OSMOSIS Superfluid Staking.

Superfluid Staking on Osmosis is looking like it could launch any day now. I thought it might be a good idea to look at what that actually means, what it will look like, and the impact it will have on yield.

What is Superfluid Staking?

That little check box in the image above is one that the Osmosis community has been waiting excitedly for for months. Put simply, OSMO will be able to be in a liquidity pool and (provided you bond the LP tokens for the 14 day option) also earning staking rewards. So you earn both the LP incentives, and staking incentive. This will work on Osmosis as liquidity has to be bonded to earn farming incentives. OSMO in the pools bonded for 14 days, is in effect securing the network just as staked OSMO is. It can't be just unstaked instantly, so the network is more secure. The Osmosis team are about to launch an upgrade so that the OSMO portion of your LP positions, bonded to a 14 day gauge will be able to be staked to a validator and have governance rights and earn staking returns.

Most "liquid staking" derivatives work in reverse to the Osmosis design. Under most models, you would stake your coins, and be issued with a separate token that represents that stake. Then you are able to add that derivative token to an LP position. This design has some security concerns, and while it has been implemented in various forms, adoption is not huge. Osmosis has flipped the model, and their superfluid staking will be an experiment likely to be watched closely by many DeFi platforms.

Edit - 28th march

I thought it would be a good idea to update this post with some recent news. Since I originally wrote this post, Superfluid Staking has settled in, and is currently live on three pools, being the OSMO/ATOM, OSMO/LUNA and OSMO/UST. The returns have settled in as being a 16% boost to the LP rewards on the 14 day bonds on those pools. Currently, the system discounts by 50% the OSMO component. The team is obviously rolling this out cautiously. It is likely that as time goes on, more OSMO pools will be added in order of the TVL they contain, and hopefully the "discount" rate will reduce in time. The rest of the numbers in this post are a little out of date.

So far I am loving this addition.

Some numbers.

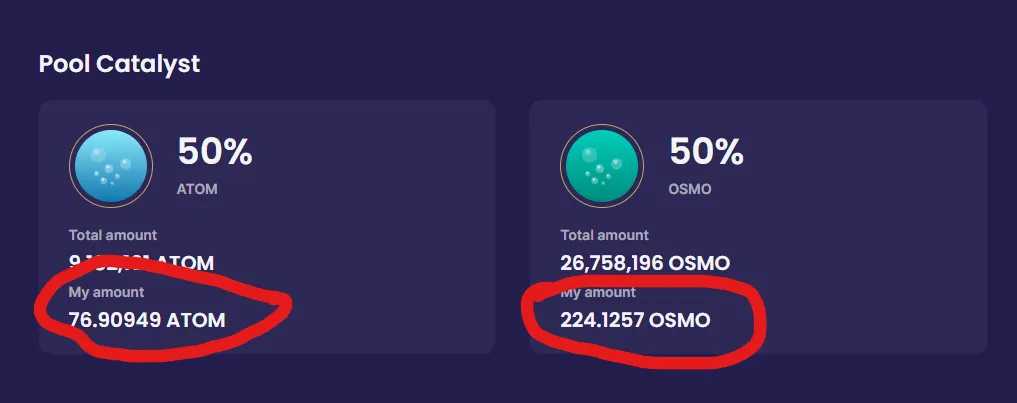

So, the best way to look at what impact it will have on yield is to have an example and do a little moths. I will use my personal LP position in the ATOM/OSMO pool as an example. At the time of working this out, we are in the middle of the market sell off caused by the conflict between Russia and Ukraine, so prices are well done on where they were just a few days ago. Anyway, for these calculations, OSMO is currently $7.69 and ATOM is $22.34.

As you can see from the above screenshots, My OSMO/ATOM LP position is currently worth $3442 and comprises 76.9 ATOM and 224.1 OSMO. Other info we need is the current APR for the pool, which I can tell you is 72.51% for the 14 day bonding. Lastly, OSMO staking yield is currently just over 80% according to my Keplr wallet.

- Currently my $3442 value earns 72.51% APR, which works out at $6.84 per day.

- The OSMO portion of that is worth $1721.

- Once superfluid staking starts, those OSMO will earn staking return also.

- Staking return will be $3.77

- Combined yield now becomes $10.61 per day.

- This works out at 112.5% APR.

So, from a purely financial perspective, the yield increases on this pool from 72.5% APR to 112.5% APR.

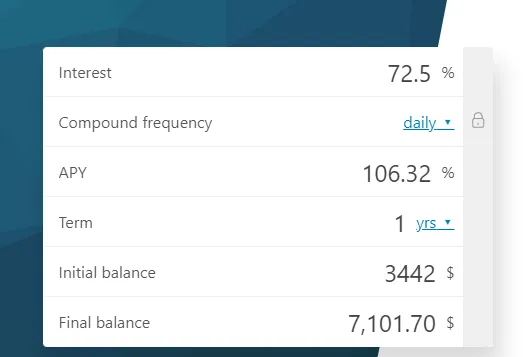

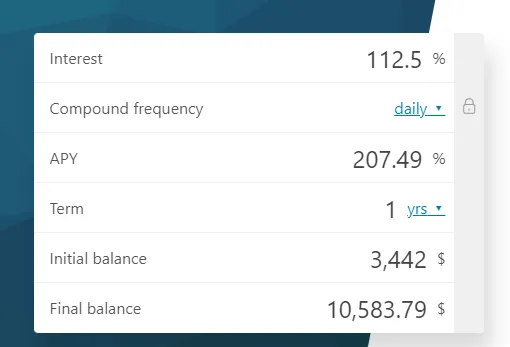

Lets look at the cumulative difference of this, compounding daily for a year.

So, in simple terms, the addition of superfluid staking adds almost $3500 to my return on this investment providing I compound all income daily for a year. Considering that is pretty close to the current value of the position, I'd say that is fairly exciting. And that is just one pool.

Now, importantly, there are a number of disclaimers that will alter that outcome:

- Once this is live, staking returns will drop. A whole bunch of OSMO that doesn't currently earn staking returns will soon, reducing the overall rate for everyone.

- The above example assumes price doesn't change over time. It will obviously, affecting returns.

- Osmosis emissions will decrease once it reaches the 12 month mark. Emissions drop by 1/3, so yields on both the LP incentives and staking will drop.

So the above example is just that, not a guarantee. But, returns will go up, at least in the short run. The other benefit is being able to actively participate in governance. That is a non-tangible benefit, but still important for a P.O.S. chain.

One more thing, this is just the start. Imagine that the Osmosis team offers this as a service to other chains? Imagine ATOM (for example) adds this, and accepts ATOM's bonded on Osmosis as staked, and pays them staking returns also. Once the Cosmos Hub (ATOM) launches its Interchain security module, staked ATOM will earn multiple different coins as yield. So you could be earning a flow of multiple tokens from ATOM in the pool (superfluid staked), plus OSMO staking returns, plus the LP farming returns, all from one LP position. This is part of the plan. May be ATOM, may not be, depends on ATOM governance. But other chains will have the option also, and big chance some will jump at it.

Superfluid staking is expected any day now, starting with this ATOM/OSMO pool first as the Beta test. Next will be the UST/OSMO pool, and then it will role out across the other OSMO pools from there.

Exciting times ahead for the Osmosis community.

To catch up on some other happenings of late around the Cosmos, take a look at these recent posts of mine:

Thanks for reading,

JK.