My first exposure to Finance was when I was 13. We spent 30 minutes each day in homerun reading anything we want. After exerting my religious rights by bringing the bible to class every day... I started in on biographies. Martha Washington, Julius Caesar, Warren Buffett... and that was as far as I got. I was hooked and pivoted to reading every popular finance book available at the local library.

I read a lot of personal finance, a lot of high finance, a lot of finance-related drama (Barbarian's at the Gate, Liar's Poker). While I loved all of it, I found myself in the Value camp, reading a lot of Buffett, Ben Graham, Howard Marks... and there I stayed for 20 years.

Now, I don't know if you're aware of this, but factors trend over time, and Value has underperformed in the last 20 years. In fact, the last 20 years have been the absolute worst time period for Value... ever. In all of recorded financial history.Which is only 500 years, and the first 350 have terrible data and record-keeping, but still...

Throughout that period, I was a terrible undisciplined investor and while I occasional had big wins, I inevitably gave it back. My personality is not a good fit for a long-term value-oriented approach. Maybe I will share some of those stories down the road.

A couple of years ago, I finally got around to reading one Jesse Livermore. Now, you may or may not realize that Jesse Livermore is about as opposite to value investing as you can imagine. He follows trends, pyramids his entries, lets profits run, and reverses direction whenever he closes a position. He's a speculator's speculator. It's all very erratic... anathema to a value investor... and extremely effective.

18 months ago, I put together a trend-following strategy that's a blend of Jesse Livermore and Turtles (which I may cover in a future post). I tracked every single paper trade for the past 18 months and it proved extremely effective in some very difficult market conditions. I even did a few actual trades with it, and those have been mostly okay too.

Maybe I will give more detail later, but I don't want to give away the secret sauce, now do I?

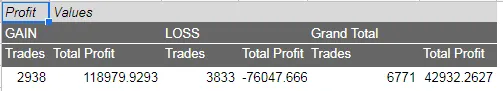

The average position size in this sample is $800, and the average holding period is 15 days. Trading every entry to attain the Total Profit shown would require notional buying power of $150,000, representing an annualized return of roughly 19% This is a long-short strategy and there is slippage in the paper-trades tracking (actual trade execution would likely be different than documented). This strategy has never been properly back-tested.

Honestly, I'm finding that entries are the least important aspect of any trading system, though I'm already getting better win-rates in the more recent portion of the sample by improving my entries.

The holy grail is in risk management and discipline, and that's where the strategy excels.

What's your trading style look like? Does it fit your personality?

(Everything included here is personal opinion. It is not financial advice. It is not legal advice. It is not even advice.)