Bitcoin is currently in the midst of an unrelenting bear market, one that hasn't been seen since roughly 2014.

Many bears out there are pointing to what happened from 2013-2015 as the blueprint for what is likely to happen during this current bear market.

Meaning that they think it still has a lot longer to go.

Except there are a couple very large differences this time around...

The number of people, amount of money, and the popularity of bitcoin are all vastly different than they were in 2014.

Which means, it would be pretty surprising to see things play out exactly the same way they did previously, especially in terms of time.

Comparing charts:

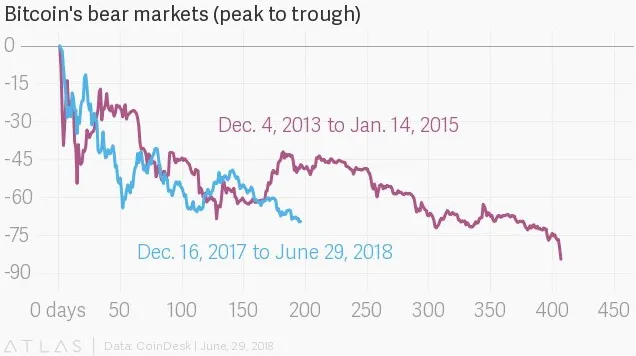

Take a look at the chart of bitcoin from 2013 to 2015.

Specifically, notice the length of time it took to play out from peak to trough:

It took bitcoin roughly 500 days to bottom in early 2015 after peaking in late 2013. A total decline of over 80%.

However, it took bitcoin right around 300 days to drop by over 70%.

Check out a chart of the current price action overlayed to what happened in 2014:

Comparing the charts you can see that the price action looks pretty similar, with one major difference...

The amount of time.

In that second chart seen above we can see that it took bitcoin over 300 days to decline by 70% in 2014 and it has taken roughly 200 days to decline by the same amount in 2018.

Which means that prices likely are moving faster now than they were in 2014.

Likely for the reasons stated above.

More people involved, more money involved, and much more notoriety/popularity.

The CEO of Bitmex agrees.

The CEO of Bitmex was on CNBC on Friday and he had similar thoughts.

Saying that he thinks the current correction is very similar to what happened in 2014 but he expects the correction to be shorter in duration for some of the reasons listed above.

Also interesting to note, Hayes said that $50k by end of 2018 is still not entirely out of the question.

“Absolutely BTC can reach $50,000 by 2018. I think that something that goes up to $20,000 in one year can have a correction down to $6,000 and will definitely find a bottom at about $3,000 and $5,000 range. We are one positive regulatory decision away, maybe an ETF approved by the SEC, to climbing through $20,000 and even to $50,000 by the end of 2018."

There you have it, it's official.

The correction will be shorter than 2014, and we will hit $50k by the end of 2018. :)

Stay informed my friends.

Image Source:

Follow me: @jrcornel