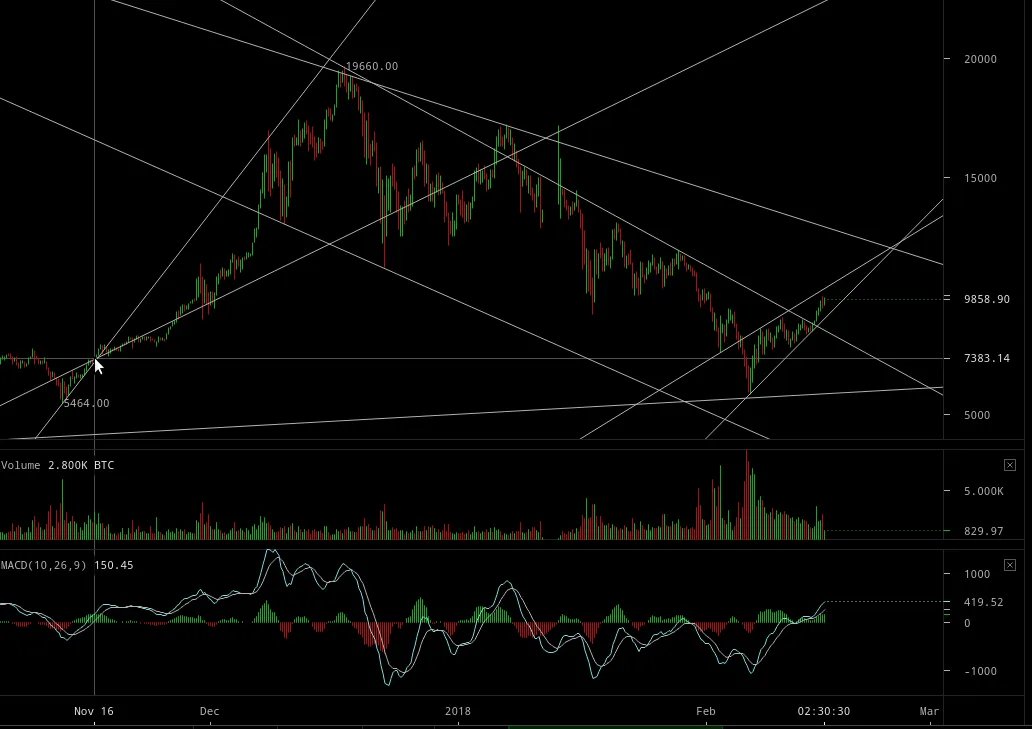

So what I misinterpreted to be falling out below the bearish rising wedge, was actually a widening of the wedge as shown below. If this wedge holds, then it’s very bearish and we would crash out of it as it hangs precariously out there heading towards at most $12k. This would be consistent with a possible renewed risk assets sell-off with a “possible spike low” for the DJIA as Armstrong’s GMW is currently warning for the month of February. Otherwise, it’s possible the low is already behind us at $5850.

click to zoom

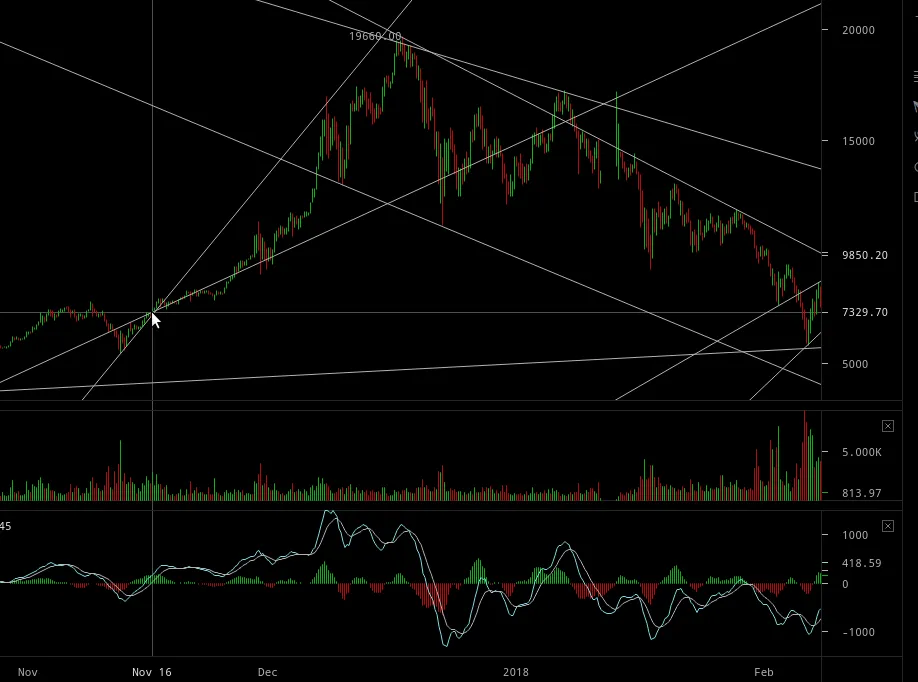

EDIT 14 hours later: As shown for November 16 on following charts, if the price breaks out above the (often bearish) rising wedge, then we’ve likely bottomed already at $5850:

click to zoom

click to zoom

The DJIA only elected two bearish weekly reversals in Armstrong’s trading system. Thus he says it’s not likely the DJIA will crash below the 23,360 low:

https://www.armstrongeconomics.com/armstrongeconomics101/training-tools/understanding-the-reversals/

If the DJIA closes today above 25521, then it’s like headed to retest highs without a spike low. However, tomorrow is a turning point.

Even though the DJIA may have bottomed and may only perhaps get a spike low to retest 23360, this doesn’t guarantee that a downdraft in the DJIA not making lower lows, wouldn’t coincide with a crash of BTC to lower lows. BTC is a much more volatile asset than the DJIA.

RE: POSSIBLE SLINGSHOT BITCOIN CRASH AHEAD