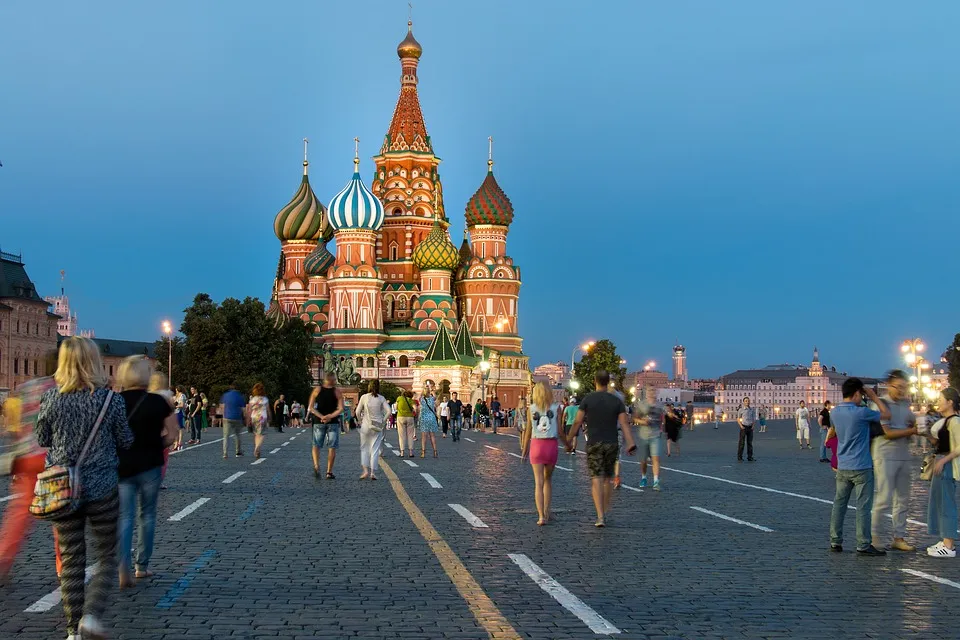

Russian Buying Bitcoin Ahead Of OFAC Sanctions

The Russian economist, Vladislav Ginko came out with another bold statement claiming that some high net worth individuals in Russia have bought 1.8 million bitcoin which at current rates coverts to around 8.6 Billion USD.

He explains that this new found affinity to Bitcoin by private rich individuals is mainly due to the mounting sanctions by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) who plans to ban the use of U.S. dollar by Russian oil companies.

He explains that these purchases will not have a direct influence to the Bitcoin price but will sure have some impact on the asset price and contribute for its upwards movement.

However not everyone is convince that of his bold statement as he previously claimed that Kremlin was looking into investing $10 billion in Bitcoin causing a senior state official to deny the rumors stating that Kremlin is unlikely to invest in Bitcoin for the next 30 years.

Ginko went on twitter to say that the Russians can push Bitcoin’s price to $2,000,000 a piece by the end of the year if the USD ban were to be implemented by OFAC to Russian Oil and gas companies.

BTC Market of Australia Now Supporting Stellar

It has been reported that leading Australian Bitcoin and cryptocurrency exchange BTC market will be adding support for Stellar Lumens (XLM).

According to the report from April 3, 2019, its users will be able to deposit XLM into the platforms in which XLM will be paired with AUD and BTC.

Trading of the newly added asset will start on April 4, 2019 which currently supports BTC, ETH, LTC and XRP.

Stellar is a decentralized cross-asset value transfer ledger that was primarily designed to make faster near instant international settlements.

XLM is often compared to Ripple (XRP) due to the similarities of the two platforms; this is no surprise as the two platforms have similar co-founder which is now the CTO of Stellar, Jeb McCaleb.

While XRP is focus on institutional on-boarding and collaboration with many financial instition, Stellar is focusing its efforts on helping people denied of financial services.

Swiss Luxury Hotel First To Accept Bitcoin

According to news reports online the Dolger Grand, a five star hotel in Switzerland, has recently started accepting Bitcoin a one of its options from customer to pay their bill.

This makes the hotel the first luxury hotel in the country to accept Bitcoin as one of its payment methods.

It announced this support on its twitter stating that have taken a step towards accepting cryptocurrencies suggesting that its initial move to accept Bitcoin is a step on accepting other cryptocurrencies in the future.

This was made possible with its partnership with Inacta, a fintech firm that developed an app that allows guest to pay for hotel services from their Bitcoin wallet.

A Swiss cryptocurrency exchange, Bity will be in charge of converting Bitcoin into fiat currencies.

It was also revealed that Inacta will extend support to other cryptocurrencies that customers can use to pay in.

Blockchain Platform From A Local Telecom Operators Endorsed By UAE Government

News are circulating online that a blockchain platform that was developed by a local telecom operator in United Arab Emirates has received official endorsement from the government.

The move was cited as part of the government’s effort to integrate blockchain technology in the country.

Du which was formerly known as Emirates Integrated Telecommunications Company created a Blockchaikn-Platform-As-A-Service (BPass) to offer cloud-based private blockchain hosting compatible with Ethereum and the Hyperledger Fabric.

The endorsement was coursed through Smart Dubai, the government agency that is in charge of implementing state-level changes that will leverage blockchain by the year 2021.

According to Du’s deputy CEO of enterprise solutions, Farid Faraidooni, the endorsement of Smart Dubai is an important step towards providing smart solutions that create efficiencies for government transactions leading up to 2021.

US SEC Just Released Its Much-Awaited Crypto Token Guidance

It has been a long time coming but the United States Securities and Exchange Commission has finally released its much awaited regulatory guidance for token issuers.

Most of the crypto community has been calling for regulatory clarity especially on the guidance to token issuer.

The release it is a step forwards to regulatory clarity in the space which took more than half a year for the agency to create.

The guidance focuses on tokens and outlines how and when these cryptocurrencies may fall under a securities classification.

The existence of the effort to create the guidance was first revealed by SEC Director of Corporation

Finance William Hinman last November with other members of the agency confirming the existence of the initiative.

According to Hinman the guidance will be written in plain English with examples that will illustrate tokens or networks that may fall under securities laws as well as those that are not.

Headlines for the world of Cryptocurrencies - April 03, 2019Resident Fund Manager At CNBC Calls For $6,000 Price Of Bitcoin / Pakistan Will Issue A Sovereign Digital Currency By 2025 / Crypto Companies Owned 30% Of This Small German Bank / Digital ID Is Paypal’s First Foray Into Blockchain Use Case / Coinbase Reveals Insurance For Its Hot Wallet |

|---|

Headlines for the world of Cryptocurrencies - April 02, 2019**Coinbase Launches International Payments Service / Nasdaq Stock Surges 20% After Bitcoin Rally / XRP Exchange Traded Product Listed In Swiss Stock Exchange / Puerto Rico Has Now Its Own Crypto Friendly Bank / Food Tech Giant Leverages Blockchain To Combat Salmonella And E. Coli / ** |

Headlines for the world of Cryptocurrencies - April 01, 2019Bitcoin To Reach A Price Of $150,000 In 2023 / US SEC Seeking Crypto Specialist Attorney Advisor / Facebook Competitor Now Wants To Issue Its Own Crypto / Finite Supply Of Bitcoin Challenges Crypto Regulators According To CME Group / Coincheck Launches OTC Traing Desk |