Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

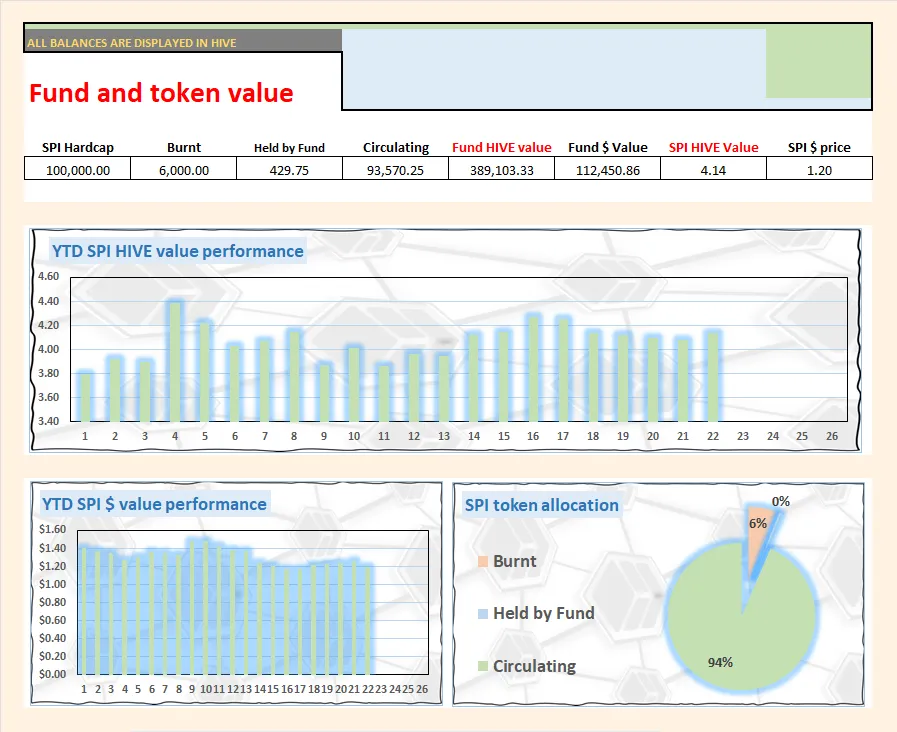

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

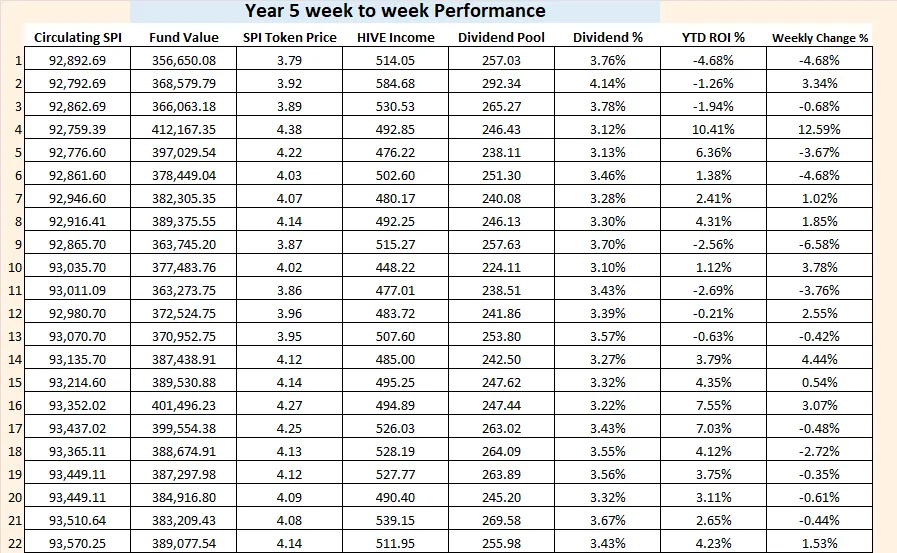

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

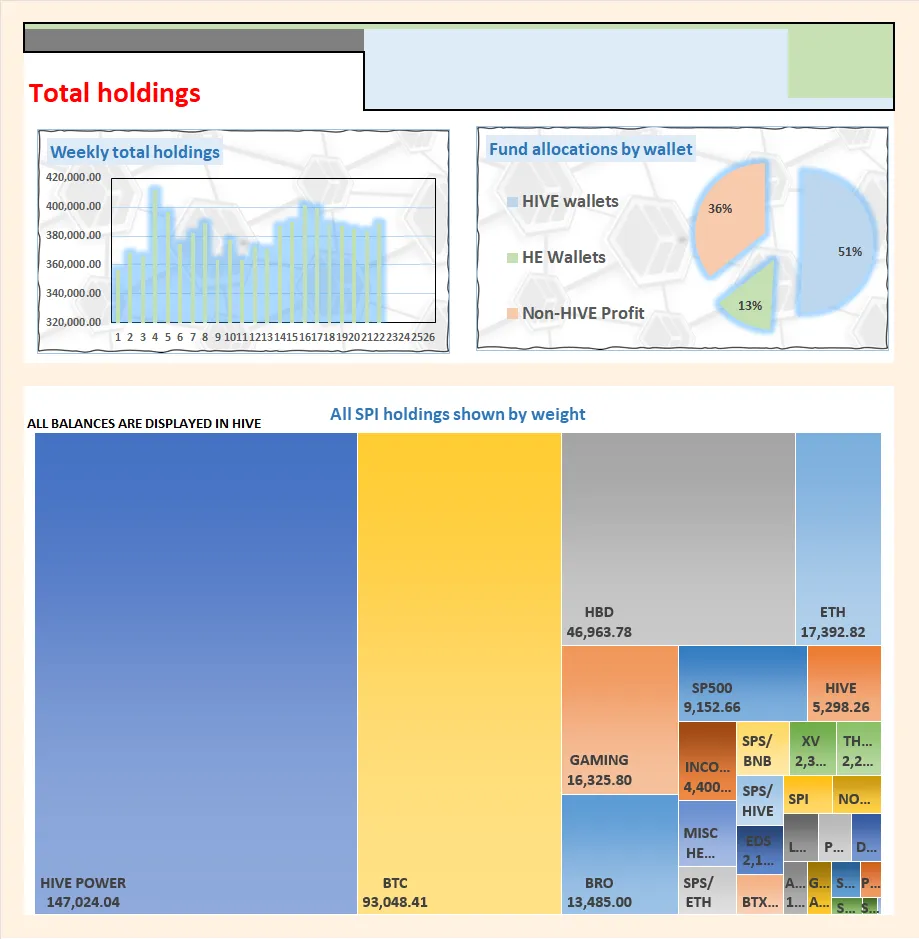

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

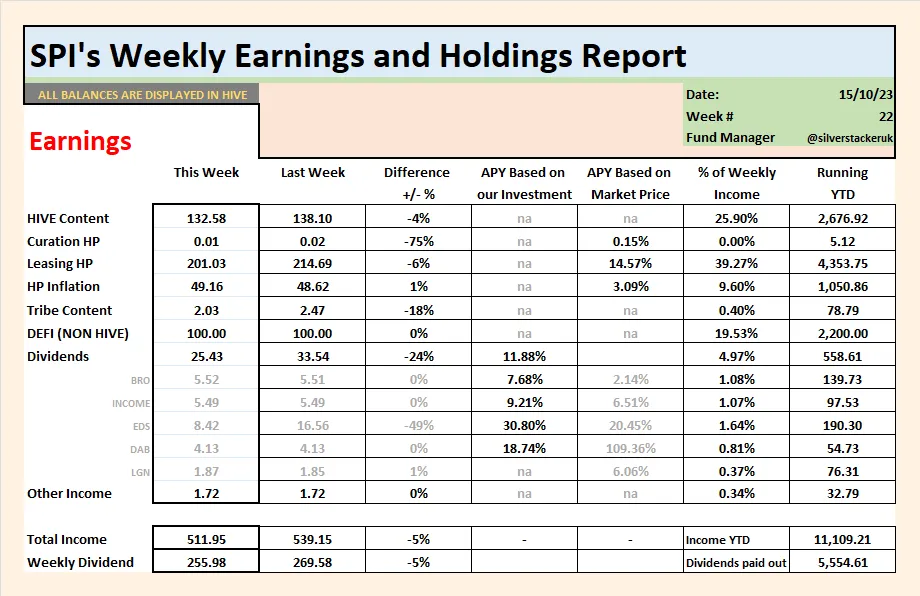

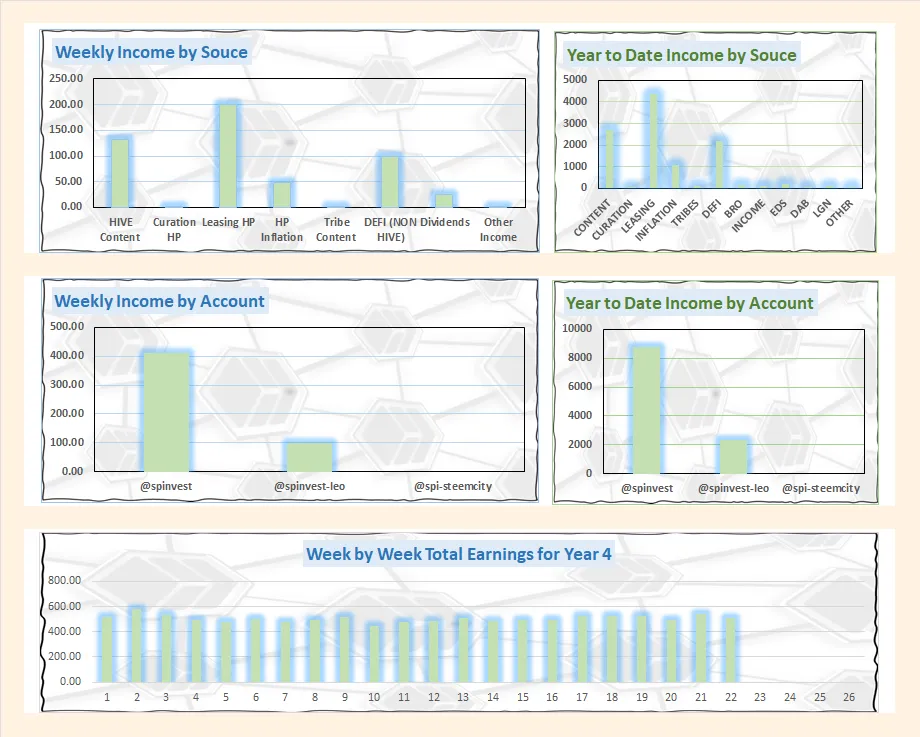

Income this week was decent. I was surprised to see that our HIVE content rewards were able to keep up with last week. Our leasing rewards dropped this week cause PWR rewards went from 20% down to 16% were it will remain for the next 5 months. Apart from that, everything is about the thing as last week. Total earned to date this year is 11,109 HIVE.

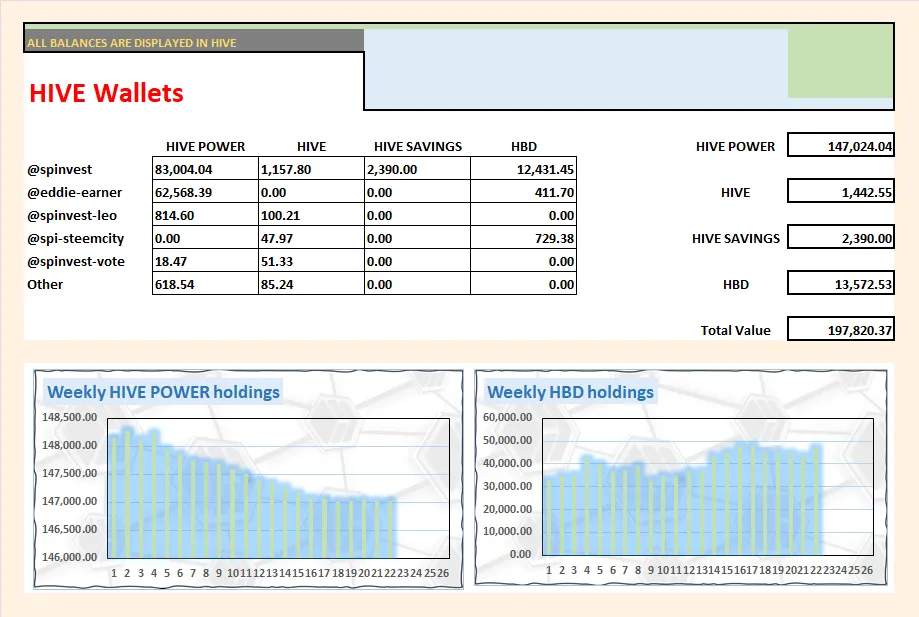

We finished the week with a 2 HP decline from last week, I had to check it twice, haha. We see the HIVE value of our HBD balance increase this week as the price of HIVE dipped a few percent. We're targeting at least 60k so we still have some time to wait I guess.

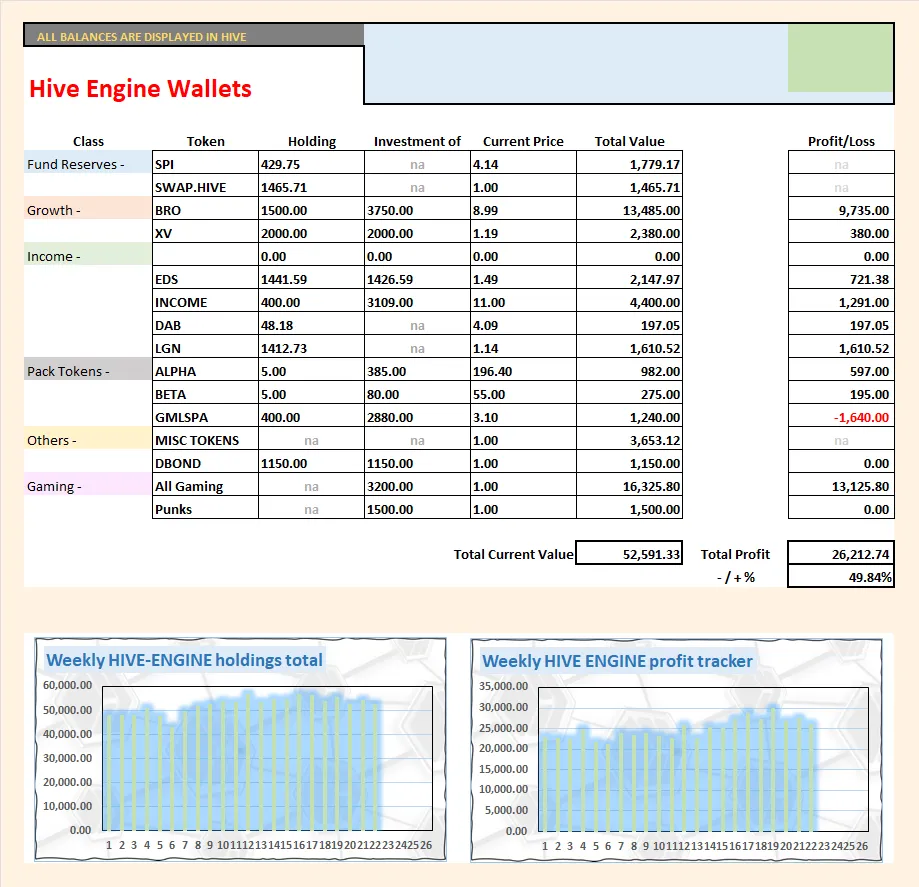

Holding in our HE wallet remains the same as last week. We pretty much have our bag filled on HE already. It's hard to invest alot when there is no liquidity for $5-10k worth of investment.

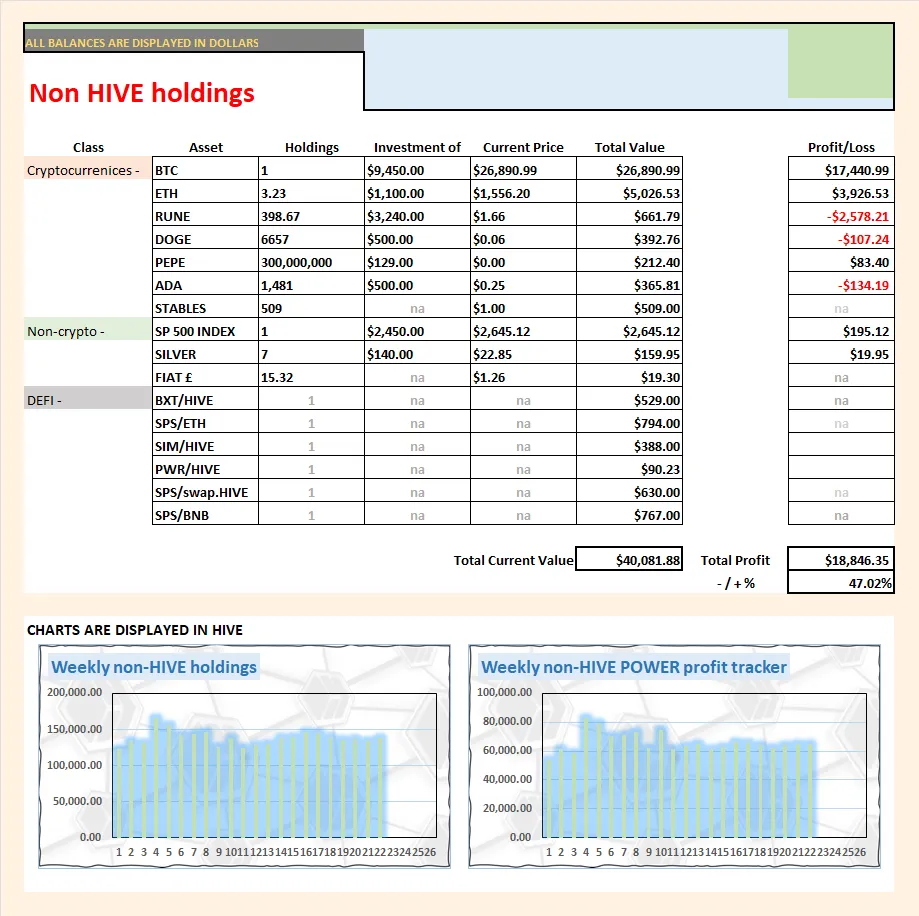

Everything is our non-HIVE holdings took a hit this week. Most of them outperformed against HIVE but in terms of dollars, down a few percent across the board. This is what happens, we've not seen enough pain yet in the crypto space for the bear market to end. October is normally a good month for crypto and we are only halfway through we will see what happens. Maybe we start a WW3 soon and we get a black swan event like Covid in March 2020.

The HIVE value of the SPI tokens increases this week and the dollar value decreases. This is the yoyo that the SPI price lives. It's very rare for the HIVE and $ values of SPI tokens to move in the same direction.

If things repeat as they did last cycle, the HIVE value of SPI tokens could increase to over 6-7 each due to our BTC holdings and it being the crypto market leader. This means when things pop off, BTC pops off first and the rest follow. Because SPI is pretty much 50% HIVE and HIVE is a low marketcap token, it takes much longer for it to start to moon. When BTC first hit $65k in 2021, HIVE was still trading at around 50 cents and this gave SPI a high HIVE value. 6 months later when BTC hit $65k again, HIVE was trading at over $2.50 and SPI's HIVE value was half what it was 6 months before.

There is little we can do about this, to be honest, and these price swings will happen each cycle. We just gotta roll with it.

There's not much else to report on. There is not much that happens during the bear market so there is not that much to report. If we think back to 2021, we are getting involved with CUB defi and EMP, making hundreds of dollars a day for a short time. The crypto market was booming with meme tokens and monkey NFTs taking over and we had new difi farms released every week to gamble money on.

Fast forward 2 years and 99% of what we were chasing in 2021 are now dead tokens/projects and the total market is down around 5% over the past week. Bummer...but it's all part of the journey. We have to have pain. Great news is, in 2 years from now, we'll be back in the land of milk and honey and we'll have plenty to report about.

Thanks for taking the time to check out the report and stay up to date with SPI.

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| CUBlife | @lbi-token | CL |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19