Although it sounds like something a Muppet would say, this is actually a fairly important issue. My guess is that close to half of the decrease in steem value we've seen since the external markets first started offering SBD is due to this effect.

It should be emphasized at the outset that there is nothing wrong with exploiting an arbitrage. THis is not intended to be an accusation agains those doing so. As a matter of fact, it should be considered a given that precisely the process I describe below would occur when an arbitrage opportunity came into existence. In fact, my suspicion, based on wallet watching for the past few weeks as I observed this phenomenon is that at least one of the most reputable members here on steemit has driven much of this volume.

In general, the arbiter is not the bad guy, the arbitrage itself is. An arbitrage opportunity is a flaw in a marketplace. A dysfunction. It tell us that something is not working correctly. In this particular case, a secondary symptom of that dysfunction is that the value of steem is falling.

There are two immediate ways to convert SBD and steem back and forth. The internal exchange and an external exchanges like Bittrex or Poloniex. The internal exchange offers direct conversion of SBD to Steem Dollars. The external exchanges do not offer direct conversion, but allow bitcoin mediated conversion. That is to say, one can sell sbd for BTC and use the proceeds to buy Steem, or vice versa.

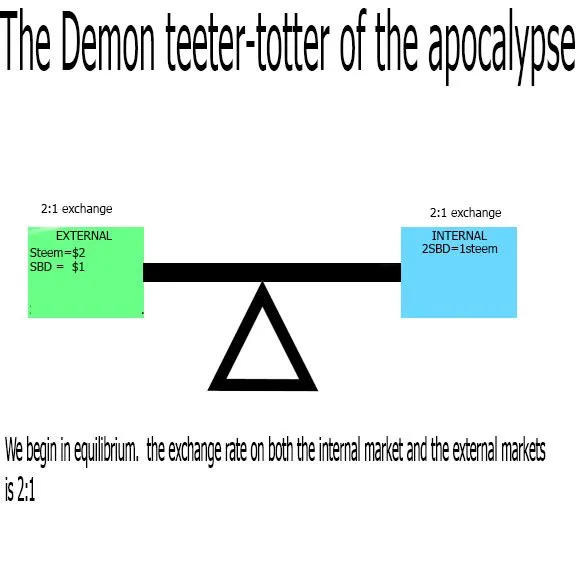

We'll start with a 2:1 steem to SBD ratio on the internal market. On the external market, steem is valued at $2 (in btc obv, but im using a dollar figure to make the math easier) and SBD are valued at $1. Thus, we have equilibrium between the two markets.

Equilibrium

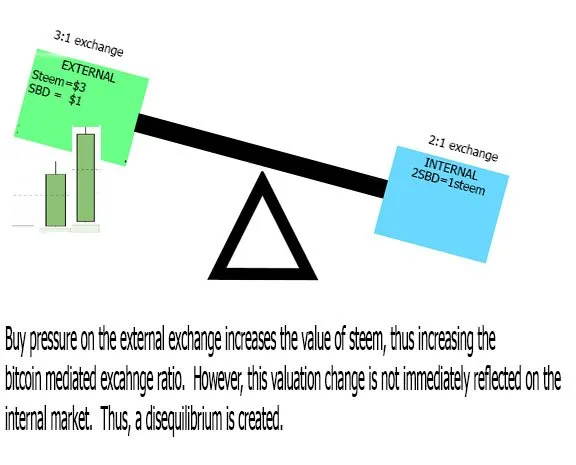

Now imagine that there is heavy buy volume for steem on an external market, and that volume increases the market price to $3. This increase will increase the mediated exchange rate on the external exchange to 3:1.

Buy volume creates disequilibrium

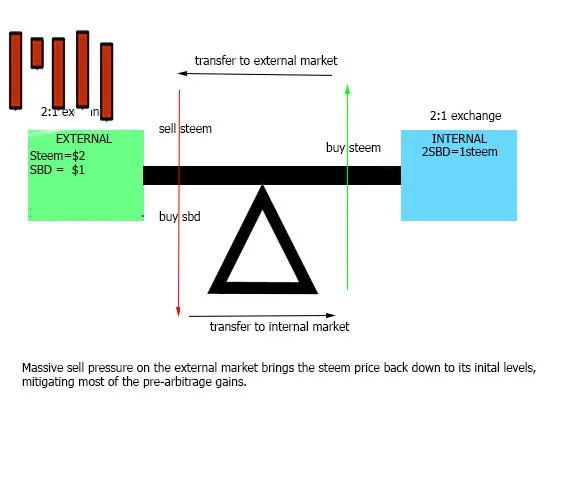

This increased exchange rate creates a disequilibrium between the two exchanges. In the normal course of events, this dis-equilibrium would most likely be cured by the internal exchange moving into alignment with the larger and higher volume external exchanges. However, the disequilibrium also creates an arbitrage opportunity. Traders are able to profit by doing the following:

- Sell off all steem holdings on the external exchange for BTC.

- Use the proceeds to buy SBD.

- Transfer the SBD to the internal exchange

- Use the SBD to buy steem on the internal exchange

- Transfer the steem back to the external exchange

- Start the proccess over again at 1

If a user were to start with 100 Steem on the external exchange.

He would sell the 100 for 300SBD, transfer the 300SBD to the internal exchange, and exchange the SBD at the 2:1 ratio for 150 Steem. He could now send that 150 steem back to the exchange and repeat the proccess.

You can see an example of a user that does this here (first one i found watching it happen the other day that wasnt linked to someone famous who might get pissed if i start speculating about his finances)

This user actually only does relatively small amounts, and he does it with one account, which makes it easier to see what is happening.

The order book "bids" will be depleted by arbiters

On the external exchanges, offers to sell a currency are called bids. There are many bids below the current market value. So if the market value were $3 for steem there might be a list of bids like

400 steem at 2.99

700 steem at 2.85

1900 steem at 2.40

1000 steem at 2.20

5000 steem at 2.10

15000 steem at 2.03

Of course, our arbiter can make a profit by selling his steem at any price above $2. But, time is a constraint for him, because the market (and probably other arbiters) will correct the disequilibrium fairly quickly. So he will simply buy off all of these bids, then sell them. He will obviously make very little money on the steem he buys at 2.03, but very little is better than none at all.

When he has finished buying all this steem, the price will be at 2.03, since his acceptance of the bids will have changed the last market price. Note that the amount of steem available for purchase on the order books doesn't really matter, because the arbiters can simply cycle their money to buy all of it very quickly.

The mechanism does not work in reverse. Thus, it has the effect of ratcheting down the price of steem

I'm not precisely certain why this process only works one way. I can tell it only does by looking at the accounts and transfers of the people who do it. I suspect that it only works one way because of SBD resistance to price change (ie the dollar peg)

Normally, any currency will go up and down as part of the regular course of events. This mechanism essentially stops steem value from increasing, but allows it to go down normally. IN even the medium term, this will assure a decrease in value.

Potential Solutions

None of these are pretty, but the reader should bear in mind that until something is implemented to close this arbitrage gap, the price of steem is going nowhere but down. It should also be noted that a bad actor could conceivably use a relatively small amount of steem to create havoc with the markets. Im pretty sure i could tank the market right now if i wanted with just the willingness to sacrifice a few thousand steem

1.Close the internal exchange: There is already a convert SBD function (the one that takes a week) for users wishing to convert their funds instantly can use either of the two external exchanges.

The original purpose of the external exchange was to use liquidity rewards to incentivize the conversion of SBD to steem at rates close to a dollar. Now that liquidity rewards aren't being distributed anymore, it is no different from any other exchange service offered.

2.Get the exchanges to stop offering SBD trades. I think though most people would probably prefer #1 to this.

3.Build in a delay when converting steem to SBD on the internal exchange. something like 10-15 minutes would likely be sufficient to allow the markets to catch up to one another. At the very least, it would limit the ability of arbiters to use a very small amount of steem to create a very large amount

IDK how viable any of these is, but i'd be really interested to hear other potential solutions.