These next 2-3 weeks are most likely going to be the most important time period in my entire life, at least from a geopolitical perspective. Of course, in my personal life, I have had and still hope to have far more significant events: getting married, watching my daughter being born, graduating college, graduating graduate school, etc. But I worry about - and keep beating the drum on - what in the actual fuck is the US going to do when these unemployment numbers come out?

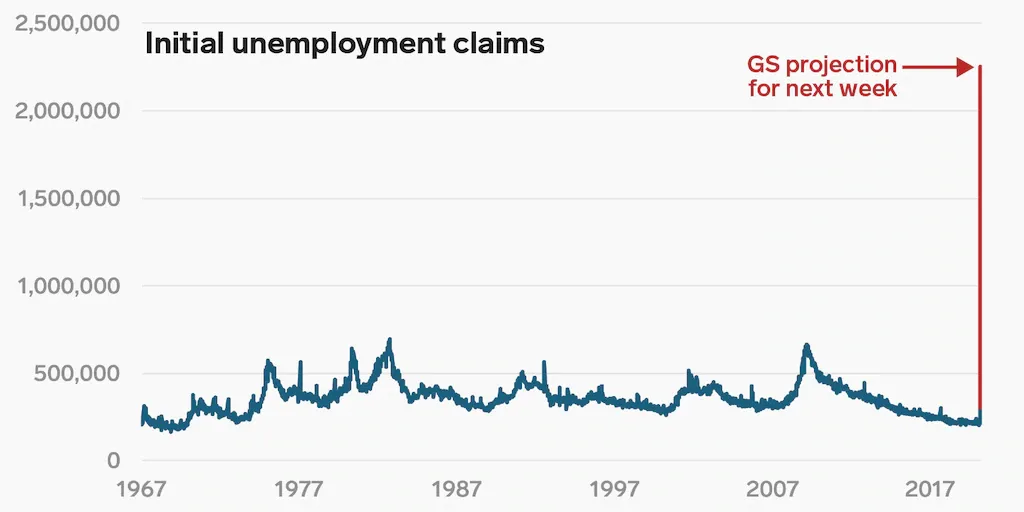

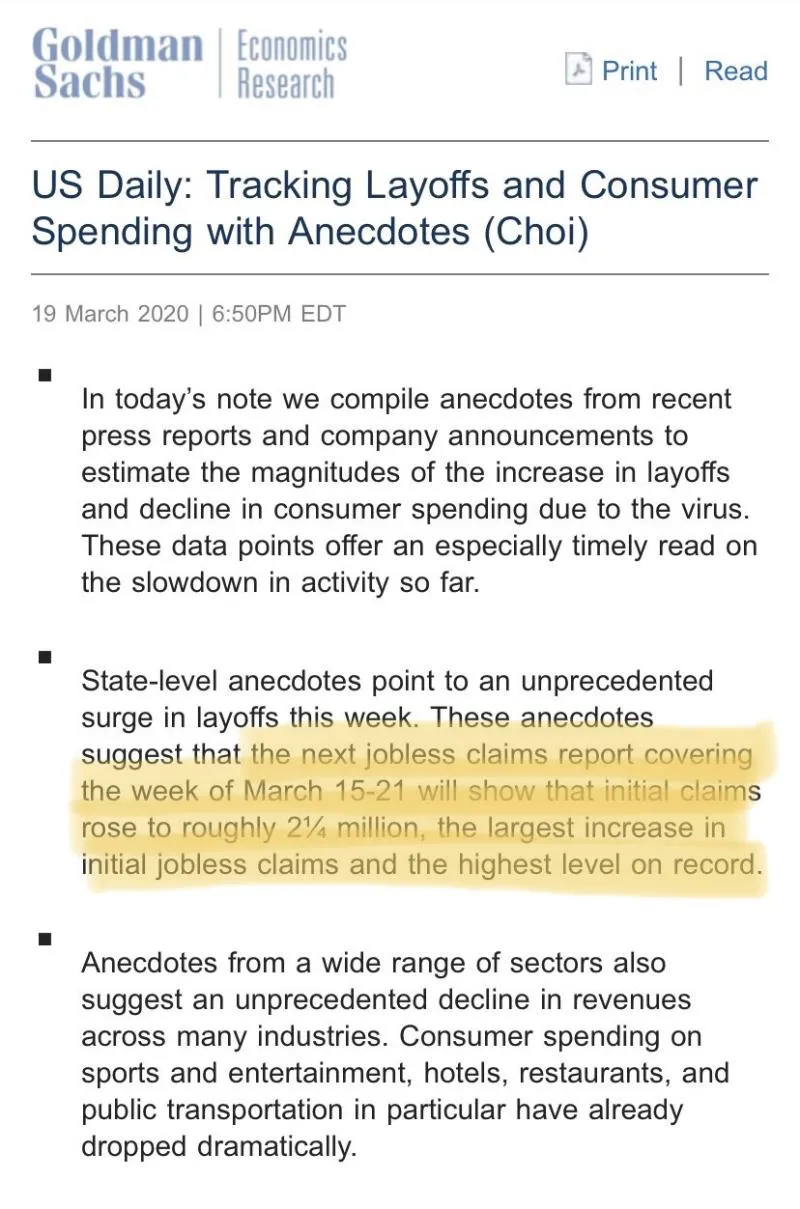

That's a chart based on some pretty solid research done by Goldman Sachs. After telling their HNWI clients for weeks to pull up stakes and batten down the hatches, they've released a series of quality public research pieces. Their anecdotal employment research anticipates "the largest increase in initial jobless claims and the highest level on record."

As you can see from the chart above, it's not even close. Previous peaks of 600,000-700,000 initial jobless claims occurred during the aftermath of the 1979 Iranian Revolution and ensuing oil crisis and also during the Great Financial Crisis. What we're going to see next week on this number is going to blow both of those time periods out of the water! GS is expecting 2.2 million or more jobless claims. That's intense.

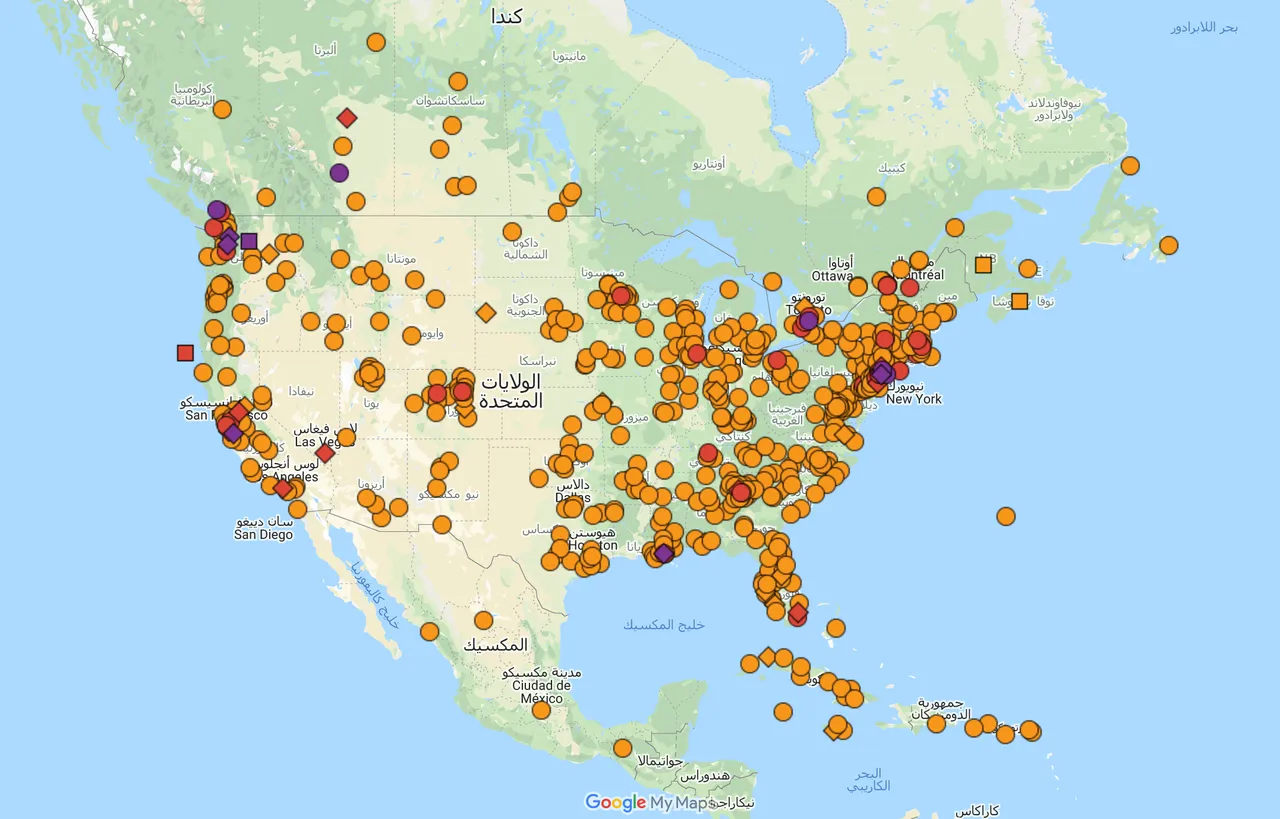

The worse part about it is that these anecdotes were based on information prior to the official lockdowns of cities and states all over the United States. So we could even see these numbers go up during the next reporting period. On top of that, we really have no idea how long these lockdowns are going to be in effect. We can only go by what has happened in China so far, where cities outside of the Wuhan epicenter are coming back online approximately 8 weeks after imposing some fairly serious community isolation procedures. Wuhan itself probably has another month AT THE LEAST. So when we compare that situation to America, where there could be UPWARDS OF TEN epicenters - Seattle, San Francisco, Los Angeles, Denver, Chicago, Atlanta, Nashville, Minneapolis, and the big terrible kahuna New York City - we could be seeing 3-month lockdowns AT A MINIMUM for many of these cities.

source ncov2019.live

In addition to those best-case scenarios, we have the general problem that Americans just don't listen to reason in general and are just kind of hard headed when it comes to people and governments telling them what to do. That's just how we are. I guess it's in our revolutionary DNA. We all have a little Patrick Henry ("Give me liberty or give me death!") in us. The kids in Florida right now are gonna be a massive source of super spreaders whenever they do find themselves going back home. And they will go back home, eventually.

So I'm feeling pretty bearish about this upcoming week. And I'm not the only one. A Congresswoman just proposed a plan to mint two $1 trillion coins to fund emergency monthly payments to every man, woman, and child in America for the entirety of this pandemic, however long it takes. The trillion-dollar coin idea goes back to this crazy loophole that was found back during one of the Obama debt ceiling crises. Treasury can't print commemorative coins in any denomination it wants, so why not $1 trillion? Why not $2 trillion?

This is the insane place where we are at. And you know what? Rashida Tlaib, the legislator behind this Automatic BOOST to Communities Act is not that far off the reservation with this one. That's probably somewhere in the ballpark of the level of intervention in the markets we need to prevent catastrophe.

A QE for the People of sorts.

So, to paraphrase one of our Founding Fathers here for modern times, we aren't battling the Redcoats here you know, but if he were around today, he might say,

"Give me these Trillion-Dollar Shitcoins, or Give Me Death!"

Posted via Steemleo