For the last three months, I have been pushing to put extra onto the house mortgage. This is because for the next eight years or so, we have a collar on the amount, which means that there is an upper interest limit on the interest we pay, regardless of what the actual interest rate is.

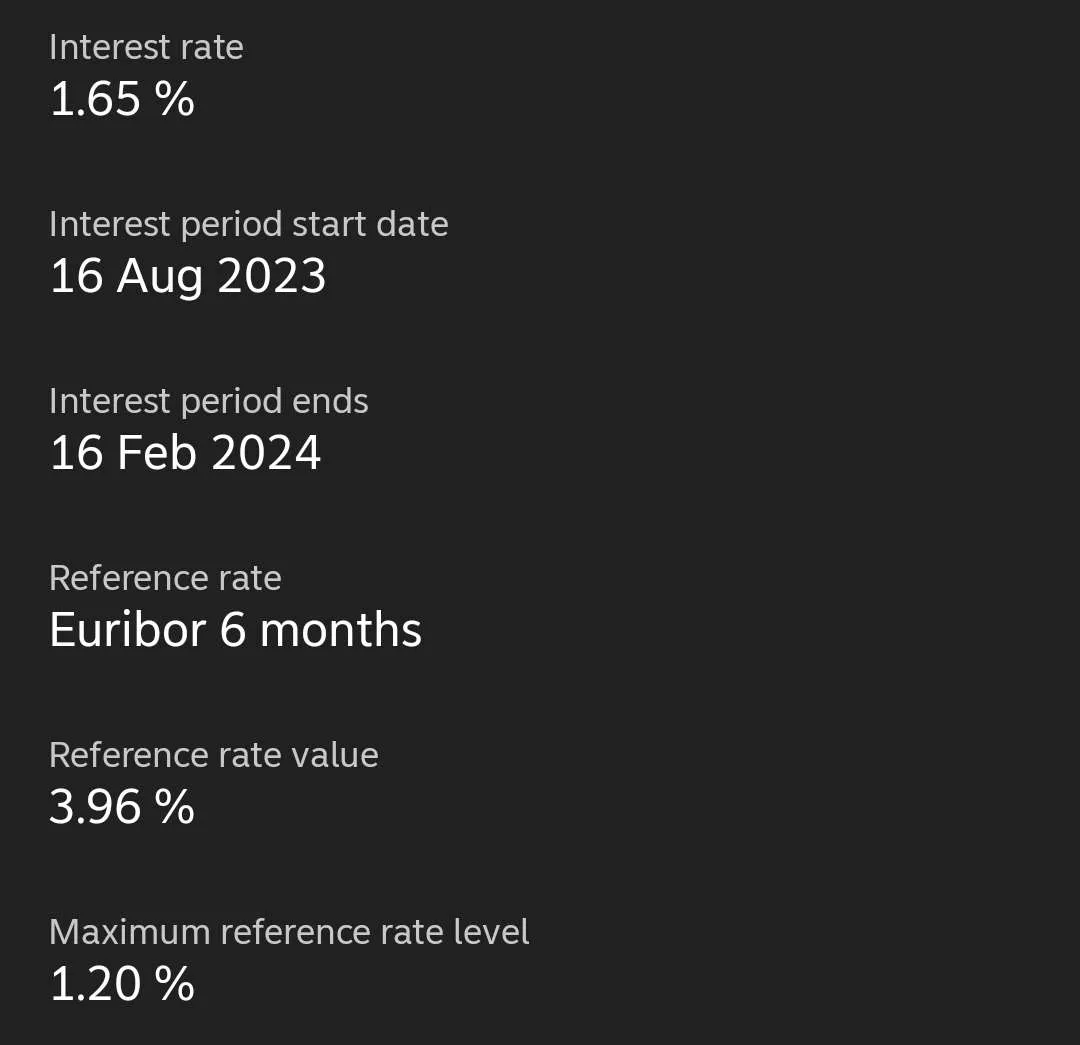

To illustrate this, here is an excerpt from the loan details:

We are paying 1.65% on the house loan, even though the reference Euribor 6m rate is 3.96%. The ceiling reference rate however is 1.2%, with the bank margin therefore being 0.45% on top of that. This means that even if the interest rates increase significantly (they are expected to fall a bit over the next few years), 1.65% is the highest we will pay. That is really good for now, however, if the reference rate falls below our minimum (which it was earlier, we will pay more than what we "should" be paying. But at these percentages, the difference between the negative end is much smaller, than the potential cost on the top end.

If we didn't have the collar, we would be paying significantly more per month to maintain the payback schedule. Or it would flex and we could pay the same, but extend the loan time significantly as we would be taking almost nothing off the principal amount, paying mostly interest only. Treating it as if we have to pay more now while interest rates are low for us, but inflation is high, means that we are effectively able to supercharge our payments and get more bang for our buck, taking more off the loan than we would be able to otherwise.

Ideally, we would pay the loan off inside the eight years left on the collar period, however that isn't practical under the conditions we have. However, after calculating a bit, my hope would be to be able to put in heavily now, so that when the collar ends, the principal is significantly lower. This means that even paying the normal schedule amount, would have far more impact on the principal and we may be able to half the total loan period.

Ideals.

Life doesn't really care about our ideals though. Which is what traps so many of us into debt cycles in the first place. This is because quite often, we will use our ideal view (or an overly positive view) of the future, without considering all of the little traps along the way. For instance, even though I knew that I have to get winter tyres this season it will cost around $1000, it doesn't mean I prepared for it well and diligently put the money aside for them. Instead, it will be a "shock" to the finances, this month, because I had hoped that I could buy them next month, when I got paid my bonus.

And we can do this often, especially when we have a line of credit and see something that we want, but can't afford. And of course, it also happens when those unexpected expenses arrive also, so we end up drawing on the line of credit, "believing" that we will pay it back the next month. Most likely though, next month we are going to be earning the same as this month, which means that if we didn't have the extra this month after our usual expenses, it isn't likely we will have the extra next month. Not only that, it gives another four weeks of unexpected expenses and something we want to come up again too. And these things inevitably do.

So, either bit by bit or or in one fell swoop, we can find ourselves consistently falling behind, unable to pay the entire amount off a credit card and paying interest, missing a payment on a bill and incurring a late fee, and inevitably, getting stuck in a loop, a debt cycle.

And while some people are heavily indebted, even those who aren't necessarily struggling that much, or are even making ends meet, are suffering. Because, making ends meet isn't thriving, because it doesn't allow for generative growth. Even if you can service debt, the cost of servicing means that it is a lost amount to potential investment. And often, it is in the times that we need to use credit, that is also the best times to invest. When we are coming up short, it is likely others are coming up short too, soo many might have to divest in order to cover costs, or maintain lifestyle, giving market opportunity to buy - if we have something to buy with.

While people are happy to spend when they have plenty, the most valuable time to spend is when the economy is struggling and people don't have enough. Buy the dip, right? But of course, investing (spending) at that time is difficult, because that is also when interest rates might be high, fuel prices are increasing, inflation on living expenses like food and energy are skyrocketing, and there is a lot of fear in the market - blood in the streets.

Everything comes with an opportunity cost, and a lot of people think that the cost of debt is limited to the interest. However, that is not the case, because the principle is also a cost of investment potential. If I am able to wrangle conditions so as to cut the mortgage in half, it means that at that point, I will also have freed up capital, which can be invested, and saved significantly on the interest. The cost of doing this by paying more now, is that the extra can't be used to invest. However, with the collar, it is an investment, because it has a multiplier attached to it. It is like for every euro I put in, it is getting an addition 20c (I haven't calculated the actual amount) added for free.

It might not make sense for everyone to pay their mortgage off faster, but for me right now, it does, so I am going to try to consistently add extra to it. Yes, there will be months like this one where the extra is less, but there will also be months where the extra is more. For instance, at least half of my bonus will go into the mortgage next month. This doesn't make up for putting in less this month (I have still added a bit more than the schedule), but it does have an overweighted impact on the principle. And the longer the earlier the "more" is added onto the mortgage, the greater the impact it will make, as it compounds.

There are always unexpected costs like a washing machine breaking down, out of the ordinary expenses like new tyres, and those desire purchases we are influenced to buy. We can prepare for these by having a little tucked away in the kitty, but once that is established and maintainable, the extra should be put to work. Because of the mortgage conditions I currently have, paying it faster is a generative investment. For someone else, it might be better to invest into something more directly - but invest we must, if we want to do more than financially survive.

Survival is the bare minimum of living.

Taraz

[ Gen1: Hive ]

Posted Using InLeo Alpha