Hello SPIers, today we do a scenario-based thought exercise. If you are an SPI token holder please take the time to fully read this because I would like your feedback. We'll start with the current situation and then look into our scenario for this exercise. I have included a solution but would really need feedback, suggestions and advice. Let's get into it, there's 1700 words so you might need a coffee.

Mo Money, Mo Problems

SPinvest with SPI in the grand scheme of things is a small fund that exists on the HIVE blockchain. Handling transactions for buying and selling activities through KYC'd platforms has not been an issue because most of our transactions are small. As an example, our largest single transaction to date was for $60,000 when we converted BTC into HIVE. On paper, this is a taxable event and if this were my personal BTC, I'd have a capital gains tax bill on the $50k profit and owe around $10k. We could have used defi like simpleswap as an example, but it would have cost a 1-2% ($600-1200) transaction fee and I'd rather have had the extra 2000-4000 HIVE at the time instead of paying fees.

Going forward, our transactions will only increase and being able to use any of my personal exchange or investing platform accounts will not an option. I understand we can do everything through DEFI and remain anonymous but my vision for SPI is with real-world assets like stocks and commodities and not hiding, worrying about possible tax repercussions.

SPinvest (SPI) needs to be able to fully operate independently.

Before we can start to look for a solution we need to understand the bare-bone basics of SPinvests structure and core values. When we know this, we can move forward knowing what suits us best based on our current set up.

Understanding SPI's Current Structure

- SPI is a private investment club

- We've had a shared partnership agreement in place from 2019

- SPI token holders are equity holders in SPI's assets

- No SPI token holder will ever be denied equity share or be liquidated

- We hardcapped at 100k SPI tokens when we moved the fund over to HIVE

- We dont sell or issue new SPI tokens

The last one may be the most important for a few reasons. Mostly because it is 100x easier and cheaper to set up a private fund compared to a publicly traded fund that actively or plans to raise capital.

Let's do a Scenario-Based Thought Exercise

.

Scenario

- SPI grows, it needs to make 6 figure trades/investments and it has no access to the use of exchanges (Binance, Coinbase) or investment platforms (AJ Bell, eToro) for tax reasons.

| Problem | Solution | Result |

|---|---|---|

| Tax man (Lets be honest) | SPinvest needs to legally become its own entity. | SPI would beable to create its own exchange accounts, bank accounts, investment platform accounts, etc. |

Basic Research Results

I have been looking into this on and off for over the past 12-18 months and the best course of action from my POV would be to create a company that holds and manages SPIs assets in a tax haven.

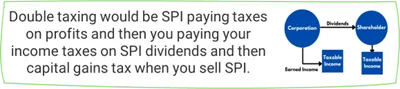

The main goal is to give SPinvest legal status, not avoid taxes but if we can avoid double taxing legally by setting up in a tax haven, why not? This might all sound overwhelming and a large step to take but it's just the next step up for SPinvest to get out of the trenches. To be honest, investors will not see much change cause it's all backend stuff. If the time comes closer, your input will be required as I'll most likely collect feedback in the form of an investor survey before anything is set in stone.

How to convert SPinvest into a Campany

Below are 6 steps that I think are the best approach for SPinvest to legally operate as a private fund. In an effort to make it less boring, I'll try to keep things short, sweet and to the point.

1/ Pick which type of company is best suited to us

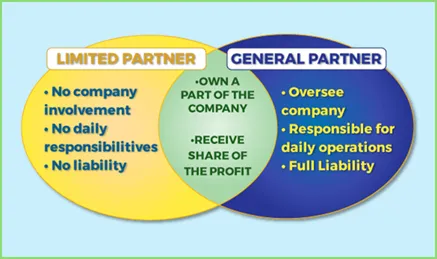

Because SPI tokens are hardcapped and we have a shared partnership agreement in place, we can set up as a Limited Partnership (LP) without many complications. The key features of a Limited Partnership are...

- General Partner (GP) Manages the assets of the partnership. This can be an entity or a trusted person and is a non-equity position.

- Limited Partners (LPs) Provided seed capital and own equity through SPI tokens

- No Corporate Tax LPs are excluded from having to pay Corporation Tax

- Pass-Through Taxation The LP itself doesn’t pay tax. Partners report and pay taxes individually on profits or gains as they

shoulddo already.

This best suits SPinvest because SPI token holders are the Limited Partners (you) that own the assets and the General Partner (me) manages the partner's assets. There is no need for a company director to be named because it's a partnership and the Limited Partners own the assets, not a single person.

This is pretty much the partnership agreement we have in place already. As a Limited Partnership we can never mint are sell SPI again (not a problem cause SPI is hardcapped) but...we can issue SPI as dividends.

Not being required to adhere to financial regulations is what makes this idea even possible. If we set it up as a public fund, the set-up costs climb into 6 figures, yearly costs into 5 figures and most of it would be going to lawyers, accountants and other professionals like auditors. Having the partnership agreement published and onchain since 2019 lets us go down the private fund route and will make things alot smoother for SPinvest. This will need to be amended to include a few things and edit others but it's 80% good to go as is.

A Limited Partnership suits us perfectly like a glove!

2/ Pick a Tax Haven to set up our LP

There are lots of countries we can pick from that offer tax advantages and each is different in what they offer, what the requirements are and of course cost. The 3 most important things for us to factor in when selecting a country to set up our LP is...

1 - Everything can be managed locally by a registered agent

2 - It has to be both income and capital gains tax-free. (LPs dont pay corparation)

3 - GPs can remain anonymous (more of a preference)

The cost does not really factor in much. We could set up in Belize and it would cost $1000 and maybe $400 a year to maintain or we could set up in Dubai for $8k and have yearly costs of $2-3k and need to rent a local office. The results are basically the same but telling people you own a company in Dubai or the Claymen Islands sounds more sexy than owning a company in Belize are Seychelles. For us, I will guess the cost will be around $5000 max set up and under $1000 per year to maintain it. I've not done intensive research into this yet, just the basics.

3/ Find a local Registered Agent

After we select which tax haven to use to manage our millions from, we will then need to find a local registered agent to do pretty much all the work for us. Many tax havens require documents to be verified and submitted by local agents only. These agents will handle filing paperwork, compliance, and legal requirements for us.

The agent will set everything up from start to finish and submit yearly financial statements & reports on our behalf.

4/ Prepare Required Documents

The amount of paperwork required is not massive but we need to show evidence of a few things to become a Limited Partnership.

1 - Partnership agreement that defines roles, contributions, cash out and ownership of partners

2 - I need to KYC to become the General Partner. The role is required to ensure the partnership assets are under management.

3 - Business Model. Something that explains SPinvest is a private investment club. Explain its structure, loosely which asset classes we are investing into, etc.

5 - Submit forms and wait

After all the documents are handled by the agent, we wait and hope that after a few days, we get good news and receive a Certificate of Registration or equivalent. As soon as we get this, SPinvest will be its own entity.

6 - Open exchange and bank accounts

After we receive our certificate as registered LP, we can use this document and whatever address we have on some tax-free island to open business accounts at crypto exchanges, investing platforms and bank accounts. Get mortgages for property.

At this point, we will have achieved our goal of making SPinvest into a legal entity with the same rights as any other company.

7 - Annual Compliance

The last thing we need to do is file annual returns, maintain a registered agent, and pay government fees. SPinvest will report profits honestly because we'll be in a tax-free zone. Partners should be aware they are taxed individually based on their tax residence but this is already the case.

The process when laid out into 6 steps makes it look fairly doable. If you are knowledgeable on this subject and can see any massive flaws in the plan are know of a much better are even different way to achieve the same results, please share below.

To wrap in 1 sentence and few points

Setting up SPinvest as a Limited Partnership in a tax-free haven might be the best way forward.

- No input is required from SPI tokens

- SPinvest will become a company with SPI tokens acting as equity shares

- SSUK will be a general partner to manage LP assets

- SPinvest will beable to open its own exchange, banking and investing accounts.

- SPI will beable to invest/trade legally and mostly tax-free.

Sounds pretty good to me, let me know what you think below and well done if you made it to the end, its alot to take in. If you're in a pinch for time, think about it and come back later with feedback and input.

Getting Rich Slowly from June 2019

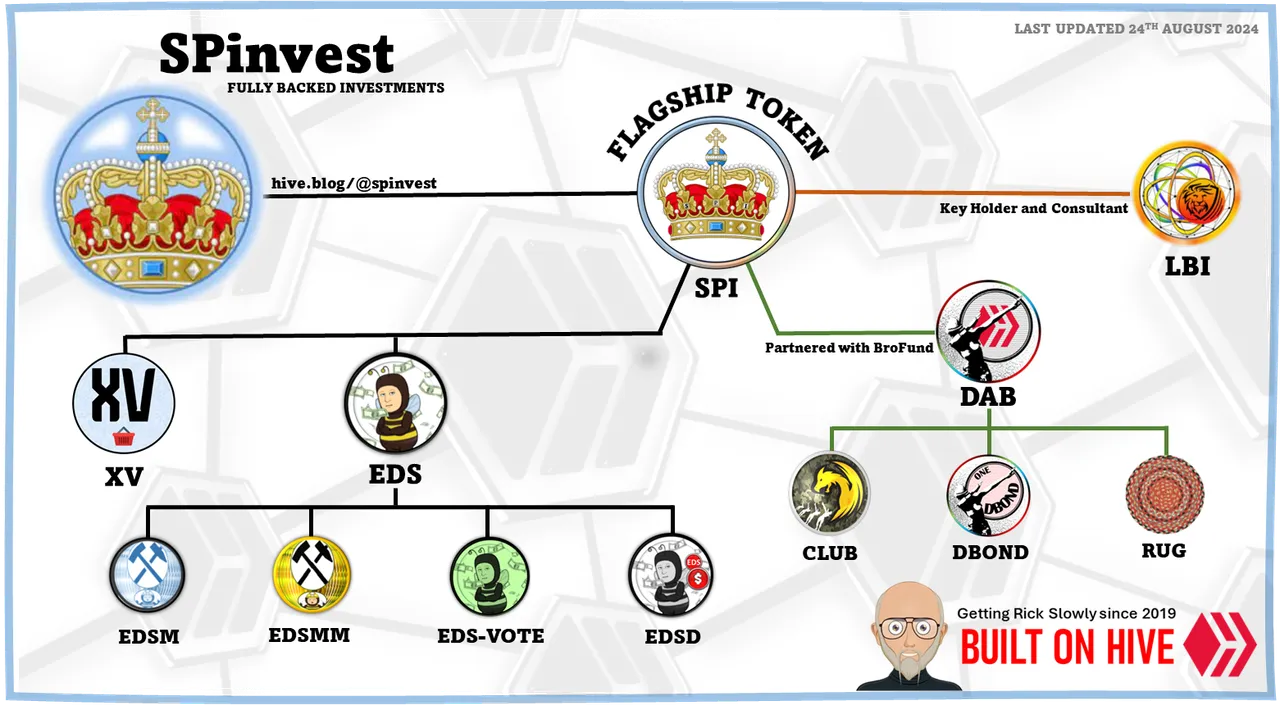

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDSI |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| EDS-vote | @eds-vote | n/a |

| EDS DOLLAR | @eds-d | EDSD |

| DAB token | @dailydab | DAB |

| DBOND token | @dailydab | DBOND |

| RUG token | @rugem | RUG |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server