Repository

https://github.com/igormuba/DEX/blob/master/Class8/exchange.sol

What Will I Learn?

- Removing a buy or sell order

- Iterating through the price queue

Requirements

- Internet connection.

- Code editor.

- Browser.

Difficulty

- Advanced.

Tutorial Contents

Introduction

On the previous tutorial we have finished all the functions to fetch the orders that have already been placed on the exchange. We have also learned how to work with it, connecting the Exchange to the ERC20 token (you can use any ERC20 compatible token on this exchange!) and placing orders on both sides of the book (buy and sell).

On this tutorial, you will learn how can you remove the orders from the user at a price point. The user will request us to remove his orders to buy or sell at a certain price, and the exchange will remove all of his orders at the given price point. Notice that we must be careful to remove only his orders, so the other orders from other people will still be on the queue of that price point. To achieve that effect, we will check for each node on the queue data structure is the maker of that order is the caller of the functions. If it is, we remove the node.

It is recommended to follow this course to understand what we will be doing here, but it is not mandatory. A previous knowledge of data structures, in whatever language, is recommended, because we are using linked lists and queues in this exercise. This class connects with the previous, as we will use the "fetch book" functions to see the changes in the book, at the end of the post.

The function and loading the token

The function will take 3 arguments, the address of the ERC20 compatible token that has a struct of a Token stored in our exchange, a boolean telling if the order is a sell order or not, and the price of the orders that the user wants to delete. Using just those 3 pieces of data, the function will, later, remove all of the orders of the user at that price point

function removeOrder(address _token, bool isSellOrder, uint _price) public{

Token storage loadedToken = tokenList[_token];

// code to remove the buy or sell order omitted

}

Notice we are also loading the token from the mapping of Token structures saved on the Ethereum storage. This will make it easier to work with the variables and data from the token on the exchange, though, it will consume more of the ethereum stack, it is recommended to avoid creating too many variables to not reach the end of the stack, but I think it is safe to create this one here, even though it is a big one.

Is it a sell or a buy order

Now, we will use the boolean value received on the function arguments to know if the user wants to remove a buy or remove a sell order, the data will be used to take the decision on the branch below:

if (isSellOrder){

// code to remove sell order omitted

}else{

// code to remove buy order omitted

}

The above is the simplest implementation I have found for that, however, many other equally or better designs can be implemented, you could actually use strings, uints, and other data types to take that decision. You can even not take any data to specify the order type! In that case, another logic would be used to see if that price is on the buying or selling side of the book.

There is an implementation that the user does not even need to tell you if it is a buy or sell order! I am not using this on my code, but if you want to try it, the user can just give the token and the price. If the price is higher than the highest price in the buy book, then it obviously is a sell order. On the other hand, if the price of the order the user wants to delete is lower. In this case, you don't even need the boolean as an argument for the function. And the implementation would be like this:

if (_price>loadedToken.maxBuyPrice){

// code to remove sell order omitted

} else if (_price<minSellPrice) {

// code to remove buy order omitted

}

Removing the sell order

Whatever the decision branch you have designed on the section above, the procedure to remove the buy and sell orders are different. Starting on the selling branch.

First, we prepare a loop to check all the orders at that price. We will need a counter for that:

uint counter = loadedToken.sellBook[_price].offerPointer;

while (counter <= loadedToken.sellBook[_price].offerLength){

// if the maker of the order is the caller

if (loadedToken.sellBook[_price].offers[counter].maker==msg.sender){

// remove the order and reimburse the caller

}

counter++;

}

The above will loop through all the elements on that price point. Now, inside it we need to do 2 things:

- remove the volume of the order of the user

- reimburse the user on the volume of that order

If the maker of the order is the caller of the function, first, we store the volume of the order into a variable:

uint orderVolume = loadedToken.sellBook[_price].offers[counter].amount;

So that we can reimburse him later. Then we do a simple check for overflow:

require(tokenBalance[msg.sender][_token]+orderVolume>=tokenBalance[msg.sender][_token]);

Before we reimburse, we clean the volume of the order, to avoid the race condition that would allow for exploits:

loadedToken.sellBook[_price].offers[counter].amount=0;

And then we can reimburse the tokens to the person that tried to sell them:

tokenBalance[msg.sender][_token]+=orderVolume;

Removing a buy order

The remove buy order decision branch is very similar to the above, in regards to logic, so I will paste the code here and explain what changes later.

uint counter = loadedToken.buyBook[_price].offerPointer;

while (counter <= loadedToken.buyBook[_price].offerLength){

if (loadedToken.buyBook[_price].offers[counter].maker==msg.sender){

uint orderVolume = loadedToken.buyBook[_price].offers[counter].amount*_price;

require(ethBalance[msg.sender]+orderVolume>=ethBalance[msg.sender]);

loadedToken.buyBook[_price].offers[counter].amount=0;

ethBalance[msg.sender]+=orderVolume;

}

counter++;

}

The first thing that changes is that instead of working with the sellBook we are working with the buyBook

Also, we are working with the users ETH balance, not the token balance. In the previous section, as the user wanted to sell tokens, he needs to have tokens. Now, as he wants to buy, he needs ETH. So, instead of working with the tokenBalance[msg.sender][_token] we are working with the ethBalance[msg.sender].

Another change is that the orderVolume is the product of the price times the amount of tokens he wants to buy, not just the tokens.

How it works

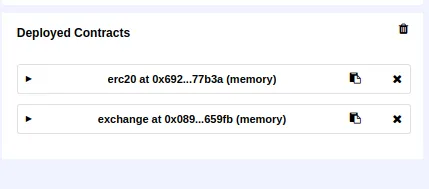

I have deployed both contracts and allowed the exchange to spend from my balance on the token contract, just like on the previous tutorial.

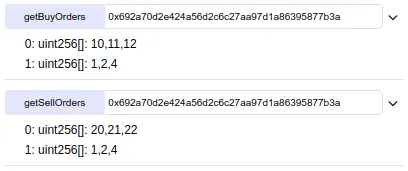

I have placed a few orders on both sides

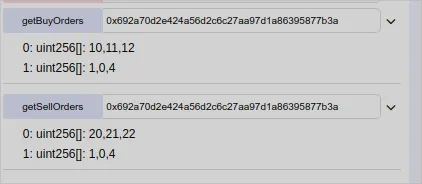

Now, removing the all volume from the orders I have placed on the buy at 11 and sell at 11:

So those orders will be ignored when parsing through them.

Curriculum

Latest tutorial of the series:

First tutorial of the series:

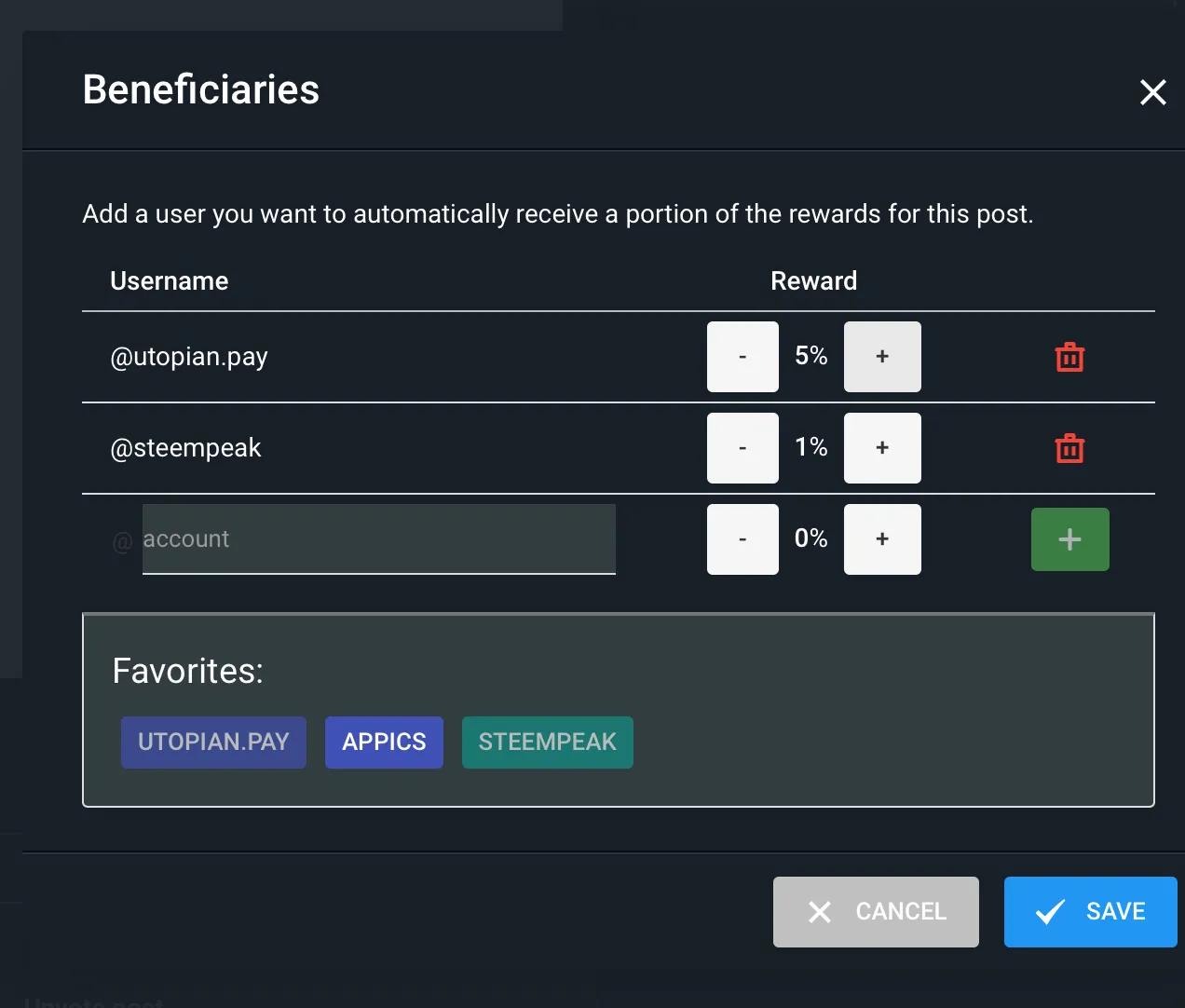

Beneficiaries

This post has as beneficiaries

- @utopian.pay with 5%

- @steempeak with 1%

using the SteemPeak beneficiary tool