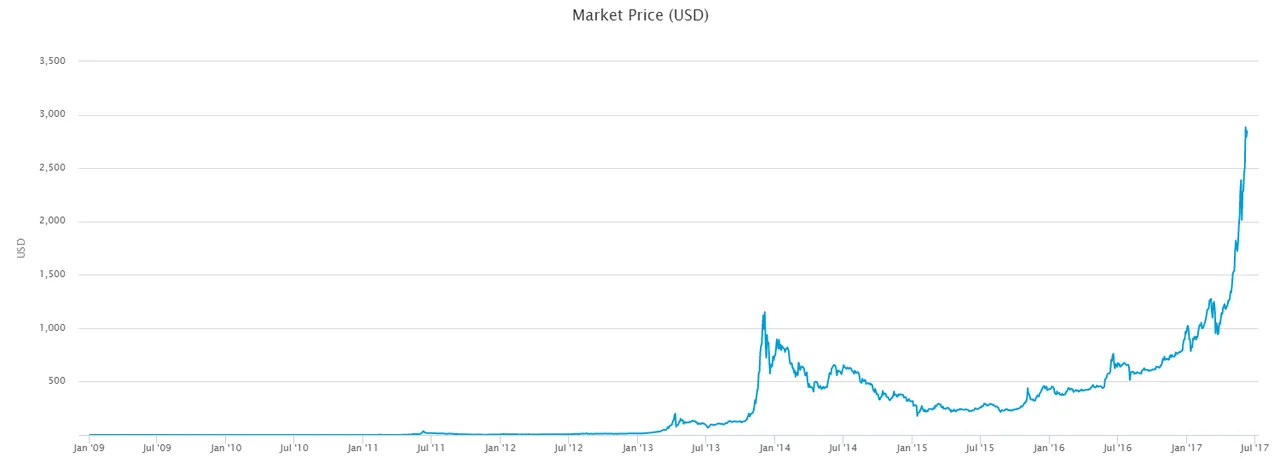

How did Bitcoin price develop?

Bitcoin price has its own wild road.

In 2009, the year Bitcoin was created, nobody could

have thought it would gain such popularity. The initial

price was about $0.001. Over the next five years there

were no significant events, so the price rose slowly

with little fluctuations. In 2013, Bitcoin attracted a lot

of attention because of the Cyprus banking crisis. In

November 2013, the Chinese started to buy BTC in

large quantities and the price increased by 1000

percent. However, it didn’t last long. In February 2014,

there was a DDoS attack on the servers of the

exchange Mt. Gox. At that time, it controlled about 60

percent of Bitcoin transactions. This occasion struck

Bitcoin hard and the price fell by 40 percent.

Throughout the year, until January 2015, the price

continued to fall down. During 2015, Bitcoin gained

popularity slowly but firmly and during that year, the

price began to rise little by little. Since May 2016,

Bitcoin has earned the trust of more and more people,

and its price has continued to rise. In June 2017, the

market saw a dramatic fall and the price decreased by

14 percent. Nowadays, Bitcoin is taking back its

positions.

What factors influence Bitcoin price?

There are a number of factors that impact Bitcoin price

over the course of time.

Market demand and supply - This factor is major.

Nowadays, Bitcoin does not have any physical

equivalent in the real world, so BTC are sold on

exchanges. The main principle of economics says that

if people buy a currency, its price rises and if people

sell the currency, its price falls. Bitcoin is no

exception. In the fall of 2013, the price went up by 10

times as a result of Chinese demand.

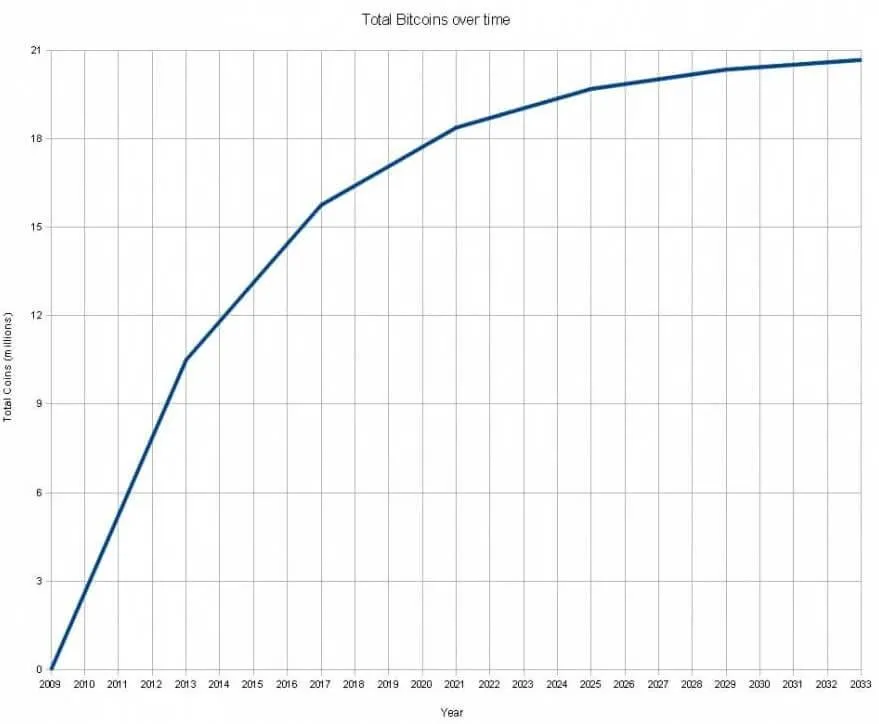

Total amount of Bitcoins and Bitcoin holders - The total

amount of Bitcoins is 21 mln, but they are produced

with time.

Currently, there are about 16 mln BTC and more than

14 mln people have wallets with BTC. This number is

growing rapidly and since the number of Bitcoins is

fixed, the price will continue to rise.

News in mass media - There’s always a human factor

involved - i.e. the way people can react to news. For

instance, remember the 25 percent price fall after Ross

Ulbricht’s arrest or the new price record in anticipation

of the Winklevoss’ ETF hearing.

Technical issues - Bitcoin has an open source code, so

everyone can examine it. New updates for fixing some

bugs and weak points in code can give an impetus for

price growth. Meanwhile, successful account hacks or

server attacks can bring down the exchange rate. In

August 2016, some hackers discovered a security

problem in Bitfinex and the price subsequently fell.

Political and economic events worldwide - In the age of

globalization, decisions in just one country can have an

influence on the entire world - i.e. accepting Bitcoin as

a means of payment in Japan .

High volatility - Volatility is the degree of trading price

variation over time. Volatility refers to the amount of

uncertainty or risk in a security's value. Higher volatility

means that a security's value can potentially be spread

out over a larger range of values. In other words, the

price of the security can change dramatically over a

short time period in either direction. The volatility of

Bitcoin is about 10 percent right now, but it is going

down.

What is the backing of Bitcoin?

Bitcoin does not have any physical backing.

It means that it’s not backed by any precious metals

or international agreements. Nevertheless, it has all the

characters of money such as:

Uniformity - All Bitcoins are equal. Nobody can

distinguish one Bitcoin from another. Each BTC has the

same value and price.

Divisibility - Each Bitcoin can be divided into smaller

parts.

Portability - Individuals are able to carry money with

them and transfer it easily to other individuals.

Longevity - After the issue, Bitcoin will exist for an

indefinite time in the system. It will not disappear at

some moment.

Recognition - Everyone can easily distinguish Bitcoin

from other cryptocurrencies.

Security - Bitcoin is protected from falsification, theft

and changes in the information of transactions.

The main difference between BTC and real-world

currencies is that all the features above are

guaranteed by methods, algorithms and protocols

proved by mathematics.

What are the most significant Bitcoin price

fluctuations?

There have been some price swings in the history of

Bitcoin.

Caused by technical reasons

In February 2011, the exchange Mt. Gox was found,

which allowed people to exchange USD to Bitcoins.

Consequently, the price rose from $0.05 to over $1.

In February 2014, Mt. Gox declared a DDoS attack on

its servers. At that moment, Mt. Gox controlled about

60 percent of Bitcoin transactions. As a result, the

price went down by 30 percent.

Influenced by international events

Between October-November 2013, organizations all

over the world announced that they had started to

accept payments in BTC. The Chinese started to buy

Bitcoins en masse and, unsurprisingly, the price rose

from $120 to $1,150.

In December 2013, the People’s Bank of China forbade

payments in BTC, which saw the price fall to $500.

Influenced by mass media

In April 2010, an updated version of the source code

was published . After that article, the price increased 10

times.

In April 2011, Time magazine published an article about

Bitcoin whereby the author talked about the future of

the cryptocurrency. Soon after, Bitcoin price grew from

$10 to $30.

What will happen with Bitcoin price?

It’s hard to predict something for sure.

Any currency can become subject to collapse. There

are some notoriously known devalued currencies such

as the German Papiermark or the Zimbabwean Dollar .

In a short period of time, their prices fell almost to

zero. They went out of use since the prices of goods

and services increased by leaps and bounds.

In theory, technical issues and limitations, code

problems, political events and decisions and other

cryptocurrencies are potential “deal breakers” for

Bitcoin. Nevertheless, currently, there are no

prerequisites for devaluation.

Many representatives of the crypto community and

investors believe that the current Bitcoin growth is

stable and not at all a “bubble.”

Bitcoin is rather young, approximately 10 years, and it

has enormous potential for growth.

It is hard to predict Bitcoin price movement so to know

more about current and upcoming trends, it might be a

good idea to follow the market and stay updated on the

news.

Article Source:https://cointelegraph.com/explained/bitcoin-price-explained