In case anyone was curious about the recent conversion affects on supply, I've been periodically recording the data continuously about twice a day and dumping them into a spreadsheet.

I first posted about it here, and from the looks of it, nobody informed me whether someone else was recording this data or not, so for now I'm still in the dark there. But someone had mentioned wanting to see this information, so I updated the public spreadsheet and made a chart.

The public spreadsheet is viewable here and the third tab contains a chart with the current filter I happen to have set up. Feel free to copy and make your own.

Initially the table was populated from coinmarketcap data, but then I fillled in with my own data.

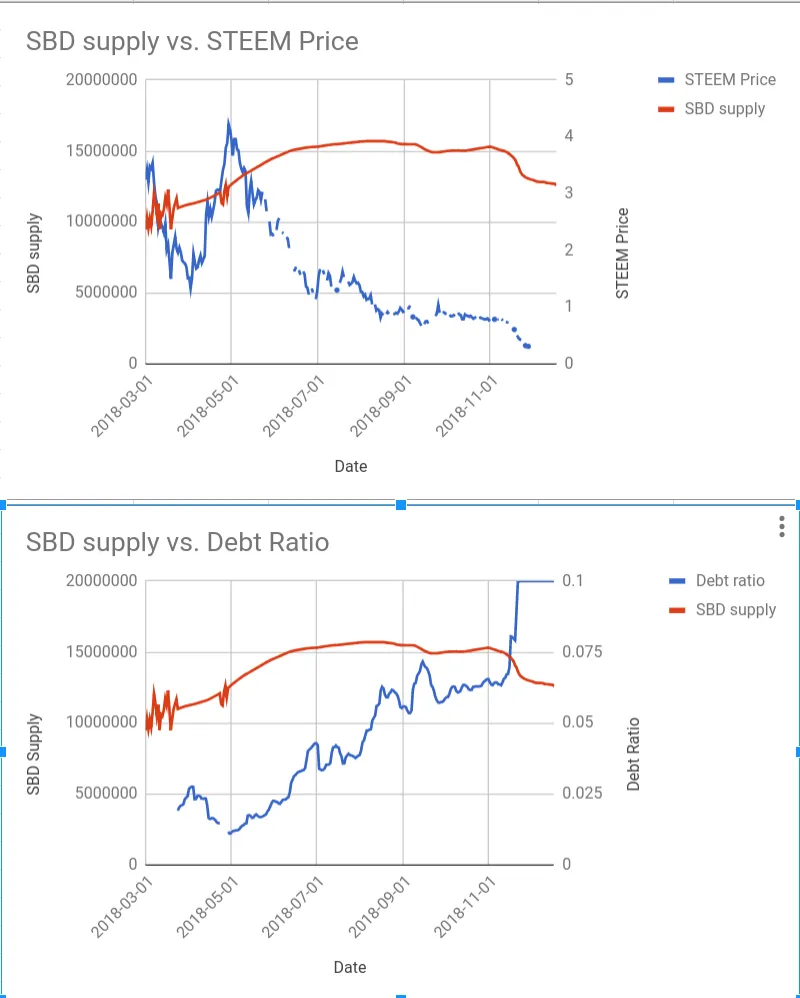

Here's a screenshot of the chart:

The end lists a supply of 12.5M and a peak of 15.3M for SBD supply. Price data isn't super accurate, the cryptofinance add-on for google sheets seems to be flaky as of late.

Also, you'll see two humps. The first decrease is likely when the SBD peg fell off and conversions started happening, and the increase is attributed to HF20 when we bumped the ratios for the start/stop printing rates to occur in the 9-10% range. As you can see from this graph, anyone who says that this 9-10% bump did anything at all does not know what they are talking about. The supply never reached the same height, and in fact, the supply went down as more conversions happened. Which means that the debt ratio hitting 10% is attributed to solely the STEEM price.

But you'll see that the debt ratio has hit the 10%, and I remember vaguely whisking past posts worried about STEEM flooding. Rest assured-- the protection is in place that STEEM supply cannot be overwhelmed by conversions (just imagine if we were still respecting 1$ worth of STEEM on payout... the amount of STEEM would be unbounded....). Yes, STEEM supply is still affected by conversions, and may give downwards STEEM price pressure, but the extent at which it will affect the overall STEEM marketcap is limited.

Hmm.. when I get around to it I suppose other data of use is the SBD price and current effective peg price. But anyway, that effective peg price simply rises and falls at same % as STEEM price in the current state of affairs, so it's not super interesting, and it's not really worth playing around with arbitrage with respect to market rate vs peg rate because of the 3.5 day median and the low SBD liquidity. I could get into this more but I feel like what's the point. If you're long on STEEM though, suffice it to say that SBD will return to 1$ (and possibly more...) when things recover.

Makes me wonder why I don't just snap up some SBD and park it... though my goal is to get more STEEM, not get a 2x return on USD (and yet it is still a risky maneuver, in the event that long positions don't work out).

Addendum, code block:

const fs = require('fs');

const steem = require('steem');

const rpc_node = 'https://api.steemit.com';

steem.api.setOptions({ transport: 'http', uri: rpc_node, url: rpc_node });

setInterval(() => {

steem.api.getDynamicGlobalProperties(function(err, result) {

const row = result.head_block_number + ',' + result.time + ',' + parseFloat(result.current_sbd_supply) + ',' + parseFloat(result.current_supply) + ',' + parseFloat(result.virtual_supply);

console.log(row);

try {

fs.appendFileSync('sbd_supply.csv', row + '\n');

} catch (err) {

// nothing

}

});

}, 1000 * 60 * 60 * 12);

running continuously with pm2 on my puny remote server somewhere out there...