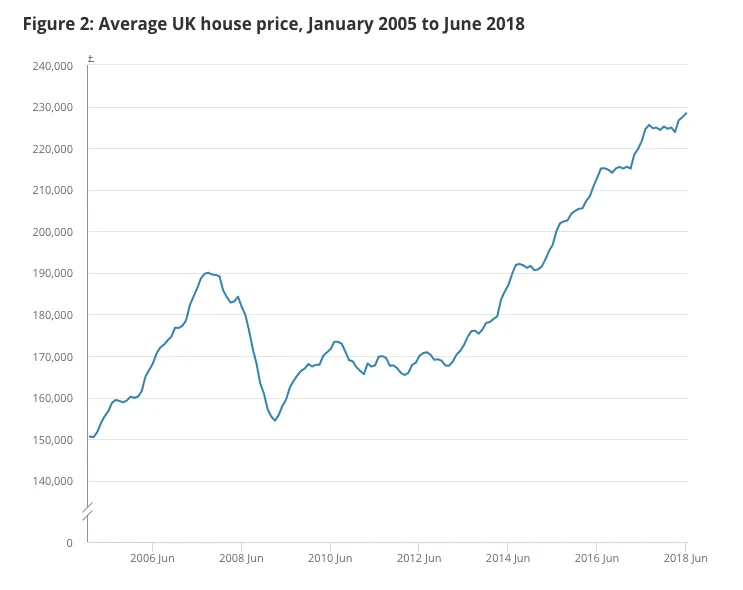

Average house prices in the U.K. have increased by 2.5 times in real terms (adjusted for inflation) in the last 40 years.

This means that the average person will now pay at least 2.5 times on their mortgage every month compared to their parents or grand-parents in 1979, which is very significant given that housing is the single largest item of spending in most people’s budgets. (Also, these are average figures, the situation in London is more dramatic!)

According to Josh Ryan-Collins in his recent book ‘Why can’t you afford a house’? this radical increase in the cost of housing is essentially down to a combination of three things

- A social and political preference for home ownership

- The increasing availability of cheap mortgages, or loans specifically to buy land and housing since the 1980s

- The fact that there is a limited supply of land, especially desirable land in big cities such as London.

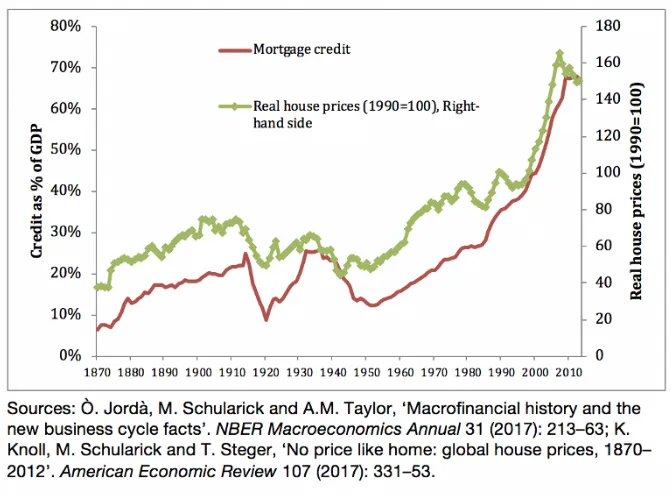

Josh Ryan-Collins theory is very simple – when you have a country such as the U.K. where people want to own their own homes, then when banks are given the freedom to make more money available in the form of loans (mortgages), this increases the demand for land and houses, which pushes the prices up, which then means that the next set of buyers have to apply for larger mortgages and so on.

As potential first-time buyers and investors alike see land and house prices going up, this further increases demand for housing and adds to the demand for higher mortgages, which adds to this inflationary price-cycle.

Behind all of this is a process known as financialisation (link to podcast here, thanks @shanibeer for putting me on to this) – in which financial services (become more central to the economy than producing tangible products.

Financial services include such things as investment and insurance services, but also loans – of which domestic mortgages are a huge part. Essentially when a bank gives someone a mortgage, they create a new asset (they basically create money), which has a ‘value’ over and above the amount initially lent because the borrower agrees to pay back much more than that original sum – typically 2-4% per annum on the figure over 25 years.

Over the last 40 years, there has been a significant deregulation of the mortgage market in the UK, and even with the 2008 financial crash, banks still have significant freedom to effectively create new financial assets (mortgages) – and there has been a trend towards allowing people to pay them off over longer and longer terms (from 25 to 35 years) which increases the number of people eligible to apply.

NB – There are 11.1 million mortgages in the UK, and the total value of those mortgages is £1.3 trillion, equivalent to more than 30% of our GDP. Mortgages in the UK are a very serious business.

The rub is that it’s those easily available mortgages have pushed up house prices, ultimately meaning that the average person now has to pay double what they would have done to buy a house in the 1970s.

To restate the situations again – when a financial product (a mortgage) is used to buy a limited good (land is ultimately limited in the UK), it just pushes up the price of that good (land and housing), and that is precisely what has happened here in the U.K.

If you’re not convinced of this, then check out this graph which shows the correlation between increasing mortgage credit and increasing house prices!

A few thoughts…

My lefty bias wants to buy this argument, but I can’t help thinking that the move towards single person households and restrictive planning laws have also contributed towards increasing house prices. It can’t just be the increasing availability of cheap credit.

Having said this I do buy the argument that it’s a major factor: land, ultimately is limited, especially desirable plots in London, and it’s places like this where the true tragedy of financialisation has affected housing: where people are more likely to see houses as assets with a potentially rising value, which means even relatively high income earners cannot afford to live in the South East as the price pressure pushes out from London. I moved 200 miles west as a result of this.

It’s also tragic that this has had the effect of encouraging people to see their homes as assets, when in reality they are basic human needs! Nothing wrong with wanting some kind of security of ownership over housing IMO, but having to pay 2.5 times as much now as compared to the 1970s is, well, harsh!

This trend of increasing house prices looks like it might be coming to an end anyway: home ownership is already down for people in their 30s, suggesting that there simply aren’t enough people able to afford mortgages to keep house prices increasing.

Sources, including pic sources

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/june2018

https://www.allagents.co.uk/house-prices-adjusted/

https://www.housepricecrash.co.uk/indices-nationwide-national-inflation.php (pic 1)

https://medium.com/iipp-blog/why-cant-you-afford-a-home-9c5cf009be21 (pic 2)