel like you are going to miss it, if you do not apply now. And they actually don't give you a 1500/- voucher at one shot, the voucher amount has got 3 components, and "Do It Yourself" gives you only 500/- . Then there is a "First Year Membership fee" Voucher which is equal to the annual fees. And there is a Activation Voucher, which gives only 250/- if you perform 1 transaction within the first 37 days from card issuance date. So now you may realize how they cleverly tease you for the offer.

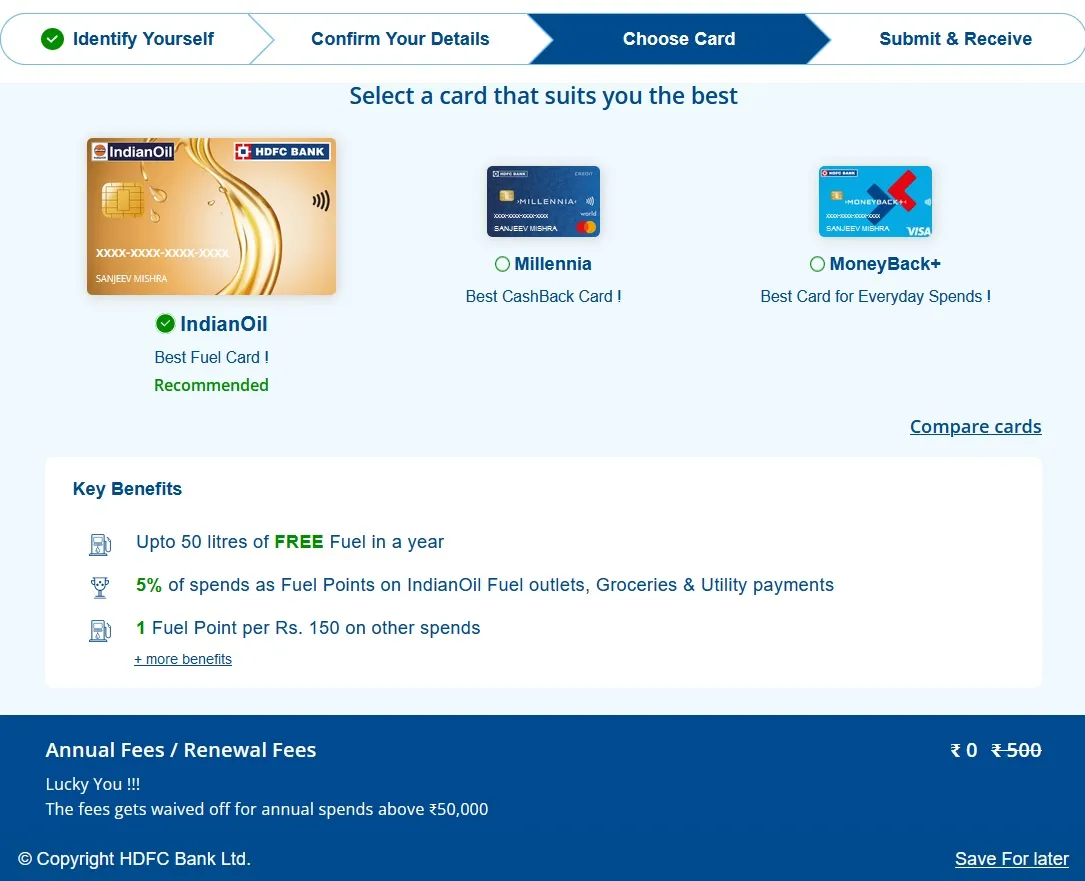

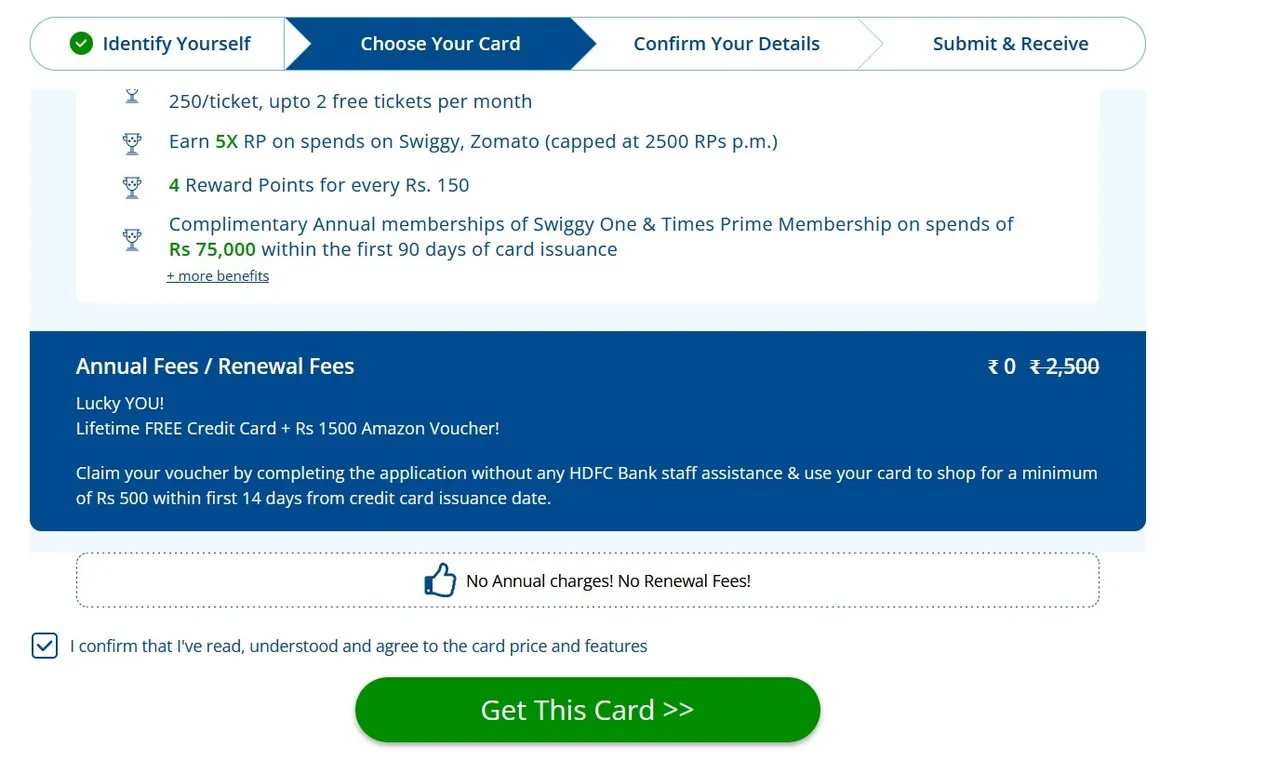

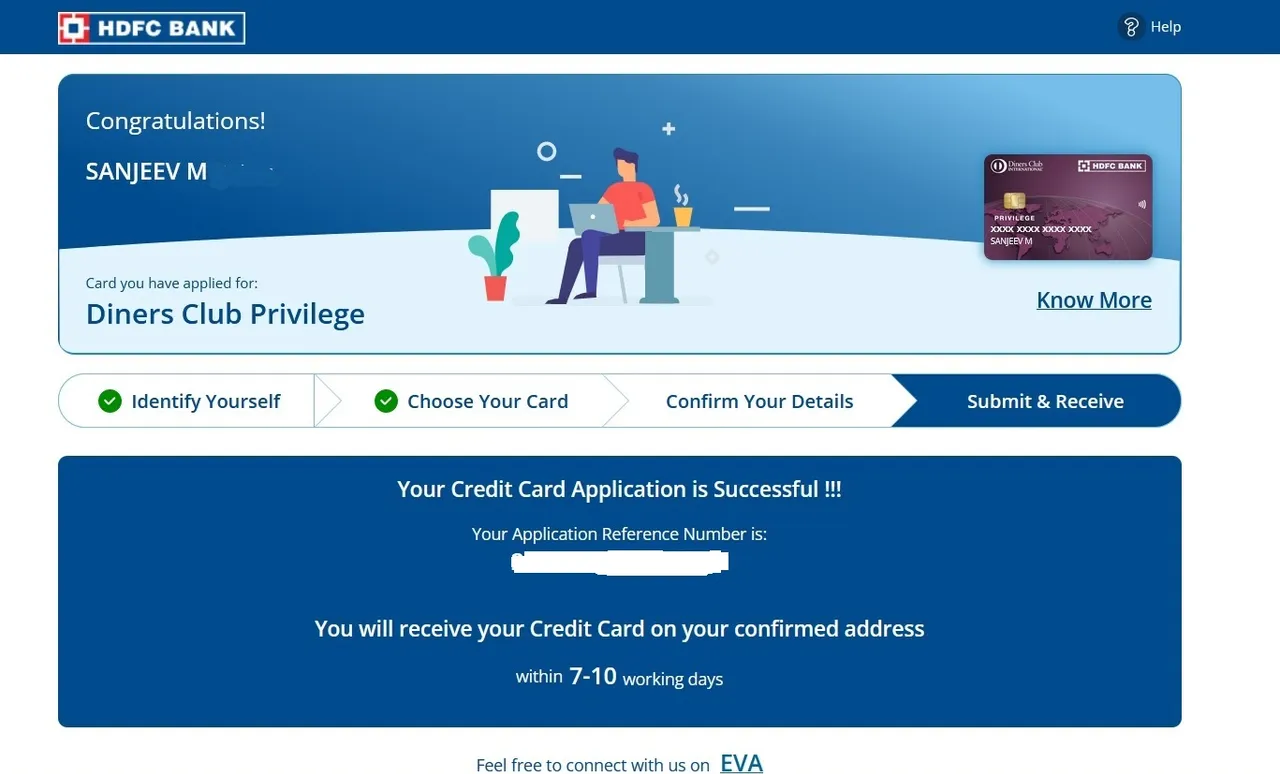

Going back to the parent page, you can select the card of your choice, and it's very important to understand the Annual fees waiver clause. The Annual fees gets waived only if you spend above a certain limit applicable for each card - else you will be Unlucky you. And the other important piece in deciding your card is what key benefits you are looking at. So choose the one that is best suitable for you. I went for the Diners Club Privilege because of these offers :

If you carefully see there is no Annual Fees, saying its a Lifetime Free Credit Card. But then I don't trust them entirely. The Annual minimum spend for this is 300000/- for the annual fee weaver, so I will have to make sure I spend that much. I already did a transaction of 500/- on the very first day, so hopefully I should get that voucher, but it may come within 90 days, ya, that is how they play around. I have still kept these screen shots. to show them later, if needed.

Credit Cards are very good as long as you manage them well. You get almost more than 45 days to pay back for your spends. But if you are not very good on your financial management, then I would strongly discourage you to go for it. The reason is that they earn most from your faults - if you do not pay in time, they charge you very hefty amounts in forms of penalties and interest. For that reason, I always put a standing instruction to auto debit the full amount by their due date. If you pay only Minimum amount due, then they still charge you interest. But then you are responsible to make sure your account has that much money. And you can do that only when you manage your finance well. So it's all connected. You should never spend just because you have got the credit card, its you who has to pay later. So spend only if you need to spend - instead of giving cash, use the credit card, and you can save the amount for 45 days earning you a little interest.

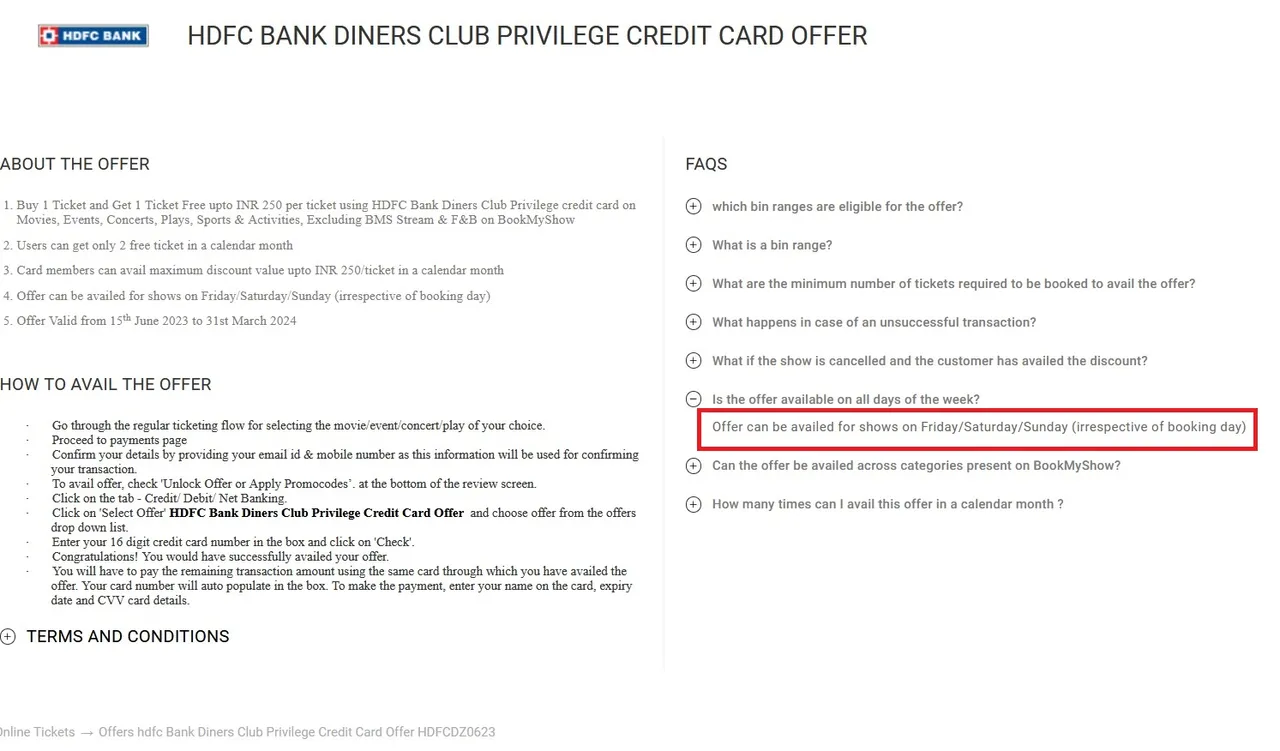

As I wrote in this post this card has got a nice offer for movies - I can get 250 off per ticket, up to 2 free tickets per month. So its like buy 4 tickets ( for my entire family) and get a 500/- discount. Or the father and son duo can go twice 😀.

And that is also not simple - the offer is applicable only for shows on Friday and Week ends, irrespective of when you book. That seems to be ok, because usually we won't go on week days anyways. The other benefit of the Diners Club Privilege card that attracted me was Free Airport Lounge access. So far I did not have this in any of my other cards, so this will be useful when we travel.

It's already been a month, and there are couple of times when the Card did not work for online payments, because its neither a VISA nor a MasterCard affiliate card. I had to use my other cards, so it also depends on the payment provider that is processing the payment. However, it works fine on POS (Point of Sales) terminals. That will help me to meet my annual spend of 300000/-, because I know they will charge even though they promised that it's free for life.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.