Rise of Hard Money is a Harbinger of Misery

Bitcoin’s coming rise to $1 million within 4 years and gold’s renewed rise, are a harbinger of an imminent, crippling stagflationary, economic collapse.

Continued from prior post:

Armstrong wrote:

6th Wave […] isn’t a walk in the park to some glorified new age of knowledge […] cannot leave behind the majority.

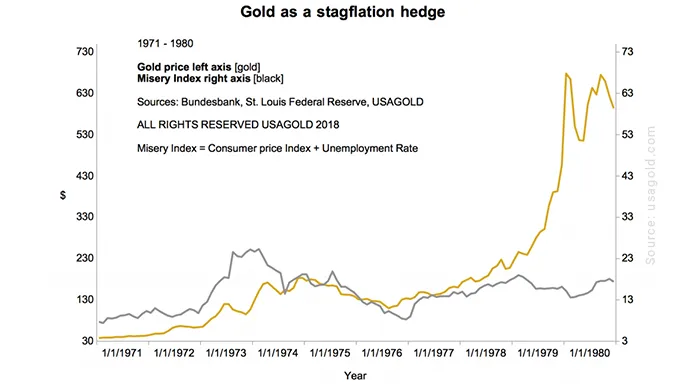

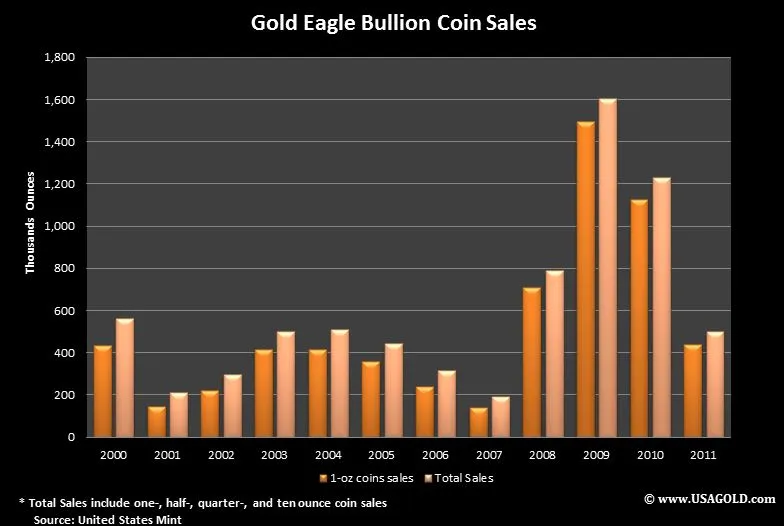

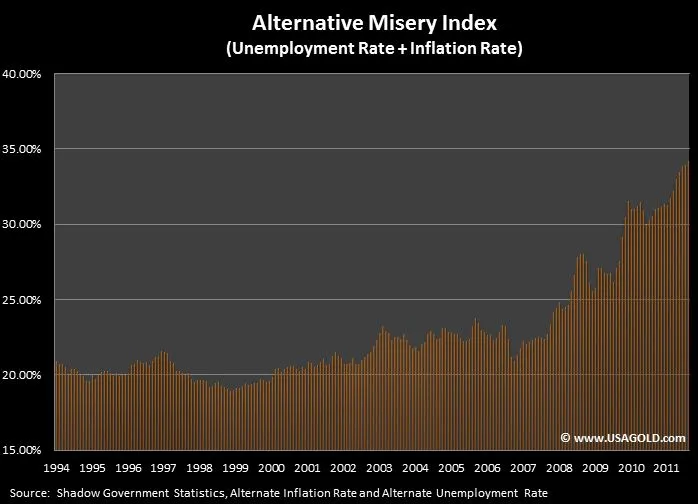

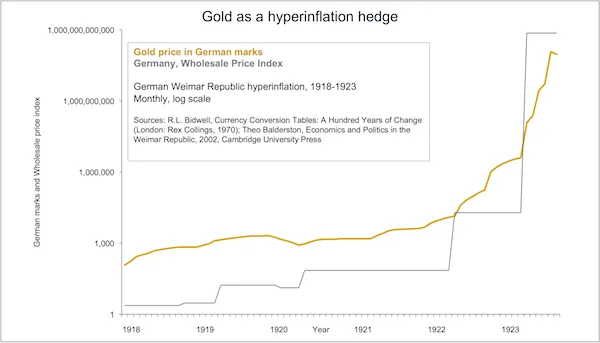

Gold in times of crises

Strong Correlation Between “Misery Index” and Gold Demand

Armstrong wrote:

Money and assets are always on opposite sides. When even gold was money it was not this miracle stability within an economic sea of chaos.

The problem has NEVER been what is money – the real problem has ALWAYS been government mismanagement. So returning to a gold standard would never make politicians honest since we had Bretton Woods and they blew that gold standard up as well.

Prosperity Coincides With Loosening of Hard Money

Armstrong wrote:

I am sorry, but you cannot possibly demonstrate that only a tangible monetary system would work when in fact the medium of exchange is solely based upon intangible human desires post-Bronze Age. Before 1650 BC, money was tangible because it was a barter system among people.

Money became intangible post-1650 BC (REPRESENTATIVE) and based solely upon CONFIDENCE that others will also accept whatever the form of payment might be.Gold is a LUXURY — it is not a TANGIBLE based monetary unit for it has no utilitarian value whatsoever. If you try to argue that TANGIBLE based monetary systems are better, that is barter and in that case, the medium of exchange must have some sort of use value such as food or bronze. Never do we see Gold forming some sort of TANGIBLE based monetary system. Gold ONLY emerged as a medium of exchange because it was once exclusively the property of royalty, and as such, it was a luxury with no practical use as food or a weapon. Therefore, gold is not TANGIBLE but it historically also requires CONFIDENCE to exist as a medium of exchange as does paper money or receipts.

You need to get you definitions correct. Any form of a medium of exchange which is TANGIBLE must have some practical utilitarian based value. Gold was a luxury and required the CONFIDENCE that someone else would also desire it for if they did not, then what would you do with it since you could neither eat gold not use it as a weapon.

Armstrong wrote:

The whole argument is a gold standard inhibited growth and created massive deflation – the 26 year Long Depression of the late 19th century. Gold does not provide for a stable monetary system and that is why Bretton Woods collapsed. Gold should remain as a private investment/hedge.

Money cannot be fixed in value while everything else floats.

Buy gold for personal reasons and as a hedge against government. If you want money to be tangible and of some constant value, then you will never see a raise, your house must remain the same price, and no investment becomes possible other than money.

We will end up with a new currency anyway and it will not be gold backed or some fixed exchange rate that is anti-freedom.

That is what Marx tried. Paint your entire body. You will die because your skin needs to breath.The monetary system[…]must fluctuate. Flat-line it and you kill society – you are dead. Cheer up! A new currency is coming.

From §Background on the Money Question, Part Two of “Money in the Gilded Age”:

Officially, the nation's money was based on gold and silver before the Civil War,

but in practice, paper money entrepreneurship fueled economic expansion. In the antebellum period local and State banks could print their own money, and in the twenty years before the Civil War more than 4000 different kinds of paper money circulated. Even more striking, according to the Treasury Department, more than forty percent of the money in circulation was counterfeit.

The North printed more than 450 million dollars in paper notes, popularly termed "Greenbacks." It used them to pay soldiers and suppliers, and from there they entered the economy. Greenbacks let Lincoln finance the unpopular war. Greenbacks let Lincoln finance the unpopular war.

They also produced an economic boom for the North.

From Why conservatives spin fairytales about the gold standard:

Hard money meant a general deflation of prices in relation to the dollar. Each year from 1875 to 1896, farm prices fell 3 percent. Georgia farmers saw the price of a pound of cotton fall from 10 cents to 5 cents […] Corn prices fell so low that Nebraska farmers decided to burn it for fuel rather than spend money and time shipping it to market to sell it.

If farmers could get a loan or a mortgage, hard money made it more expensive to pay off. When the real value of the dollar rose, the real value of their debts rose with it. Farmers had to sell a lot more wheat or corn to meet those debts.

Scarce credit combined with scarce dollars. Because the Eastern banks had a monopoly on issuing bank notes, farmers in the West and South often lacked access to currency. The lack of dollars in rural America became particularly acute after the growing season, when there was insufficient currency to move the harvest to market.

Farmers were not alone when it came to the burdens of hard money. During the long economic depressions of the 1870s and 1890s, workers and manufacturers felt the weight of the same deflationary price cycle. They asked why anyone would invest in an iron mill, for example, when the price per ton of iron stagnated or fell.

Gold made losers of farmers and other working people selling goods at deflated prices. It made losers of people who paid mortgages and owed debts. And it made losers of those who lacked access to credit and currency.

But gold was good for those who controlled the currency, held gold or issued loans. It was good for the banking corporations, Wall Street financiers and other creditors. As a result,

the gold standard shifted resources from the poor to the rich, and from the Midwest, West and South to the financial centers of the Northeast.

Armstrong wrote:

Before the Protestant Reformation,

banking was exclusively a Jewish industry for Catholics had the sin of usury. Catholics who wanted to get into the banking industry funded the Protestant Reformation as their cover to take over banking.Medieval [Jewish] bankers were merchants prior to

St. Thomas Aquinas who declared money lending to be a sinin Summa Theologica,which cleared the field of Christians. The first bankers coming out of the Dark Ageswere northern Italians, not Jews.

Armstrong wrote:

[

During the 600 year Dark Age] the banking industry remained largely tempered and controlled. Fees could be collected for providing a service butthe practice of lending money for interest was strictly forbidden due to the Sin of Usury.

The line that divides the medieval period and that of the birth of capitalism comes in during the Protestant Reformation. Take away the religious slogans and the political corruption that emerged with the Church at that time and what you are left with is the economic reasons for the rebellion. Prior to the Reformation, banking had been exclusively conducted by the Jewish community. Their religion was the only one in the west that did not deem lending money to be a sin. Catholics, who engaged in lending for interest, ran the risk of being excommunicated from the Church. The Protestants used this restriction as evidence that the Pope was the Anti-Christ suggesting that he was attempting to control the people by prohibiting the buying or selling on credit, as similar to the warnings in the Revelations. Of course, this was an extreme interpretation of the Bible, but it served a political purpose. Economics credits the birth of capitalism with the Reformation because in the Protestant regions of Europe, Christians moved head first into banking.

Prior to the Protestant Reformation banking in the middle ages centered largely on the goldsmiths. This tradesman group accepted deposits and issued receipts in return. This effectively created the

rebirth[regression] of banking in the Middle Ages similar to that which had exists in Babylonian times.

the absence of banking and credit discourages human interaction and thus acts an impediment to economic and social growth. Too much debt and credit runs the risk of destroying the very foundations of civilization as witnessed by the fall of Athens and Rome. If there is one lesson to be learned from history, it is that need for moderation in both directions of the economic pendulum.

Armstrong wrote:

Aristotle[…]saw the[…]men, making money from money. This actually influenced Karl Marx.Aristotle did not understand the economic evolution process dynamically, which has taken place in ALL societies throughout recorded history. What Aristotle saw was the abandonment of what I have dubbed the Villa Economy of self-sufficiency and the gravitation of both people and capital toward commerce. This part of the economic cycle usually involves people becoming attracted to the big city and abandoning the farm life. Every society sees this oscillation both in the concentration of capital as well as people.

[He] tried to draw a line between capitalism that would assist economic growth and that which would fuel these booms and busts driven by speculation in his mind’s eye:

“Now money-making […]

for usury is most reasonably detested, as it is increasing our fortune by money itself, and not employing it for the purpose it was originally intended, namely exchange.”

Bitcoin Will Not Be Effectively Spendable

Continued from prior post:

such as the very onerous “proof of source of funds” […] on-chain transactions fees will be $1000+ when BTC is $1 million. Thus too few people transacting on-chain

The stock-to-flows model informs us that the BTC price and thus transaction fees will rise inexorably. This means BTC will over time kick more and more people off-chain, until eventually only the uber elite can transact on-chain.

Armstrong wrote:

They see that as 100% accountable for tax purposes. Any new currency will be a unit of account internationally with each currency converted into that […] The new currency will be electronic. This will be the RESERVE CURRENCY andthat will not be used in each country to buy things. This will be up there with the SWIFT CODE system.

Bitcoin vs. Gold

Armstrong wrote:

maximum [gold] price[…]for 2032[…]$22,000 – $24,000[…] Those who think they can create their own currency […] Ain’t gonna happen

Those who thought they were clever and think they can make tax-free income in Bitcoin, all I have to say is – been there done that. There were tax straddles that allowed people to push income from one year to the next using futures. They were sold by the major brokerage houses in the late 1970s. The IRS allows such schemes to progress, then hits them with huge interest, penalties, and sometimes criminal prosecutions. If anyone thinks they can use Bitcoin tax-free – good luck. You are probably destined for real tax-free living at the closest Federal prison. Don’t worry, like Motel 6 – they will keep the light on for ya.

“How does one liquidate their gold holdings in a private manner?” Good luck. The French went after coins shows requiring that they report all attendees. The shows no longer go to Paris. The coin and bullion dealers were by law in France barred from dealing in cash. The French started to travel to Belgium to buy and sell gold.

Here follows another example of why demand for Bitcoin will trump demand for gold.

If buy 5 oz of gold or one BTC at ~$6k, then gold goes to maximum $20k but BTC to $1+ million. So if sell $100k at some point and hodl any remaining stash. So for gold 28% would be lost to taxes (USA taxation) because 100% of stash would be sold. For bitcoin, only 10% of the stash would be taxable (because only 10% of stash would be sold) and currently only at the portion above $38k would be taxed at 10%. So if the taxes on the $100k sold would only be paid after BTC reaches $1 million, then for that BTC scenario only 0.72% would be lost to taxes.

click here to read the remainder of this post…

RE: Most Important Bitcoin Chart Ever