CBDC aka Central Bank Digital Currency has been in the news for quite some time and there are multiple countries that are working on this. India has also been working on this for quite some time and now its launched in India. Currently, its launched as a pilot project in India, and through this RBI is trying to figure out the challenges if any. This is the phase when any improvement can be done before making it available to the public.

What is a CBDC?

This is a digital form of Fiat currency that can be used in the same way the physical currency is used. It carries the same value and there is no fluctuation in it but this is completely in form of digital and can be used electronically. We can call it a new face after money via technology is playing an important role and it is built on the blockchain but crypto is in no way connected with this.

A Central Bank Digital Currency (CBDC) is the digital form of a country’s fiat currency that is also a claim on the central bank. Instead of printing money, the central bank issues electronic coins or accounts backed by the full faith and credit of the government.

Timeline

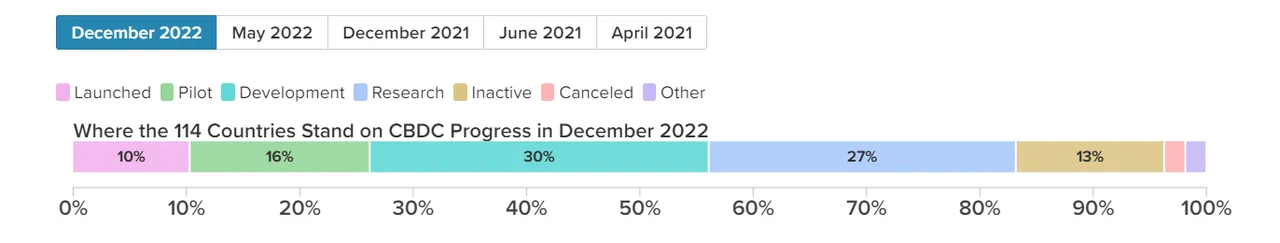

As on Dec 2022, a total of 114 countries are working on CBDC, and below is the status of the same. a major chunk of countries either in development or in the research stage. This is a good initiative but certainly, research is required to make the most out of it. This is not going to replace the physical currency for now because the entire process will take a long time however this is the beginning to make money digital and transactions will also be much faster.

Benefits of CBDC

Currently countries of facing a lot of issues with physical currency handling that includes logistics and distribution. There is a cost involved with the printing of notes and distribution of the same across the country so with this digital money, the cost for these will be reduced. There will be an additional cost to manage the blockchain but I am sure that the governments must have gone through the aspect before going on the development. Many notes are destroyed which is a loss to the government.

Better tracking of Money

Government and multiple schemes through which they want to provide benefits to the citizens and with Fiat currency they have no way to track it. Now with digital money, they will be able to track the use of the money. File this is going to be optional for people however this will also help the government to save a lot of money on the distribution and printing along with better tracking for money. Hopefully, we will get to see much more on this once it is live for the public because then only we will have more information shared by the government body.

A cryptocurrency is also a form of digital money but it is not stable and it also does not represent the value of any Fiat currency. Even with the stablecoins which we are expecting that match the value of the same coin that it is representing but still there is slight fluctuation in the value. This is in no way the replacement for crypto because both have different use cases and different reasons for their existence.

Thank you