“This indicator predicted 30 of the last 10 recessions” – wrote somebody somewhere months ago about some bond market data. It is really nice to make investing forecasts. If you make enough predictions, at least some of them will become reality and you can say: “I told you…” But blockchain preserves your success and failure equally. Here is my job tougher.

I told you

I predicted – or, I meant, it was very probably – that gold was going to show a resurrection. I was a little early, in August 2018 and in October. But I was right, gold is rallying now for weeks, finally. And it was making a smaller jump at the end of 2018, too.

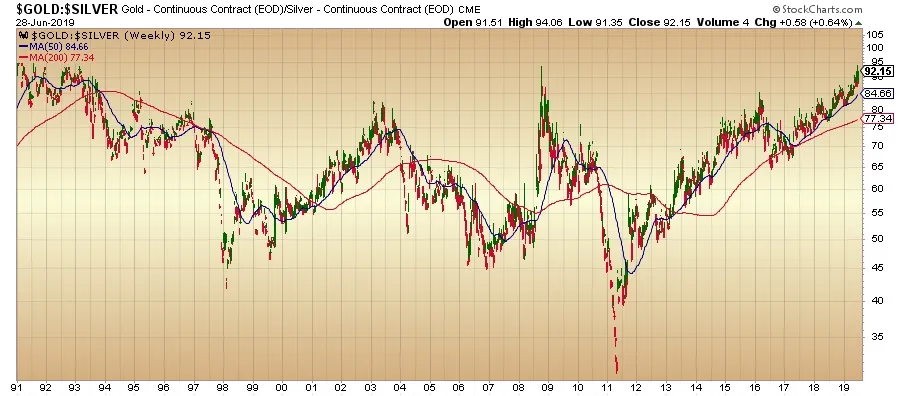

But I was also mentioning two indicators: The HUI/Gold Ratio and the Gold/Silver Ratio. Let’s see them again.

(Chart courtesy of StockCharts.com)

Historical underperformance

Despite the jump in the gold price and despite a parallel but small jump in the silver price, the ratio of the two metals remains in a pit not seen since, approximately end of 1992. Other sources are claiming it is on all-time highs, by 94 this week. That means gold is relatively expensive and silver is cheap, underperforming historically.

The ratio is in at least 26 years lows then. Did it predict the recent move in gold? I think, yes. Last year in August it was early, or I was wrong if you want. Later, in October, it was not a bad moment to buy gold or gold mines. (Gold rallied at the end of 2018, with the decline of the stock market indexes.) Then the ratio surged above the 2008 levels this spring, and some weeks after, gold jumped.

And the mines?

Basically, gold mines are surging with gold and falling with gold, in the middle and long term. And they underperform it in the (gold) bear market and overperform it in the (gold) bull market. (They are similar to leveraged gold trades.)

(Chart courtesy of StockCharts.com)

Similarly, as the Gold/Silver ratio, the ratio of the Arca Gold Bugs miner’s shares index (HUI) and the gold is also near extreme levels. Very low now, historically seeing. But in 2015-2016, it was also much lower. By approximately 0,095, and this spring, by 1,113.

Gold or mines?

In this price jump of gold, mines also are surging, but not overperforming. The gold piece increased approximately 10 percent this year, in the first 6 months (to 1412 from 1282). The HUI index, 12 percent (to 194.1 from 157.4). I have no idea why this underperformance now – but mine shares are more risky than gold.

My trade with platinum and palladium may be too early to evaluate yet. Yes, that means I’m losing… but other trades began similarly. We will see.

Trump’s fault?

Saturday morning on the G20-Summit, the leaders of the US and China, Donald Trump and Xi Jinping made some sort of agreement. How this will affect the dollar, the gold, the gold mines, and the silver price, I don’t know exactly, I have only assumptions.

The situation is complex: an agreement in the so-called trade war can mean more economic growth, globally. Better growth expectations are lowering the probability of rate cuts in the US, which can strengthen the dollar, and this is not so good for precious metals in general. Some better growth, however, can probably strengthen the silver, as an industrial metal (and maybe also platinum and palladium.)

Probably it is time to sell my last gold mines and get some silver (or silver mines)? If so, then I should act quickly. Can’t decide. I should make more homework.

(Photo: Pixabay.com)