Since the markets are driven by sentiment - how bullish are you on crypto, and what does your timeline look like?

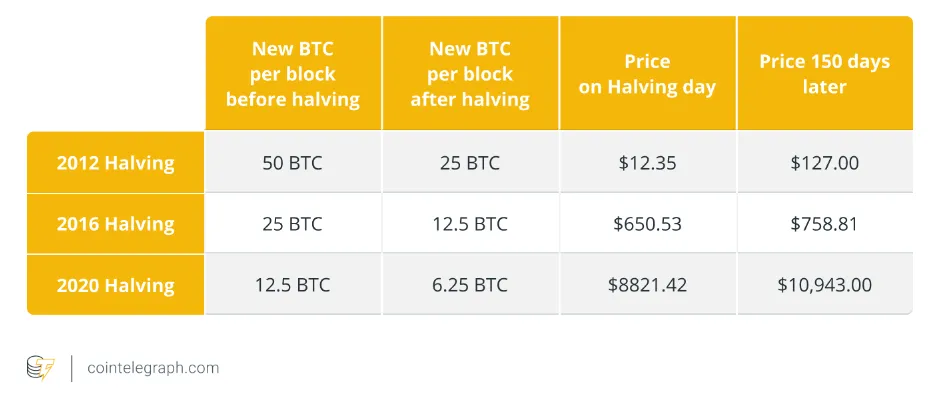

Somewhere around Q2 next year, will be the next Bitcoin halving event, which happens every four years. After this, the expectation is that price will increase, as the supply decreases. However, whilst this has happened each time, each halving event has significantly less impact on the total supply than the previous, as it halves the new supply. This likely means that new halving events aren't likely to have quite the same impact on price as past halving events, because the majority of the 21 total Bitcoin that will be created, is already out there in the wild.

Currently, just over 19.5 million Bitcoin have already been mined, meaning that there is only about 7% left to create, and that total amount is going to take a while to bleed into the total supply. After the next halving, the amount per block will drop to 3.125, which means over the next 4 years, there will only be about 650,000 Bitcoin created. That sounds like a lot and kind of is, as it is valued at about 18.5 billion dollars worth. However, considering that is the total in four years and the current known daily volume is around 14.5 billion worth, it isn't a huge amount.

It only amounts to about 3% of the current market cap.

So, personally, I am not confident that the change in supply will be sufficient to warrant a significant price increase. However, I do think that the change could drive a change in market sentiment, where there is a bit more FOMO for those who haven't yet got there fill of Bitcoin. And of course, that is what people have been doing the last few months, as they buy up the bitcoin they can, without driving the price too high.

Look at the volume since the last halving.

There are global economic reasons that impact on this also. However, from June 2021 to the end of 2022, the daily volume was around 20B, but since it has been averaging around half of that. And interestingly, on the day of the ATH of $65,000, the volume was only 36B. When it dropped to 30k the volume was almost twice as much, meaning that 4x as much Bitcoin was traded at that point and even at the low of around 17k, the volume was still at 21B. And even though price has increased 40%, the monetary volume hasn't increased, which means even less Bitcoin is being traded and changing hands.

How bullish are they?

The price is increasing, which means there is a market for it, even if it is weakish. But as we saw the other day with the fakenews pump, there is a deeper market out there biding its time. It seems they don't want to jump too soon with a big buy and affect the price, until it really is ready to explode, so they can keep accumulating slowly, cost averaging until the last moment before they expect the price to escalate quickly, and blow their load.

At that point, it is all hype.

FOMO sets in and the global stupid go mental. This will likely be timed with some kind of innovation or meta change in the industry, which I hope will be the realization that social crypto is the way to go, as it combines a proven mass drawcard, with decentralized finance. This would of course also heavily impact on crypto gaming, as social and gaming go hand in hand these days.

On top of this, the biggest users of the current web2 platforms are also younger and are more accustomed to online transactions and app behaviors. This means that advertisers are also going to look to capture the market, and that will also attract a lot of new crypto players in to capture the ad revenue. The amount of value generated will be immense, but for a lot of people, things aren't going to change much, because they will choose the non-decentralized experiences. But, with the shifts in global politics, the public shortcomings of government interventions and the increasing realization of the failures of the traditional economies, more will look to invest decentralized, pushing large amounts of value our way.

At least, that is my sentiment.

And, this is what it all comes down to - how we feel about the future. Investing is always future-based, but the cost of investing is incurred in the present. Once that value is spent, it is an immediate loss, because it is not available again unless selling what was bought. However, the aim is selling what was bought at a higher price in the future, or using what was bought to generate an income along the way. It is better when both are possible and, ideally, when holding also attracts other kinds of value, like airdrops.

As you can see, I am pretty bullish on crypto's future, because I think that our entire economic culture is making a shift toward behaviors that are well suited to be facilitated by crypto. I also think that culture is shifting toward more tech-savvy processes, and that younger group will be receiving trillions of dollars in inheritance over the next decade or two from Boomer and Gen-X parents.

Will they buy government bonds?

I don't think so.

Taraz

[ Gen1: Hive ]

Posted Using InLeo Alpha