The Early Lessons in Humility

Growing up in an environment where financial challenges were a constant presence, I was exposed to a world where the concept of excess was foreign. My parents' journey from Malaysia to Singapore was marked by sacrifices, including hard work, frugal living, and a relentless pursuit of financial stability. It was a humbling experience that shaped my perception of money from an early age. Witnessing my parents' determination to overcome credit card debts and financial constraints left an indelible mark on me 😌

These early lessons in humility taught me the value of resilience and prudence. My family's experiences underscored the importance of making sound financial choices and being prepared for unexpected setbacks. It instilled in me a deep sense of responsibility and a commitment to ensuring a more secure financial future, not just for myself but for my family as well. These lessons became the cornerstone of my financial journey and laid the groundwork for the disciplined approach to tracking and budgeting that I now adhere to! 😤

The Journey of Independence

As my family's financial situation remained precarious, my siblings and I understood that our aspirations for higher education would require a degree of self-reliance. This realization led us to embark on a journey of independence, where part-time jobs became our lifeline. We juggled multiple responsibilities, working tirelessly to save every hard-earned dollar to pay for tuition fees and daily expenses 😣

Perhaps, this period of our lives was a crash course in financial responsibility. We learned to prioritize needs over wants, to be resourceful, and to make every dollar count. It was a challenging but transformative experience that not only prepared us for the financial demands of adulthood but also reinforced the importance of meticulous tracking and budgeting as tools for securing our financial futures! ✌️

Choosing Finance as a Career

Fate had a role in my decision to major in Banking and Finance during my time at University, as it aligned perfectly with both my upbringing and my financial ambitions. My studies further deepened my understanding of financial principles and the significance of meticulous record-keeping. In the world of finance, Excel became more than just a tool for me on a daily basis; it became my closest ally in life! 😅

Today, as an Auditor specializing in banking and finance, I find myself in a position where my affinity for numbers and financial discipline are put to practical use. My career has further solidified the importance of tracking and budgeting, emphasizing that these skills are not just personal tools for success but essential my professional work 😉

The Habit of Tracking and Budgeting

Set Clear Financial Goals: I established both short-term and long-term financial goals. These objectives provided me with a sense of purpose and motivation to track my spending and manage my finances efficiently.

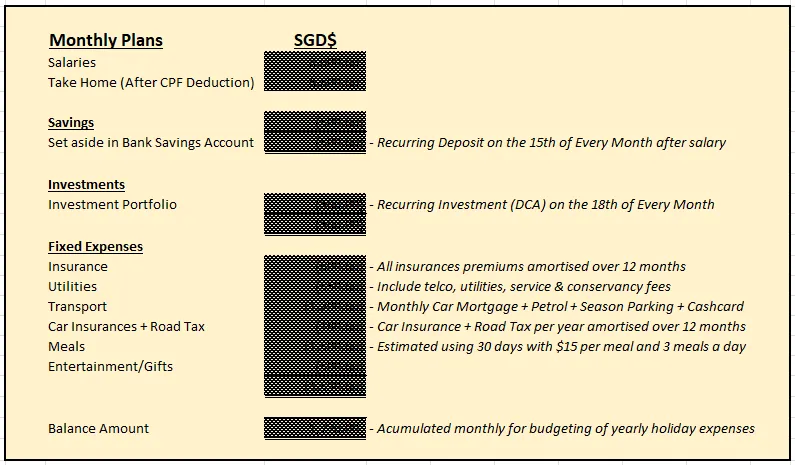

Create a Detailed Budget: I developed a comprehensive budget that encompassed all aspects of my financial life, including fixed expenses, variable expenses, savings, and investments. This budget served as a roadmap for my financial journey.

Regularly Review and Adjust: I made it a habit to review my finances regularly, at least monthly. This practice allowed me to identify any discrepancies, adapt to changing circumstances, and fine-tune my budget as needed.

The Benefits of Financial Caution

Financial Security: I have a sense of financial security and peace of mind knowing where my money goes and that I'm prepared for unexpected expenses.

Investment Opportunities: By carefully managing my finances, I've been able to invest in opportunities that align with my long-term goals after setting aside amount that needs to be saved for "rainy days".

Debt-Free Living: I've managed to avoid accumulating any unnecessary debt other than the housing loan and car mortgage that I currently have, which is a stark contrast to my family's past struggles.

My journey from a financially humble upbringing to a career in Auditing has taught me the value of tracking and budgeting. It's a habit that has not only helped me along in achieving my financial goals but also provided me with peace of mind and a sense of control over my financial future. I encourage everyone to embrace this practice, regardless of your background, as it can be a powerful tool for achieving financial success and security 😌

All images used in this post were taken from my iPhone