POSSIBLE SLINGSHOT BITCOIN CRASH AHEAD

Possible crash to $3500 ahead with a V bottom quickly slingshotting back to new ATHs within a short period of time.

It’s possible the BTC price could touch $11k before such a possible crash. Or we could turn over soon with $9k being the peak of the deadcat bounce. It also remains possible that $5850 (on Kraken) was the low, but I’m leaning away from that probability now because…

I wrote:

EDIT#3: In the most recent private subscription comments, Armstrong reminds of the possibility for a SLINGSHOT move wherein the DJIA could drop below the 2017 low, yet SLINGSHOT back to a high by 2021! Aha, so that’s what I’ve been thinking about Bitcoin that it would crash in a way that shook out all the weak hands but SLINGSHOT back to ATHs quickly and not a drawn out crypto winter. So perhaps we have more downside coming for Bitcoin before bottom. Could we decline further to the ridiculous level of $3500 first?

Armstrong is definitely thinking a further crash of everything into a SLINGSHOT move to the upside. Hmm. Maybe we should be prepared for a drop to $3500!

I had also noted the steepness of this current decline as being abnormal and not fitting our models:

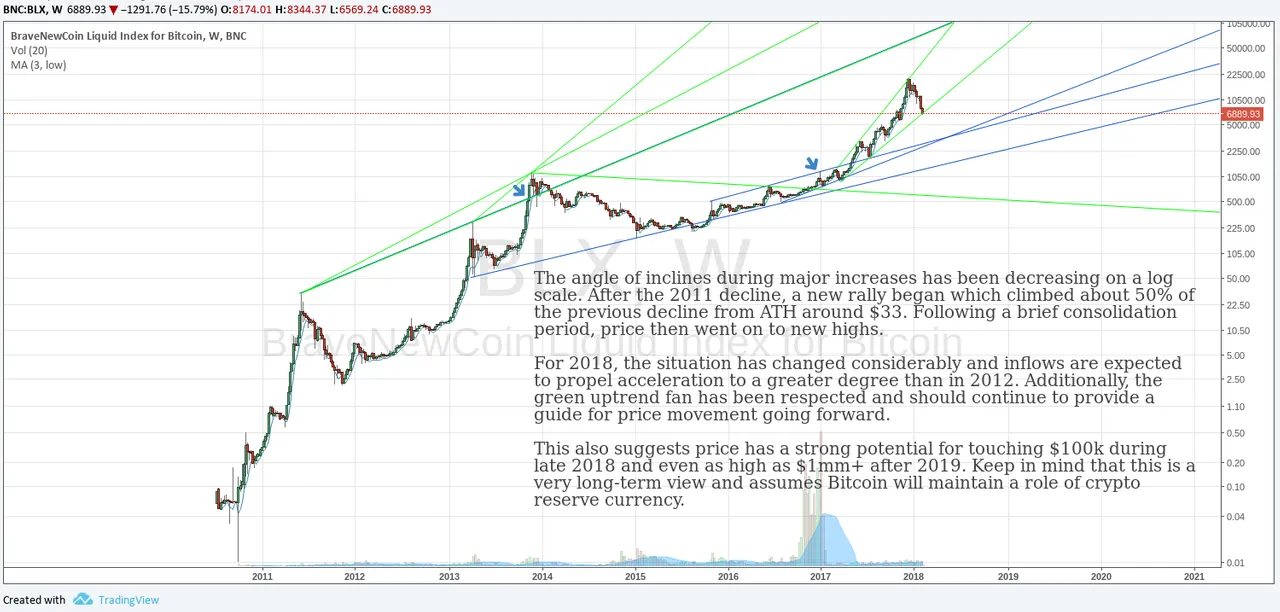

1 Unless we measure from the last bottom in 2015, but in that case the slope is much less steep yet the current decline has been as steep as the 2011 decline from the 2011 peak. Declines in 2013 and 2014 have been becoming less steep as the rate of ascent also has become less steep as adoption has widened. The steepness of the current decline thus must be a bear trap to fake out the weak hands.

Such as not fitting this model:

I was going to note that the 2011 decline from the 2011 peak was more significant than the decline thus far, so if we were modeling the current decline as correlated to the peak of 2011, instead of one of the flag patterns before the peak of the funnel in 2011, then we could see this current decline down to $3500, and then take more than a year to reach new ATHs (but not 3+ years as would be the case with a correlation to the 2014 - 2015 crypto winter). This is the other possible scenario, but I think it is less likely because 1) the length on the current rise on log chart is not as long as the one to the peak in 20111 thus we need to attain higher ATHs first before correlating to the 2011 peak; and 2) the current fundamentals call for a blowoff top because the ICO mania won’t stop until the regulators stop it (or per my aforementioned wild conjecture that Tether and SegWit theft will destroys the centralized exchanges), which is not soon.

Armstrong wrote:

ANSWER: Yes. With Dow declining, we are failing to see a rally in cryptocurrency or gold and the long-touted flight to quality is not unfolding as most have expected.

When Equities typically decline, people run to the government bonds, and this we call the Flight to Quality.

[…]

So what is going on this time? We are in the midst of the Transition from the confidence in government to the private sector but nobody seems to understand what is unfolding. This is why we are getting mixed signals and strange relationships.People will invest in the private sector and sell government bonds, smelling a default in the wind.We are more than likely going to get the first kneejerk reaction, where equities will DECLINE and people will rush into government bonds, even with negative yields. This should create the final bubble top in debt, and then it will reverse in a Flash Crash type move. Traditional people will buy bonds and lose a fortune. Others will sell their stocks at the lows and jump on short positions. This will set the stage for a crazy period that comes around every so often, measured in hundreds of years.

I had also written:

Clearly we’re in a Panic Cycle year as evident by havoc on the global markets the Trump tax cuts will have. This is causing much uncertainty which I think is what is causing the VIX to go crazy. Also the government shutdown in the USA added to uncertainty over short-term timing of flows.

Rogers predicts the stock market will experience jitters until the Federal Reserve increases borrowing costs.

“I’m very bad in market timing,” Jim Rogers said. “But maybe there will be continued sloppiness until March when they raise interest rates, and it looks like the market will rally.”

Taking another look at the following chart which was posted upthread, perhaps the rightmost green uptrending line on the chart will become resistance instead of support as it did in 2011! We can visualize an analogous line on the 2011 funnel (which isn’t drawn but you can use a ruler on the image below to visualize it). Thus we can still possibly make new ATHs late in 2018 but $40k only. Any move to $100k would be delayed into 2019.

click to zoom

The pattern of 2011 and now are exactly the same, except for the less steep slope of the rise, but the slope of crash underway is the same. The price crashed 94% in 2011! Also the prior peak in 2013 and the second blue arrow drawn on the above chart align horizontally at ~$1275 for a -94% collapse where the current crash would likely meet the bottom blue line! Holy shit!

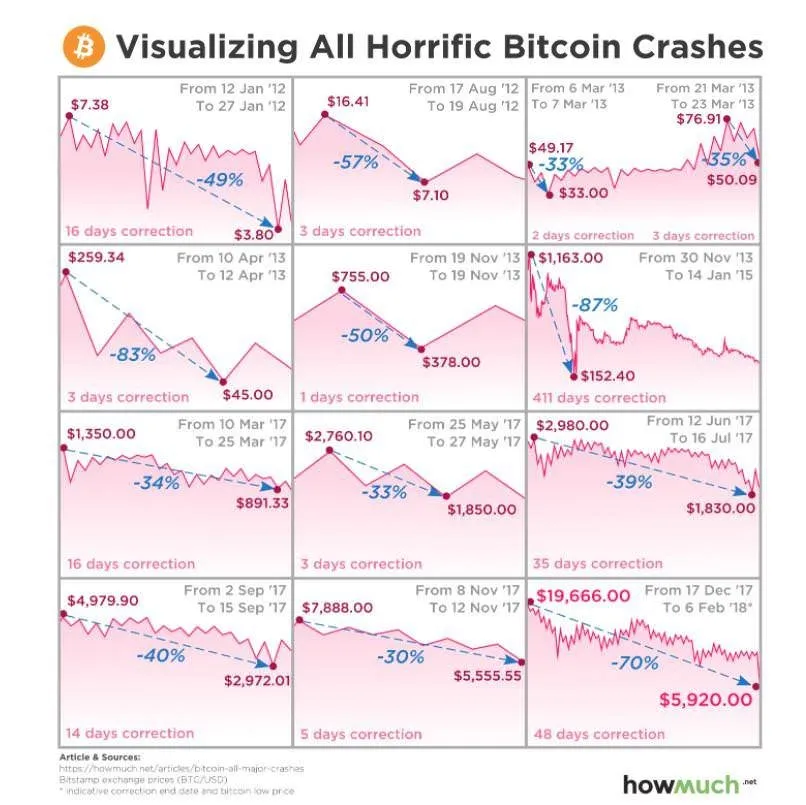

The only two corrections which were this great and this rapid were 2011 and spring 2013. Both crashed more than 80%. Thus this correction is probably not finished. The remaining question is whether we crash -83% (spring 2013) or -94% (2011)?

Elliot Wave analysis in January was also predicting this, although I think EW is hocus pocus with 50% chance of being corrrect or incorrect, lol.

Even the long-term HODL (hold on for dear life) bulls are starting to get that queasy deja vu nausea.

The market has weakened considerably. And more bad news is coming any day or week from now. Everyone is having a difficult time shifting their attitude from bullish to bearish. It’s denial. So therefor I’m thinking we probably get a strong deadcat bounce now, because of the denial. But then we rollover and go lower. Ditto the DJIA.

Also this chart from zerohedge:

click to zoom

Btw, the above chart is misrepresenting the crash from 2011-06-09 to 2011-10-20 as shown on 99bitcoins.com from $29.58 to $2.31 in 133 days, thus -78%. Actually I think the intraday peak was above $32 and bottom closer to $2.10, so another 80+% crash (roughly about -94%).

IMPORTANT NOTE: if we break down below $6000, it’s going to be a panic and it’s plausible that altcoins (and ICO bags) are going to go no-bid as they did during the crash after Dec. 2013. So far the alts have held up recently well considering and in fact since Dec. 10, Bitcoin’s share of the total crypto marketcap has fallen mainly due to gains by Ethereum and “Others” (not including other Top 10 alts), but I think perhaps this is because everyone’s assuming we’re not in another 80+% crash. The proliferation of ICOs is why “Others” is sucking up so much BTC (and presumably some of these ICO issuers are selling the BTC for fiat to guard against losses, pay expenses such as buying off the legal counsel, and pay themselves yachts, crack, hookers, and such). Perhaps it’s different this time because there’s so much (unwavering/unbreakable?) speculative fever in ICOs and such (and given this may only be a SLINGSHOT and not a long drawn out crypto winter), but it’s plausible that altcoins will be on firesale prices when/if Bitcoin drops to $3500. The mindset of those buying ICOs has been it would be sure money because the market is flooded with greater fools coming in. But if the fear of drawn-out crypto winter becomes visceral, we might see the demeanor of the market change?

In fact, demeanor is a significant reason I don’t think we’ve bottomed yet. There’s far too much optimism still. A bottom comes when everyone becomes very pessimistic. The fact that the shitcoins are leading Bitcoin is very weird and perhaps very ominous because it means no one believes this crash is going to last very long or go very deep enough to turn away the flood of the masses and institutional investors coming into cryptocurrency.

There’s far too much of this going on:

RE: Are Most Cryptocurrencies Doomed to Collapse — because they’re “ICO-issued”?