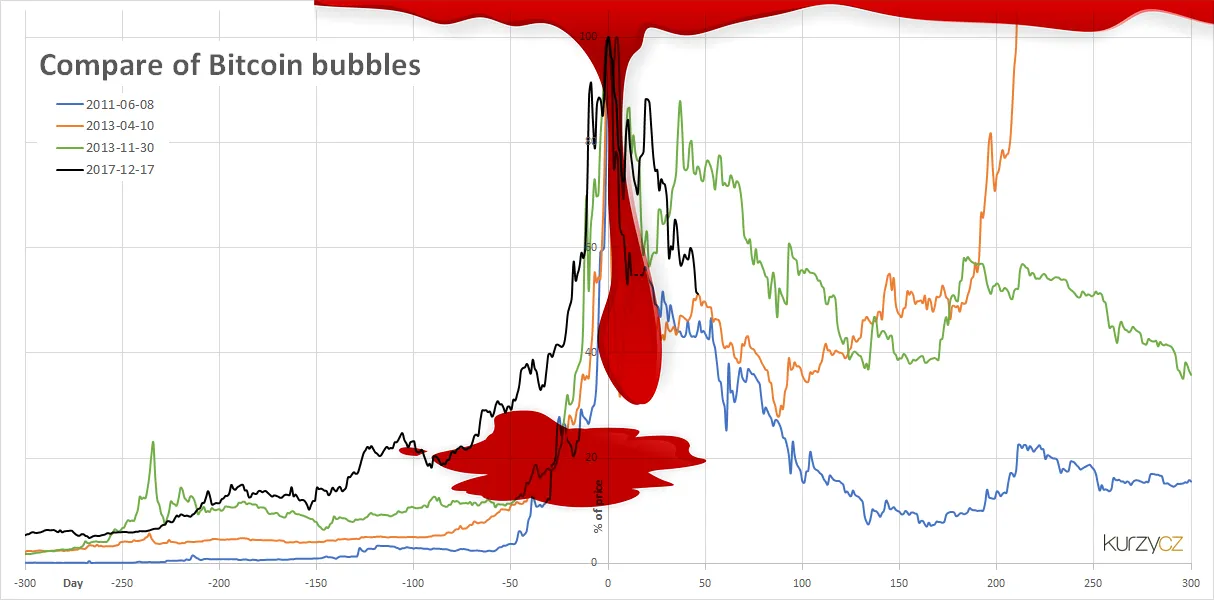

There is a lot of noise regarding the recent crash of almost every cryptocurrency. It’s about time, to get a more analytical perspective.

What goes up, must come downAfter the all-time-high (ATH) in December, cryptocurrency markets started to struggle with the beginning of the new year. Since then, most of the coins went from the top of the mountain straight downwards and until now, there is no certain prediction, when the market will recover. My hypothesis is, that instead of giving in to FUD (fear, uncertainty doubt), embrace this as a healthy correction and think about the larger perspective. But first, let’s take a look at the reasons for the situation we currently have.

Sources: [1] [2]

There are multiple reasons, why our eyes are drenched in red right now. I’m just going to give you a quick overview about the most common ones.

Media coverage

Over the course of the last months, but especially the last weeks, nearly everybody who has something negative to say about Bitcoin or cryptocurrencies in general, had the opportunity to do so. Krugman (1), Shiller (2) or the BIS (3), just to name a few.

Increase of regulation

The uncertainty connected to the increasing attempts of governments to regulate cryptocurrencies is most likely another aspect. Asia is among the biggest markets and the attempts of the Chinese (4) Russian (5) and South Korean (6) governments to get a grip onto the trading of cryptocurrencies stir a lot of troubles for investors.

Tether manipulation

Another reason are the ongoing questions about the rise of Bitcoin last year in connection with the accusations towards Tether (7) and the possibility of market manipulation. Without proper regulation, the risk of manipulation is always quite high. Just think of the many groups organized in Discord or Telegram, which are trying to pump a certain coin and dump it later, just to generate quick profits.

Transaction costs

Maybe not the among the biggest influences, but the extremely high transaction costs of Bitcoin, which occurred during the last year, probably had an impact as well. It wasn’t reasonable to use Bitcoin for smaller payments anymore, because the confirmation costs in the blockchain network were too high. Maybe we will see positive developments, as soon as the Lightning Network is fully implemented.

Chinese New Year

Among early Bitcoin investors it’s common knowledge, that there will always be a huge dip in January. This is mainly connected to the beginning of the Chinese New Year and the big cash out, which happens accordingly. In addition to all the other variables, this seems to increase FUD, especially among the late-adopters.

Virgins vs. veterans

Think about November last year and the beginning of the rush towards the ATHs of nearly every top coin on the market. This was the time, when media reports were increasing as well. Bitcoin hits 10,000$, 15,000$, 20,000$! BAM!

Human greed is incredibly powerful and a lot of “normal people” were attracted to the thought of becoming rich overnight. As understandable as it is, this drove the price of Bitcoin even higher and higher. Exchanges were forced to shut down new registrations, because the steadily increasing demand was just too much to handle (8).

But with all the mentioned influencing factors, it’s not surprising, that a lot of the unexperienced people, who just started to invest in cryptocurrencies recently, are now in fear of losing their money.

“To the moon!”; “Lamboooo!” – Yeah, shut the fuck up.

This might seem a bit harsh, but during the last months, I got more and more annoyed by the people, who were new to cryptocurrency investments. The reason is simple: Most of the time, they had absolutely no clue, what they were talking about.

They didn’t know anything about blockchain technology, haven’t read a single white paper or educated themselves about an incredibly volatile and therefore extremely risk-associated market. And my guess is, that the ones, who were most enthusiastic a few weeks ago, are now among those, who are panic-selling, because the market didn’t match their expectations.

They lacked any kind of realism but had a lot of overconfidence. This was especially striking, when they invested in ICOs (initial coin offerings) and didn’t get a thousand percent ROI (return of investment) or more after a week. It’s incredible, how demanding and hostile a lot of people can be, as soon as they put their money at risk. Sure, we all want profits in the end, but every investment you do is risky.

Every time you buy something at the stock market, buy cryptos or take part in an ICO, you should consider your money gone. Sometimes, everything works out and you can cash out with great profits – but it is as likely to lose your whole investment. If you get angry about losing money, then you are everything but a good investor.

Instead, learn from your mistakes, do some research and try to be smarter next time. Disconnect emotionally from every dollar you use as an investment – it will be better for your health, trust me.

Source: Sadly, I do not know the origin of this meme, so I re-created it. If you happen to know it, just pass the information and I'll link it properly.

All those big talks about coin XY will reach an incredibly high value at a given point are bullshit. There is not certainty. Not at all. It may happen – or not. Some projects are more promising than others, therefore they bear less risk – but there will always be risk involved.

People, who are thinking, they are going to drive a Lambo at the end of the year, should think again. It’s merely a possibility, nothing more. We all have dreams and most of them come true, if we have the financial means to realize them, but don’t think, it’s always going to be easy. Maybe you will be lucky and everything it needed, was one smart investment, but most the time this will not be the case. If you want to get rich, I’d rather advise you to work hard. This might be more promising in the end.

Personally, I think, getting rid of uneducated and hostile investors is probably the best thing, which can happen to a new (cryptos are still relatively new) market. This correction can be used, to separate the wheat from the chaff and to mature in a healthy way. Rapid, uncontrolled growth may result in cancer – you don’t want this for your body and you should not want it for any kind of investment, because it’s not unlikely, the increase of value is not justified – yet.

Don’t get me wrong here, I think, blockchain has come to stay. There are so many interesting projects connected to it and much more will appear in the future. Which projects will survive, I do not know, but I’m optimistic, the blockchain impact on our lives will steadily increase. Maybe it will take a while again to reach a new ATH; predicting markets is incredibly difficult and often connected to failure. Don’t let emotions cloud your judgment. Always keep a rational distance, avoid FUD as well as FOMO (fear of missing out), you will be better off in the end. Educate yourself as much as possible, if you are about to invest into something; get information from different sources. Never listen to people, who are promising you a guaranteed positive return of investment.

That being said, I do hope, I was able to calm you a bit and give you a more rational approach to crypto markets and their associated volatility.

I wish you all the best for your future trades and investments.

Stay smart!

Feel always free to discuss my ideas and share your own thoughts about the things I’m writing about. Nobody is omniscient and if we all walk away a bit smarter than before, we’ll have achieved a lot.

Thanks for reading.

Ego

References

(1) https://www.nytimes.com/2018/01/29/opinion/bitcoin-bubble-fraud.html

(2) https://www.cnbc.com/2018/01/26/robert-shiller-says-bitcoin-is-an-interesting-experiment.html

(3) https://www.theguardian.com/technology/2018/feb/06/bitcoin-price-crackdown-bis-cryptocurrency

(4) https://www.forbes.com/sites/leonhardweese/2017/11/29/bitcoin-regulation-in-china-still-unclear-but-chinese-exchanges-thrive-overseas/#5a2fc3636487

(5) https://www.theguardian.com/technology/2018/jan/17/bitcoin-continues-slide-drop-russia-china-regulatory-fears-cryptocurrency

(6) http://www.independent.co.uk/life-style/gadgets-and-tech/news/bitcoin-regulation-latest-south-korea-trading-ban-how-happen-price-what-happen-rise-drop-a8183136.html

(7) https://qz.com/1196866/bitcoin-prices-could-be-40-lower-because-tether-propped-it-up/

(8) http://www.businessinsider.de/crypto-exchanges-are-shutting-out-new-users-because-they-cant-keep-up-with-demand-2017-12?r=US&IR=T