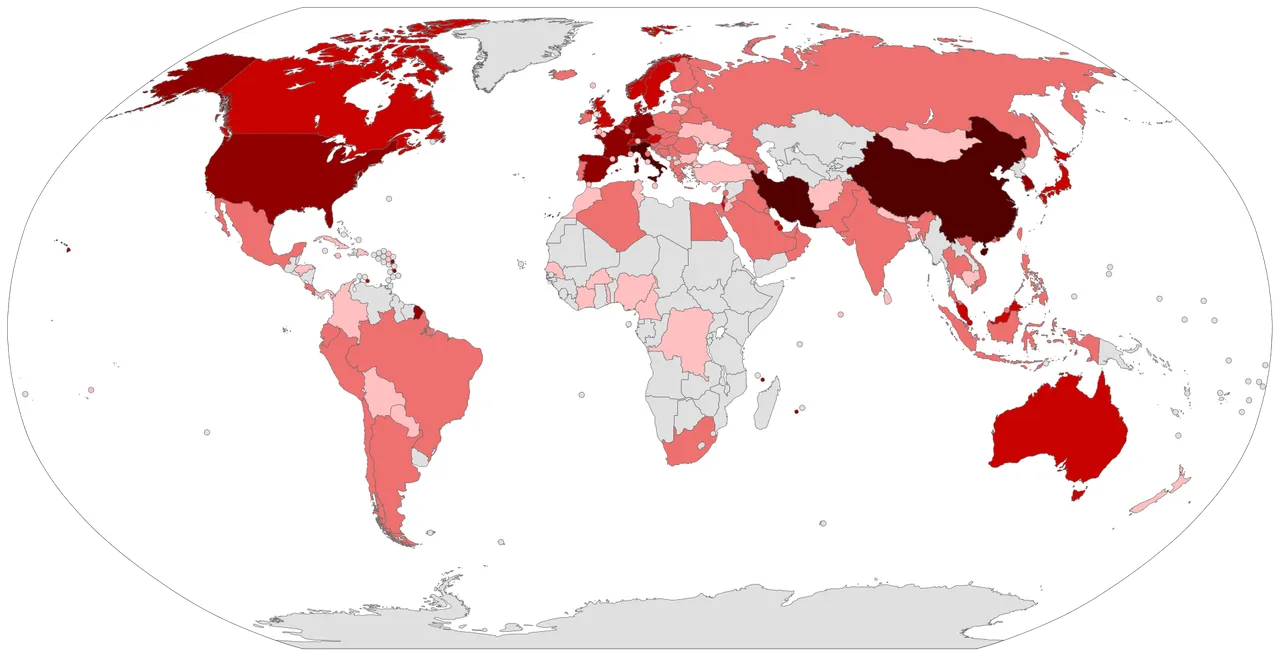

[ Map of the pandemic as of 11 March 2020 (Wikipedia)]

The rapid spread of the coronavirus, now a pandemic, is causing panic in financial markets, capital flight, currency devaluation against the dollar, and an increasing threat of a global recession.

Although the situation initially seemed to be confined to Asian countries, the current scenario is completely different: the outbreak is present in at least 114 countries, has infected nearly 120,000 people and has left more than 4,200 fatalities.

In addition to the decision of Italy to quarantine the whole country - in addition to a rapid spread of the disease in the rest of Europe and the United States - the collapse of oil prices and the roller coaster of the stock markets, causing A global economic recession in the first half of this year is considered by many experts to be almost imminent.

Jeffrey Frankel, a professor at Harvard Kennedy School at Harvard University, said that the possibility of an economic downturn "appears to have increased dramatically."

"We are very close to a global recession," he warned.

A voice of alert that has begun to spread among most of the economists and investors, especially now that the cases of contagion are increasing rapidly.

Wall Street sank into a bear market on Wednesday after the Dow Jones index ended 20% lower relative to its February bullish record, ending the longest period of gains. in the stock markets in the history of the United States.

The stock market crash came after the World Health Organization (WHO) announced that the coronavirus is officially a "pandemic. "

[Wall Street became a "bear market" on Wednesday.]

On a day-to-day basis, fear of contagion and isolation measures taken in some countries have hit the tourism sector hard, with airlines reporting unprecedented financial losses that have led them to close air routes or operate "ghost" flights with almost no passengers. .

Among the most drastic measures, the United States announced on Wednesday the suspension of "all travel from Europe" to its country for 30 days.

Additionally, many companies have asked their employees to work from home, while closing factories in China and elsewhere have caused problems in global production chains.

In this scenario, companies are preparing to report results in the red, and if economic growth stagnates -with a decrease in investments and less consumption in households- the economic effects of the pandemic could generate an increase in unemployment and stagnation in the salaries.

THREATS TO PARALYZE GLOBAL GROWTH:

"The coronavirus threatens to paralyze global growth," said Tom Orlik, the chief economist at Bloomberg Economics.

"A month ago, the most likely scenario seemed like a major outbreak limited to China and other countries suffering relatively minor effects. That now looks too optimistic," he said.

[Airlines could lose up to $ 113 billion in revenue this year.]

"The chances of the worst-case scenario happening , with the major economies suffering a significant impact, are increasing day by day."

In that case, the global cost could reach US $ 2.7 trillion, if all countries are exposed to the consequences of the pandemic.

And if the American economy contracts, Orlik said, the dynamics of the presidential elections could also be affected.

Rohan Williamson, professor of finance at the McDonough School of Business at Georgetown University, Washington DC, also believes that we are close to a global recession.

The effects of the coronavirus and volatility on global stock markets are indicators of concern to investors, he said.

"Clearly there has been a shock to global demand that has a huge impact," explained Williamson.

AND LATIN AMERICA?

Marcos Casarin, chief economist for Latin America at the British consulting firm Oxford Economics, projected that the general economic contraction will drop in the first quarter and will be "short-lived" .

From that perspective, Casarin said that under the circumstances, "we are very close to a global recession", although the main question mark is what will happen to the recovery that should come in the second quarter.

"It will all depend on how many emergency blocks are imposed beyond March."

In the case of Latin America, he explains, we are facing a worrying cocktail.

"The combination of falling oil prices, currency collapses and coronaviruses is definitely negative for growth, " said the economist.

[Brazil, Chile and Colombia are among the countries most affected by the devaluation of their currencies so far this year.]

And countries that are already in recession (such as Argentina , for example) "will see a deeper recession," while those on the brink of one, such as Mexico , "will be dragged into a recession . "

On how to deal with the crisis in the region, Casarin says that most governments have practically no room to relax fiscal policy, that is, lower interest rates, reducing the cost of credit.

THE WORST IS YET TO COME:

Although projections vary, there is a kind of consensus among financial analysts that the outlook should improve in the second half of the year.

However, many warn that the economic impact has not bottomed out, as the virus continues to spread rapidly .

"The worst for the economy is yet to come in the coming months," wrote Joachim Fels in a note to his clients, global economic adviser to PIMCO (Pacific Investment Management Company), a firm that manages large-scale investment funds.

["Coronavirus threatens to paralyze global growth," said Tom Orlik, chief economist at Bloomberg Economics.]

While Jan Hatzius, chief economist at investment bank Goldman Sachs , informed clients that the duration and depth of the economic downturn depend on the measures taken by governments.

It remains to be seen "whether health authorities can materially delay the spread of the virus through increased testing, restrictions on mass gatherings and quarantines of infected people."

Neil Shearing, chief economist at analyst firm Capital Economics, warned that if conditions worsen, a "sharp, but probably short, recession is coming ."

And he added that as the virus spreads, there is a good chance that the most negative scenario of economic projections will become the most likely.

International organizations have also made projections considering different scenarios, according to the rate of spread of the virus.

In the worst case scenario, world economic growth could drop to half of what had been projected (falling as low as 1.5%), according to the Organization for Economic Cooperation and Development (OECD).

And the United Nations Conference on Trade and Development (UNCTAD) this week warned that the cost of the crisis in global income could reach US $ 2 trillion, and that the duration and depth of the crisis will depend on three things.: How far and how fast will the virus spread, how long will it take before a vaccine is found, and how effective will governments be at mitigating the damage.

Follow me: @nirmal for more updates. I am a Tech and SEO Blogger. You can visit my blog: https://hitricks.com. Thank You.