On the 26th July 16 Hardfork 12 disabled the Liquidity rewards on Steemit. Wait, What? Liquidity rewards, why where these removed?

I found this posted on Github

Due to the controversy of liquidity rewards we are going to evaluate our design and change liquidity rewards if needed. For now, we believe they are not providing enough value to keep around. We have decided to disable liquidity rewards altogether for the time being while we work on a more permanent solution. This is a temporary change. The internal market not charging transaction fees may be enough of an incentive to trade internally that we may not need liquidity rewards at all. All of these aspects will go into our final decision. We encourage the community to voice their thoughts on liquidity rewards and potential changes in a civil and objective manner.>

https://github.com/steemit/steem/issues/178

I love controversy so I decided to dig a little deeper to see what I could find and I quickly found this post by @blakemiles84

@blakemiles84/two-users-are-gaming-the-liquidity-reward-system-and-earning-1200-steem-per-hour

In this post @blakemiles84 says

The two accounts in question @adm and @abit are buying from each other on the market, and then sending to the other in an automated endless loop, generating liquidity points>

Where by @abit replies

Rather honest I must say! And his comment ‘if I don’t do that, others will’ is just so true. How many people think ‘if only I got there first’ but say the complete opposite.

Analyzing the SteemSQL Database

This information is already out there on Steemit but until this week, I was not able to access any data on the Liquidity rewards. Now with the upgrades @arcange made to the Steemsql database, there is so much more information readily available.

I wanted to find out how much @adm and @abit had ‘gamed’ from the system that had this shut down so fast, and maybe get an idea of ROI on the liquidity rewards

I connected to Steemsql using the following query

SELECT

*

FROM

VOLiquidityRewards(NOLOCK)

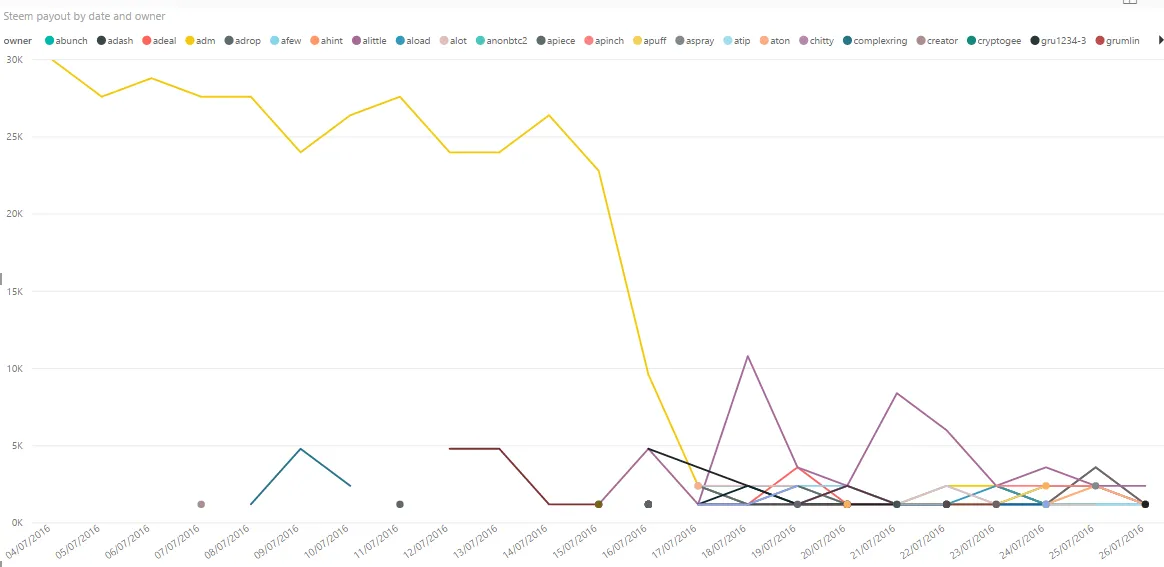

To my surprise there were only 538 rows of data. However this 538 rows of data contains a total liquidity reward payout of 645,600 steem. I also found it very interesting that the payout dates started on the 4th July 16 and ended on the 26th July 16. Very short lived. Only 22 days. And only 46 liquidity providers.

The rewards for this liquidity were based on points and allocated each hour. Whoever had the most points each hour got 1200 Steem. This is a good incentive to provide liquidity to steemit. People want a return on their investment right? People would consider purchasing Steem and provide liquidity with a good return.

Let’s see what return these 46 providers received each

And over the 22 days

Conclusion

Nice. Very nice. The problem I have now is that I don’t know how much liquidity these accounts provided at the time to see what the actual return on investment was but I have a feeling that this investment yielded a very high return for @abit and @adm and his team of bots.

Let me make a disclaimer now however, I don’t know how this process worked, so my ‘feeling’ is not an educated guess.

I also don’t know how much of the 645K steem went to @abit and @adm because of the team of bots. I can’t be sure from just this analysis which accounts tie back to each other. Another feeling I have is that the accounts that begin with ‘a’. Such as abit, alittle, adeal and so forth do show a naming pattern. But like I said, I can’t confirm a hunch on this analysis alone

Posted on Utopian.io - Rewarding Open Source Contributors