Following on from this post I did about 'why you can't afford a house' (a topic I'm far from finished with btw), I did a little digging into just how much UK property wealth might be over-valued....

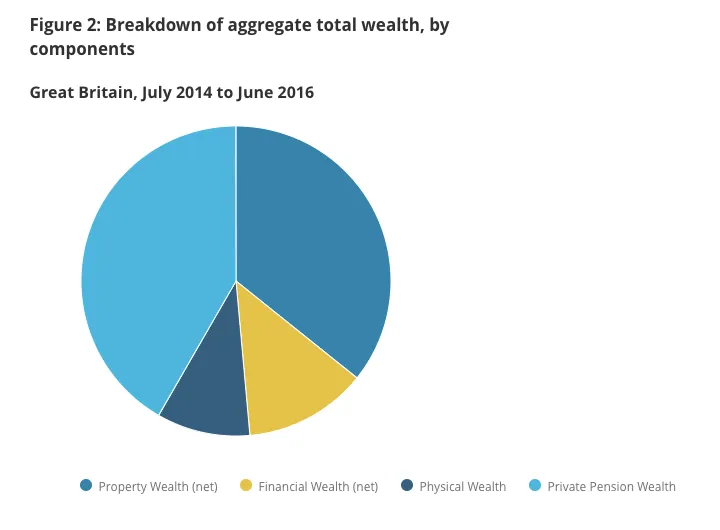

The Aggregate Total Net Household Wealth in the United Kingdom was £12.8 trillion in June 2016 (latest ONS figures from the Wealth and Assets Survey)

Of this...

- Private Pension Wealth - 42% = £5.3 trillion

- Property Wealth - 36% = £4.5 trillion

- Financial Wealth - 13% - £1.6 trillion

- Physical Wealth - 6% - £1.2 trillion

Taken together, this makes the total aggregate debt of all households look relatively insignificant. The ONS Wealth Report also states that:

Total aggregate debt of all households in Great Britain was £1.23 trillion in June 2016 of which £1.12 trillion was mortgage debt, and £117.0 billion was financial debt.This is < 10% of Total Net HH worth, so seemingly not a problem

/

However, I think we need to treat the above wealth figures with a level of scepticism for at least three reasons:

That gives us a reduction of around £3.5 trillion and a more valid figure of around £9.5 trillion, or 25% less than the stated figure.

Another couple of reasons I think the above figures are overvalued are because I can't see that much scope for future growth, for two main reasons:- Uncertainty over Brexit - this may all be fine in the long term, but for the next couple of years I just see stagnation as companies hedge their British investments. And maybe some property speculators will decide it's a good time to cash in and get out of London?

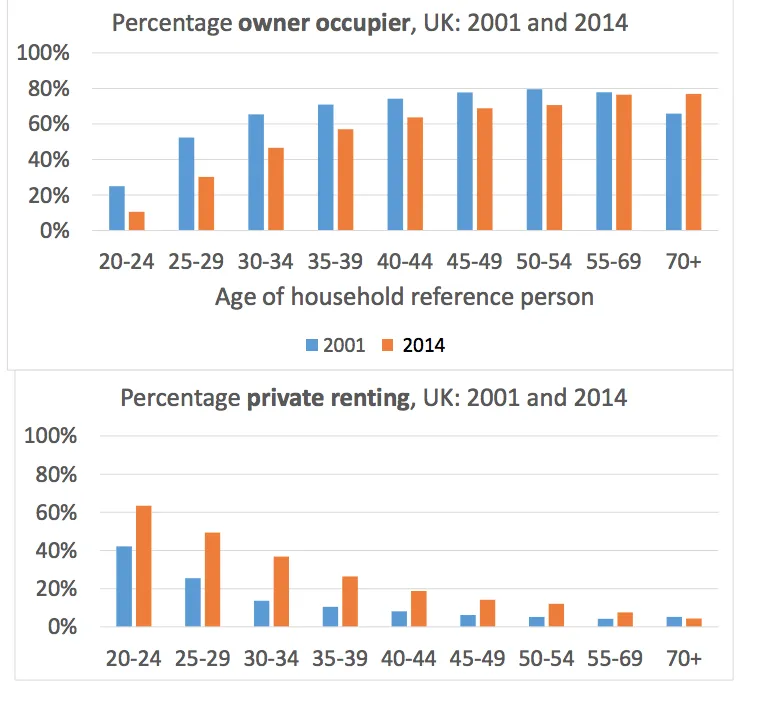

- Young people (as in the majority of people under 40) cannot afford to buy houses at current prices. This is where most of the demand that drives property prices ultimately comes from, and houses are so expensive on average compared to wages that the typical 35 old cannot afford to get on the property ladder. As the figures below (source) suggest:

The really telling figure above is that percentage of people private renting aged between 25-basically doubled in the 13 years between 2001 and 2014.

/

The really telling figure above is that percentage of people private renting aged between 25-basically doubled in the 13 years between 2001 and 2014.

/

To my mind the only question is whether we're going to see a property price CRASH with all of the chaos that ensues, or just a gradual readjustment of house prices and stagnation.

ATM it seems that property prices are still going up... the latest figures are showing that the total value of UK's housing stands at over £7 trillion - that's housing stock alone! But as I see it this is just fiction, it can't go on!

When (I don't think it's a matter of if) property prices readjust downwards, that will be good news for the under 30s, however, it's the 30 and 40 somethings stuck with 4 bed houses and £150K + mortgages I feel sorry for!

NB - I've got a theory, that seems to be born out by a cursory analysis of wealth trends across classes that if you're in the middle income deciles then your mortgage payments are basically pumping up the pension pots of those in the upper deciles, but more on that laters!