I closed my Tesla shorts today (I sold a put type certificate in Frankfurt), with a decent profit. Tesla shares were at 308.80 on October, the 2th, 2018, as I began to short them, and now, are by 231.90 (approximately a 25 percent fall). The initial certificate price provided slight leverage, so in reality, I gained 35 percent in total.

Tesla in another channel?

But my opinion didn’t change really much about Tesla, I think more growth and earnings are priced in that it should be by realistic expectations. Tesla maybe a wonderful car but the factory probably won’t be very profitable.

But in my experience, Tesla pretends to move in channels, earlier between 300 and 380, later between 250 and 350, approximately. I suppose a new channel can be evolving now, perhaps between 200 and 300. Anyway, I will look forward to other entrance points to short it again in the near future.

(Click chart for higher resolution. Stockcharts.com)

Fund-raising expectations

I realized Tesla fell 18 percent in the last 12 months, and the Dow Jones Automobiles and Parts Index, 16 percent. Not really underperforming. A lot of bad news is priced in at the car-makers prices already, maybe a rebound is near. Tesla announced a capital fund-raising through the issuance of new shares and debt earlier. I suppose they will prepare some good news soon to attract buyers. Although, if the fund-raising would fail, that could push the price really low in a new abyss.

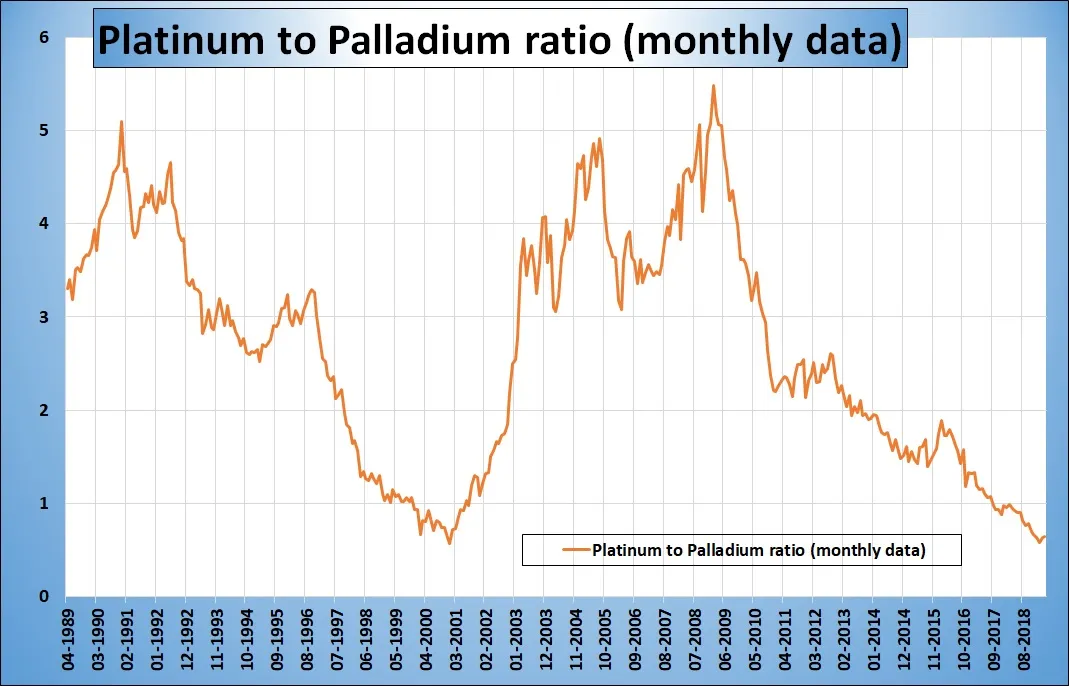

Sincerely, I also needed my own fund-raising to realize my new plan, in precious metals. That was a further reason to liquidate the Tesla short. I wanted to act and accomplish the new idea, shorting palladium and go long on platinum. Because the spread of the two precious metals is near an all-time high (the Platinum to palladium spread is near all-time lows). Palladium seems to be overvalued and platinum, undervalued. (I wrote about it yesterday.)

(Click chart for higher resolution.)

Liquidate VIX Trade?

Parallelly with the Tesla trade, I bought VIX shorts earlier. It was partly a good idea, one of the trades is moving in positive territory, the other buying, near zero. But I panicked in December and sold the half of it, unfortunately.

I’m scared of VIX now again, after reading this article of The Felder Report about the very high institutional short interests. Actually, I’m more long than short, relatively optimistic, although, the palladium short and the gold mines I still have, can have a positive impact also in bearish stock markets.

Two legs better than one leg

I’m trying to trade asset pairs, make dual trades where one leg is complementing, balancing the other leg (but both have a chance of winning). The platinum/palladium is another one, although, I suppose, these trades can stay even 1-3 years in my portfolio.

In fact, I bought platinum 2x long ETC (4RUM) and a palladium daily short ETP (1PAS.MI). Another option was buying certificates in Frankfurt, there are hundreds of them only following these two metals. But they seemed more expensive for me, and they have mostly at least 2x-3x leverage, and are expiring shortly, in some months.

(Photo: Pixabay.com)