A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Callable Bond '?

--

A callable bond is a bond that can be redeemed by the issuer prior to its maturity. If interest rates have declined since the company first issued the bond, the company is likely to want to refinance this debt at the lower rate of interest. In this case, the company "calls" its current bonds and reissues them at a lower interest rate.

A callable bond is also referred to as a redeemable bond.

--

Breaking Down...

' Callable Bond ':

--

A bond is a debt instrument in which investors earn interest on the par value of the bond.

--

The issuer makes periodic interest payments to bondholders for the duration of the bond. Upon maturity, the principal investment is repaid to the investor. However, bonds that have a call feature may not reach their maturity dates.

A callable bond means the issuer reserves the right to return the investor's principal and stop interest payments before the bond's maturity date. For example, a bond maturing in 2030 can be called in 2020. A callable, or redeemable, bond is typically called at an amount slightly above par value; the earlier a bond is called, the higher its call value. For example, a bond callable at a price of 102 brings the investor $1,020 for each $1,000 in face value, yet stipulations state the price goes down to 101 after a year.

Most municipal bonds and some corporate bonds are callable. Treasury bonds and notes, with very few exceptions, are non-callable.

Advantages of Callable Bonds:

-- A callable bond pays an investor a higher coupon than a non-callable bond. The issuer has flexibility in payment amount and loan length when borrowing money from an investor. Issuing a bond lets a corporation borrow at a lower interest rate than a bank loan, saving the company money.

For example, a corporation decides to borrow $10 million in the bond market and issues a 6% coupon bond with a maturity date 5 years from now. The company pays its bondholders 6% x $10 million = $600,000 in interest payments annually. Three years form the date of issuance, interest rate falls by 200 basis points to 4%, prompting the company to redeem the bonds. Under the terms of the bond contract, if the company calls the bonds, it must pay the investors $102 premium to par. Therefore, the company pays the bond investors $10.2 million which it borrows from the bank at a 4% interest rate. It reissues the bond with a 4% coupon rate and a principal sum of $10.2 million, reducing its annual interest payment to 4% x $10.2 million = $408,000.

Disadvantages of Callable Bonds:

-- Bonds are usually called when interest rates fall. This exposes the investor to reinvestment risk, which involves reinvesting the principal at a lower interest rate. For example, say a 6% coupon bond is issued and is due to mature in 5 years. An investor purchases $10,000 worth and receives coupon payments of 6% x $10,000 = $600 annually. Three years after issuance, the interest rate drops to 4% and the bond is called by the issuer. The bondholder must turn in the bond to get back the principal and no further interest is paid. The bondholder not only loses the remaining interest payments, but may be unable to match a bond that pays 6% in the current 4% interest rate environment. The investor might choose to reinvest at a lower interest rate and lose potential income.

To reduce its cost of borrowing, when interest rates rise, the issuer will call its bonds from the market and have them reissued at the lower interest rate. When a company reissues a bond at a lower interest rate, the bond costs the investor more than when it was originally issued. The company can call a bond at a price below the market price. The price of a callable bond will not be much higher than its call price, as lowering interest rates mean calling the bond is likely. An investor must consider the yield-to-call (YTC) and yield-to-maturity (YTM) when analyzing potential returns for a callable bond to ensure the potential income matches his objectives. A callable bond may not be appropriate for an investor seeking regular income and predictable returns.

Types of Call Features:

-- Optional redemption lets an issuer redeem its bonds when it chooses. For example, a municipal bond has call features that may be exercised after a set time period, typically 10 years. Sinking fund redemption requires the issuer to adhere to a set schedule while redeeming a portion or all of its bonds. Extraordinary redemption lets the issuer call its bonds before maturity if specific events occur, such as if the underlying funded project is damaged or destroyed.

Call protection means a set time where the bond cannot be called. The issuer must clarify whether a bond is callable and the exact terms of the call option, including when it can be redeemed and what the price will be when the bond is first sold.

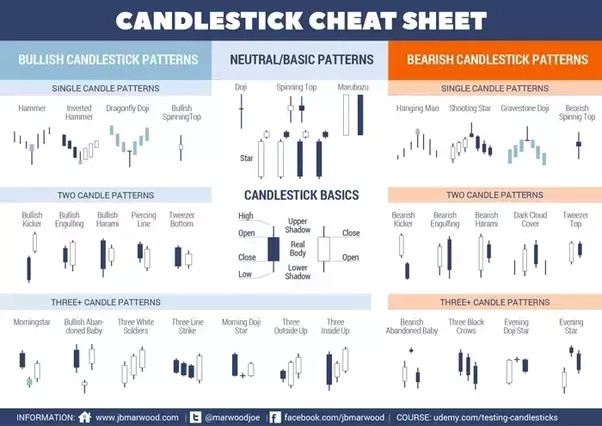

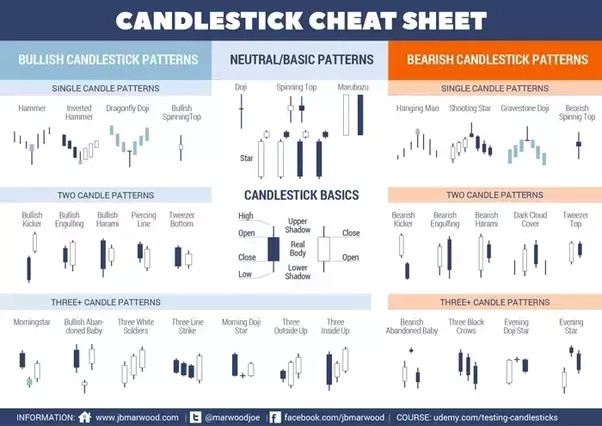

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

I am leaving these images I made here until I figure out one that fits properly and looks right for the first/main image for the post/series.

--

Since Steemit dev's changed the size of the picture frame that shows, it has honestly been a real problem getting images to match the screen, it was perfectly fine months ago before they messed around with it.

SMH.

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

@barrydutton/open-bazaar-ceo-sent-me-a-nice-package-this-week-it-s-almost-heeeere

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Monero (XMR) - d8ecb02c09f70ec10504b59b96bc1f488af28b05933893dfd1f55b113e23fbff

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Callable Bond '?

--

A callable bond is a bond that can be redeemed by the issuer prior to its maturity. If interest rates have declined since the company first issued the bond, the company is likely to want to refinance this debt at the lower rate of interest. In this case, the company "calls" its current bonds and reissues them at a lower interest rate.

A callable bond is also referred to as a redeemable bond.

--

Breaking Down...

' Callable Bond ':

--

A bond is a debt instrument in which investors earn interest on the par value of the bond.

--

The issuer makes periodic interest payments to bondholders for the duration of the bond. Upon maturity, the principal investment is repaid to the investor. However, bonds that have a call feature may not reach their maturity dates.

A callable bond means the issuer reserves the right to return the investor's principal and stop interest payments before the bond's maturity date. For example, a bond maturing in 2030 can be called in 2020. A callable, or redeemable, bond is typically called at an amount slightly above par value; the earlier a bond is called, the higher its call value. For example, a bond callable at a price of 102 brings the investor $1,020 for each $1,000 in face value, yet stipulations state the price goes down to 101 after a year.

Most municipal bonds and some corporate bonds are callable. Treasury bonds and notes, with very few exceptions, are non-callable.

Advantages of Callable Bonds:

-- A callable bond pays an investor a higher coupon than a non-callable bond. The issuer has flexibility in payment amount and loan length when borrowing money from an investor. Issuing a bond lets a corporation borrow at a lower interest rate than a bank loan, saving the company money.

For example, a corporation decides to borrow $10 million in the bond market and issues a 6% coupon bond with a maturity date 5 years from now. The company pays its bondholders 6% x $10 million = $600,000 in interest payments annually. Three years form the date of issuance, interest rate falls by 200 basis points to 4%, prompting the company to redeem the bonds. Under the terms of the bond contract, if the company calls the bonds, it must pay the investors $102 premium to par. Therefore, the company pays the bond investors $10.2 million which it borrows from the bank at a 4% interest rate. It reissues the bond with a 4% coupon rate and a principal sum of $10.2 million, reducing its annual interest payment to 4% x $10.2 million = $408,000.

Disadvantages of Callable Bonds:

-- Bonds are usually called when interest rates fall. This exposes the investor to reinvestment risk, which involves reinvesting the principal at a lower interest rate. For example, say a 6% coupon bond is issued and is due to mature in 5 years. An investor purchases $10,000 worth and receives coupon payments of 6% x $10,000 = $600 annually. Three years after issuance, the interest rate drops to 4% and the bond is called by the issuer. The bondholder must turn in the bond to get back the principal and no further interest is paid. The bondholder not only loses the remaining interest payments, but may be unable to match a bond that pays 6% in the current 4% interest rate environment. The investor might choose to reinvest at a lower interest rate and lose potential income.

To reduce its cost of borrowing, when interest rates rise, the issuer will call its bonds from the market and have them reissued at the lower interest rate. When a company reissues a bond at a lower interest rate, the bond costs the investor more than when it was originally issued. The company can call a bond at a price below the market price. The price of a callable bond will not be much higher than its call price, as lowering interest rates mean calling the bond is likely. An investor must consider the yield-to-call (YTC) and yield-to-maturity (YTM) when analyzing potential returns for a callable bond to ensure the potential income matches his objectives. A callable bond may not be appropriate for an investor seeking regular income and predictable returns.

Types of Call Features:

-- Optional redemption lets an issuer redeem its bonds when it chooses. For example, a municipal bond has call features that may be exercised after a set time period, typically 10 years. Sinking fund redemption requires the issuer to adhere to a set schedule while redeeming a portion or all of its bonds. Extraordinary redemption lets the issuer call its bonds before maturity if specific events occur, such as if the underlying funded project is damaged or destroyed.

Call protection means a set time where the bond cannot be called. The issuer must clarify whether a bond is callable and the exact terms of the call option, including when it can be redeemed and what the price will be when the bond is first sold.

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

I am leaving these images I made here until I figure out one that fits properly and looks right for the first/main image for the post/series.

--

Since Steemit dev's changed the size of the picture frame that shows, it has honestly been a real problem getting images to match the screen, it was perfectly fine months ago before they messed around with it.

SMH.

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

@barrydutton/open-bazaar-ceo-sent-me-a-nice-package-this-week-it-s-almost-heeeere

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Monero (XMR) - d8ecb02c09f70ec10504b59b96bc1f488af28b05933893dfd1f55b113e23fbff

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Monero (XMR) - d8ecb02c09f70ec10504b59b96bc1f488af28b05933893dfd1f55b113e23fbff

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.