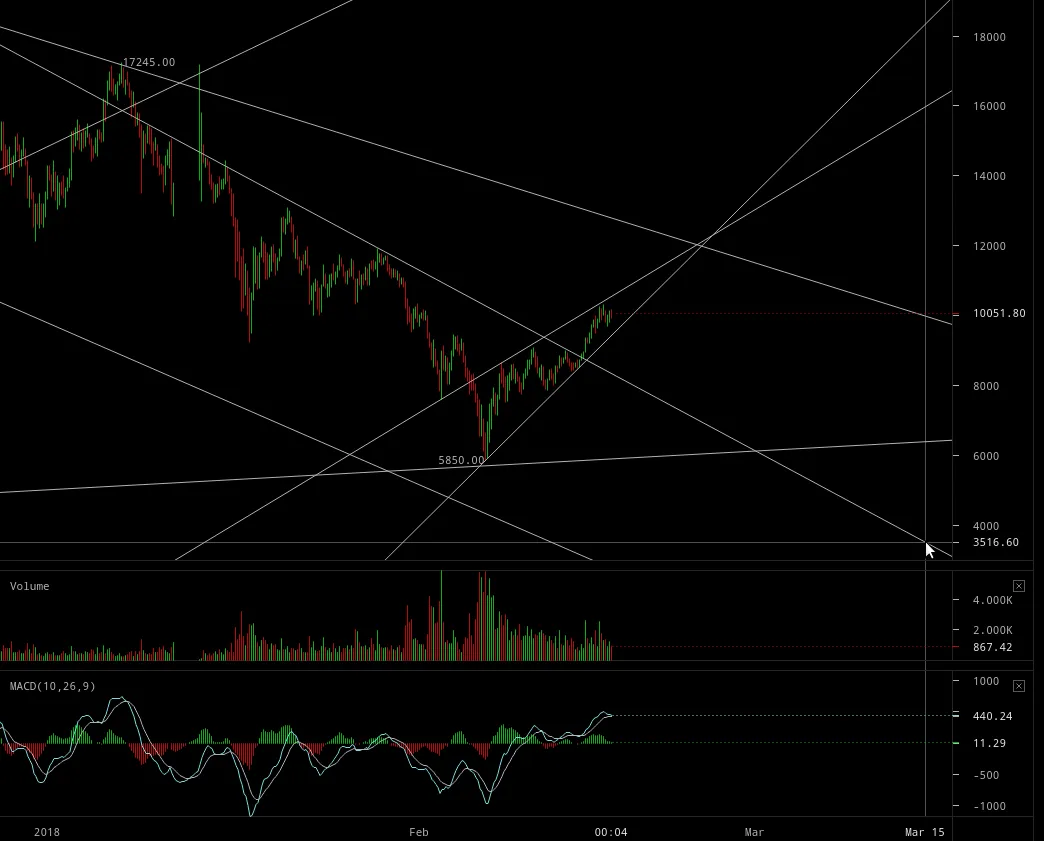

As predicted, today is likely a turning point and next week the declines may begin with target for the low potentially in the week that begins March 12 (see chart below). If DJIA fails to close above 25,500 today, then retest of lows is likely. So then BTC would be expected to break down out of the ascending wedge and retest $5850 lows or crash through to $3505. Because of the strong bounce this week, I no longer think $1275 is plausible. We're climbing a Wall of Worry of uncertainty, but the fundamentals are still bullish. This is not a crypto winter. At worst a SLINGSHOT crash or maybe only a choppy correction with bottom behind us. Yet my odds still favor the SLINGSHOT move down to $3505 with a V bottom rebound.

Stocks Turn Lower on News of Mueller Indictments Against Russians

Armstrong market wrap:

The US started the session climbing around 200 points but was hit upon the indictment news. The headline and news conference initially cost the rally around 250 points which took us into negative territory. Guess many will spend their time on Twitter watching for updates. However, even within the final 30 minutes of the weeks trading, we tested both sides of that range yet again. The long weekend, continued uncertainty and the Weekly technical level took their toll on settlement prices as we drifted back to almost unchanged on the day. NASDAQ finished lower

Inflation is back. Don't panic

Even the Bank of England has warned that rates will rise more aggressively than previously thought […] Washington's spending spree — $1.5 trillion in tax cuts, $300 billion in extra spending — could be "too much of a good thing." Echoing Wall Street's inflation jitters, Blankfein said […] Fear of inflation and higher interest rates sparked the market sell-off that began February 2, when the Labor Department reported that wages grew at the fastest pace in nine years. Fed minutes: The Federal Reserve didn't raise rates last month, but its meeting minutes, to be released Wednesday, may provide a sense of the board's economic outlook.

click to zoom

The Mueller indictments turn out to be apparently a face saving gesture of weakness. However, this could still spook the markets as they might see a Trump mandate as too much economic stimulus and too much inflation too fast thus rising interest rates which the majority incorrectly perceives as correlated with falling stock prices (and that point has been explained ad nauseum many times by Armstrong and I think I linked to his pertinent blogs on that point recently).

RE: POSSIBLE SLINGSHOT BITCOIN CRASH AHEAD