Hi guys! Just when you think you’ve heard it all, another wave of opinions and heated debates emerge. This time, THORChain is at the center of the fire. I've seen a myriad of discussions, from the protocol's mechanics to what’s thought to be bad, broken and suggestions for fixes. It’s interesting how these discussions only come up when you’ve got something good going. Let's dive into it.

Now some critics describe THORChain as a fascinating decentralized protocol, albeit with supposedly 'flawed mechanics'. They argue that it’s kind of like a distant cousin of UniswapV2, emphasizing that both Uniswap and Thorchain use XYK but on its own exclusive bridge which makes LPing unsustainable.

The main point of the argument was that the way UniswapV2 and THORChain are set up isn't the best for people providing money or for those trading, that it can cause less money to be available for trades, especially when certain cryptos change in price.

But those arguments are wrong, the critics always come out to be short of understanding about how Thorchain actually works, they just guess that it’s like what they’re already used to without actually using it or checking through the docs, it’s also interesting how they sound very smart, but end up saying a lot of rubbish. I know this because I’ve gone through the docs severally and actually use the protocol.

THORChain uses a method called XYK to set its prices. This method is important because it allows for a super wide range of price quotes.

These wide price quotes help create something called Liquidity Synths. Liquidity Synths are tools that make trading faster and cheaper, especially compared to some slower systems. As we've seen so far, there's a growing adoption of synths, with savers providing a true passive LP.

Secondly, THORChain's Streaming Swaps. These babies execute not just better, but faster than your average CEX. And with slip-based fees in the mix, attacks become a thing of the past. The result is that you can effortlessly swap a cool $30m across TC in a mere 24-hour window. If that's not efficiency, I don’t know what is! Who will help me tell these people?!

And then there's the whole debate about using RUNE as a base pair. It's not just a random choice; it's a strategic move to secure external capital. This ensures there's a hard-coupled security and any dumping of RUNE simply bleeds L1 capital, also, Node operators bond RUNE as a commitment to run the THORChain network giving it economic security. It's not a flaw, it's a feature. I’m not spinning this out of my mind it’s in the docs.

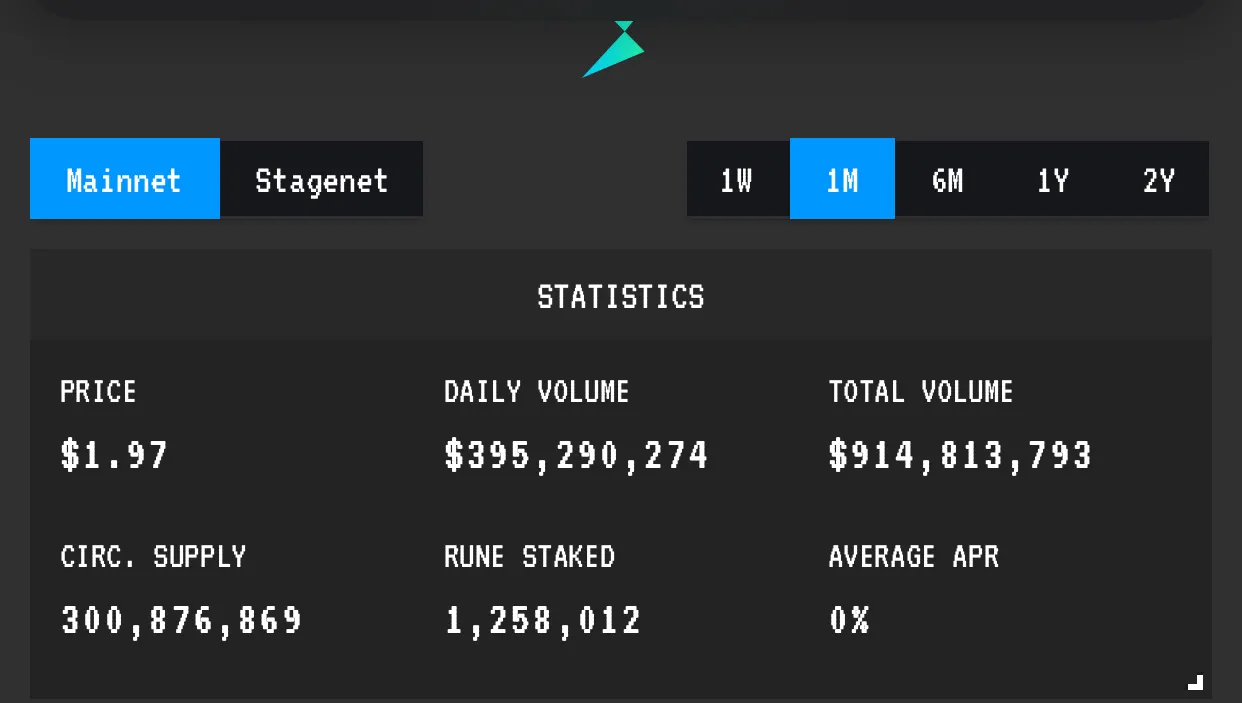

The long and short of it? THORChain isn’t just another DEX in DeFi. It is leading a new path, one that integrates Swaps, Savers, and Lending. If its mechanics were truly flawed, it wouldn’t be working as it is presently, being the number 3 DEX based on volume excluding volume not accounted for like bonded RUNE, with daily volume of over $390m in a bear market, I guess this is why there’s so much hating.

But maybe it’s just me, other systems are way flawed and do not offer half of the services THORChain does in a truly decentralized manner, the margin is wide.

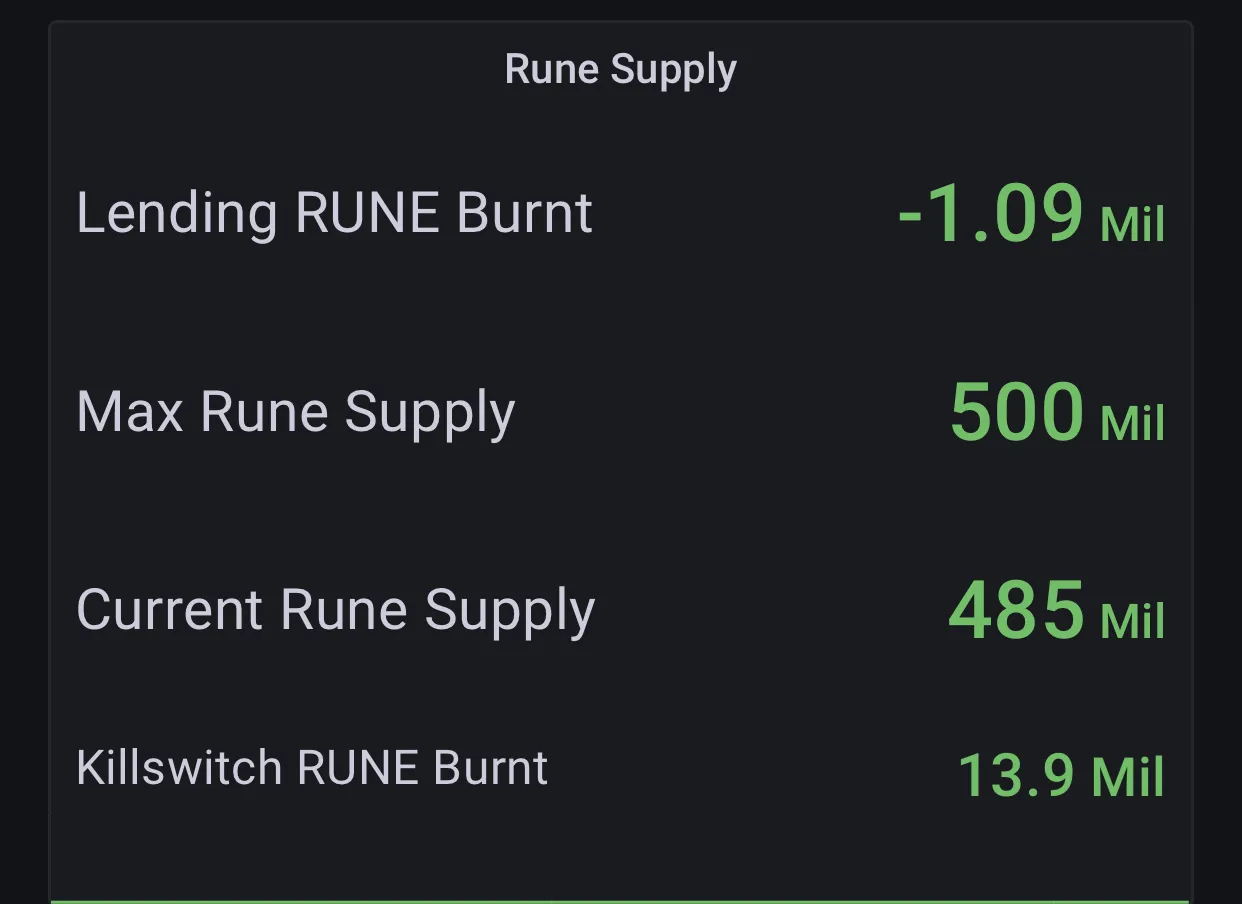

Meanwhile all of this is happening just after we celebrated 1M Rune tokens being burnt from the Lending mechanism just launched on THORChain. I wrote about this ingenious implementation of the mint and burn mechanism. At the time of writing this post, 1.1M RUNE tokens have been burnt and it’s not even 6 months yet.

Everything seems to be going well for THORChain with the price of RUNE ranging around $2, still very undervalued, I remember months back when Vitalik called the solution Thorchain is offering the Holy grail of crypto, if ever he actually checks out for solutions and uses them I wonder what his opinion of THORChain would be now. Has the Holy Grail of crypto been truly achieved?

I think so Let’s hear your thoughts in the comments.

Thanks for reading.