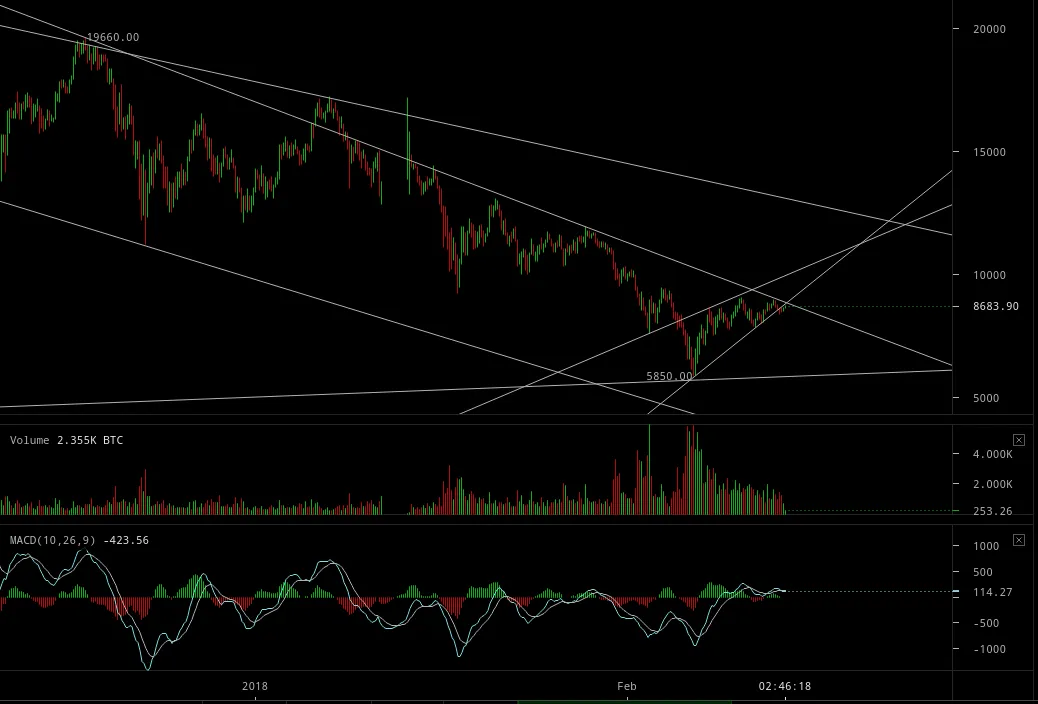

UPDATE: potential crash imminent!

click to zoom

On the the above chart, I’m showing my interpretation. I see zoomed on the chart in my prior comment with the price updated to just now, that the rally was in a bearish rising wedge, which the price has broken down out of and is trying to hug the bottom of the overhead resistance of the (eventually bullish) declining wedge. So this appears to indicate that BTC will head to lower lows imminently! Looks like it will stay within the bearish wedge until it bottoms. So this could possibly be a very rapid crash to $1275 by Feb 27.

So eventually the bearish declining wedge will be bullish, but maybe not until we’ve already hit rock bottom. It’s still plausible that there could be a break to the upside over the declining wedge now, which would target at least $11k, but it’s looking less likely.

Coindesk’s TA agrees leaning towards bearish.

Additionally the $750 report from Armstrong which I mentioned before, seems to imply that in order to get a slingshot in the DJIA then we need for the DJIA to bottom in February (with a new ATH in March?), or daily closing low in February with an intraday low in early March and a month-end close March above 23490. So this means to align with the SLINGSHOT risk off scenario with a quick rebound to risk on, would require a flash crash.

Also another datum was on page 42 of that report, Armstrong noted that the 30 year Treasury bond which is in a declining channel just recently deadcat bounced from the bottom line of the channel. So this seems to confirm an uncertainty panic into risk off that could revert back to risk on quickly once the real trend continues. He also notes a directional change for bonds coming in May and the German bond is poised to fall out of its channel precipitously. Tie that into a blog today Merkel & Schulz Under Tremendous Pressure in Germany.

On the positive side, Armstrong notes that the S&P500 and even more so the Nasdaq has lagged the DJIA in this bull market so far, and this is because of massive fear by the boomers of losing their nest egg given the 2009 subprime collapse. The DJIA is what the international investors invest in most (because it’s the most liquid). So the international capital flows into the dollar are leading the way, but eventually the retail public in the USA will come rushing in and Nasdaq will skyrocket probably along with cryptocurrency. So the bodes well for a potential SLINGSHOT effect.

Also I want to quote this which seems to bode very well for cryptocurrencies:

This brings us to 86 years from the 1932 low which just so happens to be 2018.

[…]

The burning question then remains, is 2018 the start of a massive new economic depression or the beginning of another Sovereign Debt Crisis?

[…]

Under a normal cyclical model outcome, 2018 would be the end of the cycle and we would typically expect another economic collapse. Yet the monetary system is far diferent today than it was in 1932, 1842, or 1756 for that matter. This time around the monetary system is all based upon credit.

[…]

The more likely course of the future will be a Sovereign Debt Crisis which impacts both the Federal and State/Municipal level. This suggests that there would be a higher probability of a Cycle Inversion [meaning heading into highs from 2018 – 2021, not into a risk off winter]. This does imply a stronger move toward cash rather than bonds and private sector assets […] a Cycle Inversion implies a continued rally for at least 3.14 years taking us into the 2021/2022 target as a minimum.

For those who can afford $750 like pocket money, I recommend the report. It’s very interesting reading.

This Conflict between Fiscal & Monetary Policy is also sort of a summary one facet of the 100 page report.

UPDATE 13 hours later: The BTC moved just slightly above the top of the declining wedge which projects to $8438 for a close on Friday, but remained below the bottom of the rising wedge. Closing the week below the top of the declining wedge would be bearish, otherwise the potential remains to move higher to test the overhead resistance at the top of the drawn funnel on my chart, or perhaps even move directly into the SLINGSHOT with the crash low already behind us. Although Armstrong’s GMW still has a neutral short and long-term outlook with “New Lows Likely” on the monthly outlook, I believe this is highly dependent on whether the stock markets decline anew. If further flight to 20 year Treasuries resumes, then all risk assets spike low in preparation for a SLINGSHOT move back to the upside as the reality that the sovereign bond crisis is about to explode in Europe takes hold. There’s uncertainty about Europe, impeachment of Donald Trump on horizon, Democrats taking back control of Congress in November, etc… But the bottom line reality as covered in Armstrong’s $750 report, is that bonds have peaked and there’s no where to run and no where to hide for international capital except for the short dollar vortex. The dollar has turned back up already and the international capital has taken a breather into cash to survey the landscape. There’s no other option but back into risk on private assets. However the near-term uncertainty and the resultant knee-jerk move into cash, could create a flash crash, because the retail investor is not yet substantially in the markets. Thus what ever the international capital does at this point can have a significant instant effect, such as crashing the markets. Also it can cause a contagion spooking the markets causing a crash. There’s probably not a significant level of shorts to cover to counter act this temporary pullback to cash.

RE: POSSIBLE SLINGSHOT BITCOIN CRASH AHEAD